ASIC Regulations: What Australian Traders Need to Know

Learn how ASIC protects Australian traders through robust regulations, transparent practices, and investor safeguards. Discover why brokers like AvaTrade and eToro thrive under ASIC’s trusted oversight.

Writen by:

Arslan Ali But

28 January 2025

8 minutes read

Writen by:

Arslan Ali But

28 January 2025

8 minutes read

The Australian Securities and Investments Commission (ASIC) stands as one of the world's most trusted financial regulators, overseeing the integrity and security of Australia’s financial markets. Established to protect traders and ensure fair practices, ASIC enforces stringent compliance standards for brokers operating in the region.

For Australian traders, choosing an ASIC-regulated broker ensures access to secure trading platforms, transparent pricing, and fund protection. Brokers like AvaTrade and eToro, known for their adherence to ASIC’s regulations, exemplify the benefits of trading within a well-regulated framework.

This article explores ASIC’s role, its responsibilities, and how it safeguards Australian traders in an evolving financial landscape.

What is ASIC?

Definition and Overview

The Australian Securities and Investments Commission (ASIC) is Australia’s independent financial regulatory authority, established in 1991. It is a statutory body tasked with overseeing the nation’s financial markets to ensure they operate fairly, transparently, and securely. ASIC plays a critical role in maintaining the integrity of Australia’s financial system while protecting the interests of traders and investors.

Core Functions

- Regulates financial service providers, including brokers, investment firms, and insurance companies.

- Enforces laws that ensure consumer protection, prevent misconduct, and promote market integrity.

- Implements guidelines to maintain transparency and accountability within financial services.

Scope and Influence

ASIC supervises over 2,000 financial entities, ranging from forex brokers to large investment firms. Brokers such as AvaTrade and eToro operate under ASIC’s regulatory framework, demonstrating compliance with its stringent standards.

By ensuring brokers adhere to strict licensing requirements, fund segregation rules, and transparent pricing structures, ASIC creates a secure environment for Australian traders. Its influence extends beyond national borders, setting an example for regulatory excellence globally, particularly in the Asia-Pacific region.

For traders, ASIC’s oversight provides peace of mind, knowing their investments are protected under a robust regulatory framework.

Key Responsibilities of ASIC

The Australian Securities and Investments Commission (ASIC) has a pivotal role in ensuring the stability and integrity of Australia's financial markets. Its responsibilities encompass the following core areas:

a. Protecting Investors

ASIC prioritizes investor protection by mandating transparency and ethical practices across financial services.- Risk Disclosures: Brokers must provide clear and prominent warnings to inform traders about potential risks. For example: Statements such as “76% of retail CFD accounts lose money” are mandatory for regulated brokers like AvaTrade and eToro, ensuring that traders make informed decisions.

- Fair Practices: ASIC enforces rules that prevent misleading advertisements and ensures brokers disclose all fees and terms upfront, fostering trust among retail and institutional investors.

b. Market Oversight

ASIC actively monitors and regulates market activities to maintain fairness and integrity.

-

Fraud Prevention: By detecting and preventing insider

trading and market manipulation,

ASIC ensures a level playing field for all participants.

Example: In 2023, ASIC imposed fines exceeding AU$75 million on firms breaching transparency and compliance rules, emphasizing its commitment to market integrity.

c. Licensing and Supervision

ASIC sets stringent criteria for licensing financial entities, ensuring only credible firms operate within its jurisdiction.

- Rigorous Evaluation: Brokers like AvaTrade and eToro undergo comprehensive assessments to secure ASIC licenses.

- Ongoing Supervision: ASIC conducts periodic audits to ensure adherence to fund safety standards, such as maintaining segregated accounts, and operational transparency.

By fulfilling these responsibilities, ASIC upholds investor confidence and promotes a secure trading environment within Australia's financial ecosystem.

