Best Cryptocurrencies for Beginners to Trade in 2025

Discover the best crypto for beginners in 2025 and learn how to trade safely with expert tips and market insights.

Writen by:

Arslan Ali But

22 January 2025

8 minutes read

Writen by:

Arslan Ali But

22 January 2025

8 minutes read

Are you wondering how to trade crypto safely in 2025? This guide covers the best cryptocurrencies for beginners, including Bitcoin, Ethereum, and Solana. With the growing adoption of digital currencies, the market continues to evolve, offering numerous chances to capitalize on price movements. Both individual traders and institutional investors are expanding their positions, signaling strong momentum in the space.

To succeed in this dynamic market, traders should focus on key factors such as:

- Liquidity: Ensures smooth trade execution with minimal price impact. Bitcoin (BTC) and Ethereum (ETH) are known for their high liquidity, making them ideal for both short-term and long-term strategies.

- Volatility: Creates opportunities for profit but requires careful risk management. Altcoins like Solana (SOL) and Avalanche (AVAX) often experience sharp price swings, attracting traders seeking quick gains.

- Emerging Trends: Keeping an eye on new market developments can help spot potential winners. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to shape the crypto landscape.

With the right strategies and tools, traders can make informed decisions and improve their effectiveness. Whether you're new to the market or an experienced trader, understanding these aspects can help you navigate the fast-paced world of crypto trading in 2025.

Factors to Consider When Choosing Cryptocurrencies to Trade in 2025

Choosing the right cryptocurrencies requires a strategic approach to minimize risks and maximize potential returns. With over 23,000 cryptocurrencies in circulation and a market capitalization exceeding $3.5 trillion (as of Jan 2025), understanding key factors can help traders make well-informed decisions.

Liquidity

Liquidity is a critical factor, especially for day traders who need to enter and exit positions quickly. A highly liquid cryptocurrency offers:

- Tighter spreads, often below 0.1% for major assets like Bitcoin.

- Faster execution, ensuring minimal slippage even during volatile periods.

Volatility

The crypto market is known for its price swings, with some assets experiencing fluctuations of 10% or more within a single day. While volatility introduces risks, it also presents opportunities for profit.

- High-volatility assets like Solana (SOL) and Dogecoin (DOGE) can see price movements of 15-30% in short timeframes.

- Lower-volatility assets such as Bitcoin and Ethereum tend to have price swings around 2-5% daily, making them more stable choices.

Utility and Real-World Use Cases

A cryptocurrency’s utility determines its long-term demand and value. Projects with strong use cases tend to have higher adoption rates and price stability.

- Ethereum (ETH): Processes over 1.2 million daily transactions, supporting decentralized applications (dApps) and smart contracts.

- Binance Coin (BNB): Powers the Binance ecosystem, with over $76 billion in trading volume on Binance Exchange.

- Ripple (XRP): Handles cross-border payments in seconds with fees as low as $0.0001 per transaction.

Traders should prioritize cryptocurrencies with practical applications and active development communities.

Market Sentiment

Investor sentiment plays a significant role in crypto price movements. Factors such as media coverage, regulatory news, and social media hype can cause rapid changes in market direction.

- Over 60% of retail traders rely on social media for crypto news and market trends.

- Major announcements or influencer endorsements can lead to price surges of 20-50% within hours.

For instance, a single tweet from influential figures like Elon Musk previously caused Dogecoin’s value to surge by over 50% in a day. Staying updated on sentiment shifts can help traders capitalize on emerging trends.

Regulatory Environment

Regulations can either accelerate market growth or introduce uncertainty. It's essential to monitor regulatory changes in key regions such as the US, EU, and Asia.

- Countries with pro-crypto regulations, such as Singapore and Switzerland, have attracted billions in crypto investments.

- Stricter regulations, like China’s ban on crypto trading, led to a market decline of over 20% in 2021.

Keeping an eye on evolving regulations can help traders avoid unexpected risks and identify markets with growth potential.