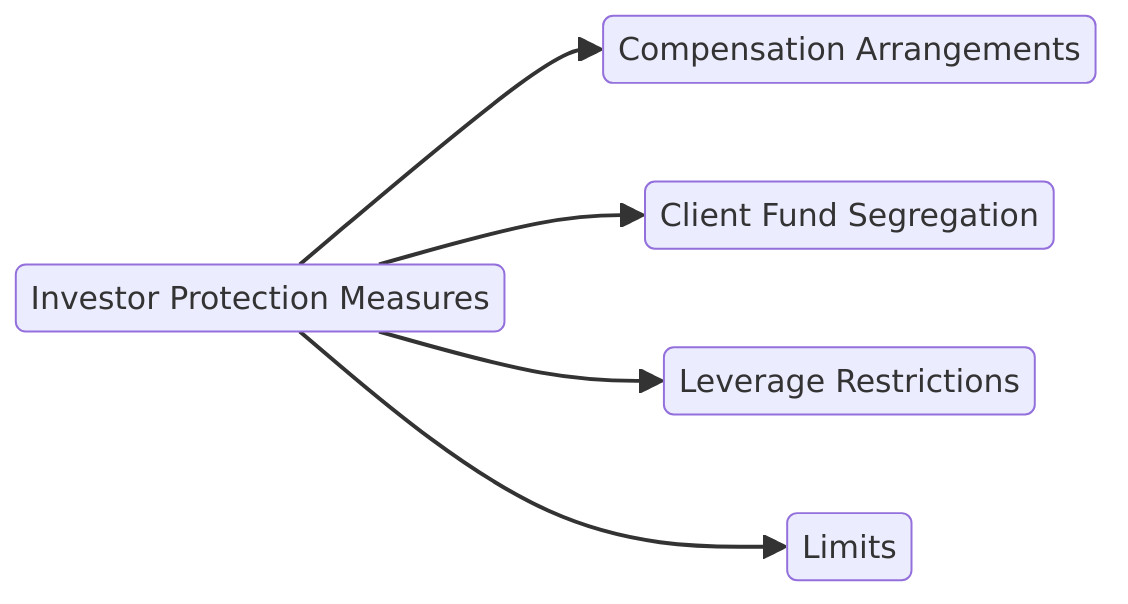

Investor Protection Measures

ASIC implements robust investor protection measures to safeguard traders and maintain confidence in Australia's financial markets. Key measures include:

a. Compensation Arrangements

ASIC mandates that Australian Financial Services (AFS) licensees maintain professional indemnity insurance to cover potential claims by retail clients.

- Purpose: Ensures that clients can be compensated for losses resulting from breaches of financial services laws, including cases of broker insolvency or misconduct.

- Example: In 2023, ASIC oversaw more than $17.4 million in compensation to retail investors by over-the-counter (OTC) derivative issuers, highlighting the effectiveness of these arrangements.

b. Client Fund Segregation

ASIC requires brokers to segregate client funds from their own operational funds.

- Implementation: Client funds must be held in separate trust accounts with authorized deposit-taking institutions, ensuring they are protected even if the broker encounters financial difficulties.

- Example: Brokers like AvaTrade comply with ASIC regulations by maintaining segregated accounts, providing clients with assurance that their funds are secure.

c. Leverage Restrictions

ASIC imposes leverage limits on contracts for difference (CFDs) offered to retail clients to mitigate the risks associated with high leverage.

- Limits:

- 30:1 for CFDs referencing major currency pairs.

- 20:1 for CFDs referencing minor currency pairs, gold, or major stock market indices.

- 10:1 for CFDs referencing commodities (excluding gold) or minor stock market indices.

- 2:1 for CFDs referencing crypto-assets.

- 5:1 for CFDs referencing shares or other assets.

- Rationale: These restrictions aim to reduce the size and speed of retail clients’ losses by limiting exposure to market volatility.

Transparency and Compliance

ASIC enforces rigorous transparency and compliance standards, ensuring Australian financial markets operate with integrity and traders have access to clear, reliable information.

Transparent Reporting

ASIC mandates that brokers publish annual financial statements and undergo regular independent audits. This ensures brokers maintain operational transparency and comply with financial standards.

- For instance: ASIC-regulated brokers like eToro publish detailed reports , enabling traders to assess the company’s financial health and operational integrity.

Cost Disclosure

Brokers must provide clear and comprehensive breakdowns of trading costs, including spreads, commissions, and overnight fees.

For example: AvaTrade ensures all trading fees are transparently displayed on its platform, empowering traders to calculate potential costs and make informed trading decisions.

Complaint Resolution

ASIC requires brokers to establish effective mechanisms for resolving client complaints swiftly and fairly.

- Example: ASIC-regulated brokers must be members of the Australian Financial Complaints Authority (AFCA), providing traders access to impartial dispute resolution services.

Benefits of Trading with ASIC-Regulated Brokers

Trading with ASIC-regulated brokers offers several advantages that ensure a secure and transparent trading experience:

Fair Practices: ASIC enforces strict standards to ensure brokers operate transparently and ethically. Brokers like AvaTrade and eToro comply with these regulations, providing traders with honest pricing, clear risk disclosures, and responsible practices.

Fund Safety: ASIC mandates that brokers segregate client funds from operational accounts and maintain indemnity insurance to cover potential claims. For example, AvaTrade holds all client deposits in separate, secure accounts, ensuring protection in case of financial difficulties.

Dispute Resolution: ASIC mandates that brokers establish clear and accessible mechanisms for resolving trader disputes. If issues remain unresolved, traders can escalate cases to the Australian Financial Complaints Authority (AFCA), an independent body providing fair and impartial dispute resolution services. This framework ensures traders have avenues to address grievances effectively.

source: asic.gov.au

For example, in the 2023–24 financial year, financial firms reported over 4.7 million complaints through their internal dispute resolution processes, with more than 75% resolved within a day. Additionally, 13% of these complaints resulted in monetary remedies, collectively totaling over A$375 million.

Common Criticisms of ASIC

a. Limited Cross-Border Authority: ASIC faces challenges in regulating offshore brokers that target Australian traders without proper licensing. In 2024, ASIC drafted new reporting rules for foreign brokers serving Australian clients to enhance oversight and mitigate risks associated with unregulated entities.

b. Strict Leverage Caps: ASIC's leverage restrictions, such as the 30:1 cap on major forex pairs, aim to protect retail traders. Some traders find these limits overly restrictive, arguing they reduce profit potential. However, ASIC extended these measures for an additional five years in 2022, citing their effectiveness in reducing retail client losses.

c. Delays in Enforcement: While ASIC's investigations are thorough, they can be time-consuming, potentially leaving traders exposed during prolonged legal processes. For instance, in 2024, ASIC's enforcement actions resulted in $32 million in civil penalties and nine criminal convictions, reflecting ongoing efforts to address misconduct despite inherent delays.

ASIC continues to enhance its regulatory framework to address these challenges, striving to protect Australian traders effectively.

ASIC vs. Other Regulators

ASIC vs. FCA (UK)

Both ASIC and the FCA prioritize investor protection, but their enforcement actions differ in scale. In the 2023/24 period, the FCA imposed 12 financial penalties totaling just over £42 million, reflecting a decrease from previous years.

ASIC vs. CySEC (EU)

ASIC enforces stricter leverage limits (30:1 on major forex pairs), compared to CySEC’s more flexible caps (50:1). This focus on reducing trading risks ensures greater protection for Australian retail traders, while CySEC provides more flexibility for experienced investors

Unique Strengths of ASIC

ASIC’s regulatory framework emphasizes safeguarding retail traders. Its leverage caps and client fund segregation requirements protect traders from significant losses and broker insolvency. In 2024, ASIC introduced enhanced dispute resolution systems, increasing trader confidence in Australian financial markets.

Conclusion

ASIC plays a pivotal role in ensuring transparency, protecting investors, and maintaining fair practices in Australia’s financial markets. Its robust regulations and emphasis on retail trader safety make it a trusted authority for both novice and experienced traders. Choosing ASIC-regulated brokers guarantees a secure and transparent trading environment.

Ready to trade confidently? Discover trusted ASIC-regulated brokers on WhereToTrade and take the first step toward a secure and successful trading journey today!

Table of contents

1. What is ASIC? 2. Key Responsibilities Of ASIC 3. Investor Protection Measures 4. Transparency and Compliance 5. Benefits of Trading with ASIC-Regulated Brokers 6. Common Criticisms of ASIC 7. ASIC vs Other Regulators 8. Conclusion