Best Crypto for Beginners to Watch in 2025

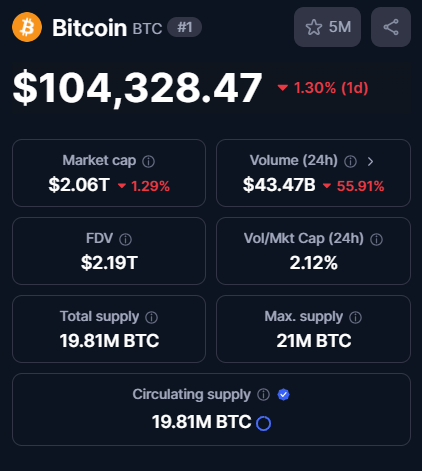

Bitcoin (BTC): The King of Cryptocurrencies

Bitcoin (BTC), the first and most widely adopted cryptocurrency, continues to lead the digital asset market with a dominant market capitalization exceeding 40% of the total crypto market. With a circulating supply of over 19 million BTC and a capped supply of 21 million, Bitcoin's scarcity enhances its value, making it a sought-after asset for traders and investors alike.

Due to its substantial liquidity and price influence, Bitcoin often dictates the overall market direction. Historical data shows that over 60% of altcoins closely follow Bitcoin's price movements, reinforcing its role as a market barometer. Institutional interest in Bitcoin has grown significantly, with major financial institutions holding billions of dollars in BTC, further strengthening its market position and stability.

Why Bitcoin Remains a Top Choice for Traders

- Unmatched Liquidity: Bitcoin consistently records a 24-hour trading volume of over $50 billion, ensuring smooth trade execution with minimal slippage. High liquidity levels allow traders to enter and exit positions efficiently, even during periods of extreme volatility.

- Market Influence: Bitcoin accounts for around 55% of daily crypto trading activity, influencing market trends and providing insights into broader market sentiment. Its historical correlation with traditional markets, such as gold and equities, makes it a useful indicator for risk appetite in the financial world.

- Institutional Adoption: Institutional investors, including hedge funds and publicly traded companies, collectively hold over 8% of Bitcoin’s total supply, recognizing it as a hedge against inflation and a store of value. Companies like MicroStrategy and Tesla have allocated billions to Bitcoin, demonstrating confidence in its long-term potential.

- Volatility with Profit Potential: Bitcoin’s average daily price fluctuation ranges between 2-5%, offering trading opportunities across different strategies. In bullish phases, Bitcoin has historically delivered annual returns exceeding 200%, making it attractive for traders seeking growth.

- Security and Network Strength: The Bitcoin network is supported by over 400,000 miners, contributing to a total hash rate exceeding 500 exahashes per second (EH/s), making it the most secure blockchain. This robust infrastructure ensures resilience against attacks and operational stability.

Bitcoin's combination of liquidity, market influence, and institutional backing positions it as a cornerstone of the cryptocurrency market. Whether for short-term trading or long-term investment, Bitcoin remains a powerful asset in the ever-evolving digital economy.

Ethereum (ETH): The Backbone of DeFi and NFTs

Ethereum (ETH) is the leading blockchain for decentralized finance (DeFi) and non-fungible tokens (NFTs), securing over 80% of DeFi platforms and more than $50 billion in total value locked (TVL). Its smart contract functionality powers a wide range of decentralized applications (dApps), attracting developers, traders, and institutional investors alike.

Key Features of Ethereum:

Dominance in DeFi and NFTs:

- Supports a vast ecosystem of dApps and protocols.

- Over 1.5 million daily transactions, making it the busiest blockchain.

Smart Contract Capabilities:

- Enables trustless automation of financial services.

- Widely used for lending, staking, and NFT marketplaces.

Market Liquidity and Volatility:

- Daily trading volume exceeding $20 billion, ensuring deep liquidity.

- Regular network upgrades create price movement opportunities for traders.

Whether you're looking to capitalize on short-term price swings or invest in Ethereum’s long-term growth potential, its broad utility and continuous innovation make it a cornerstone of the crypto market.

Solana (SOL): The High-Performance Blockchain

Solana (SOL) is known for its high-speed transactions and low fees, processing up to 65,000 transactions per second (TPS) with fees as low as $0.00025 per transaction. This makes it one of the most efficient blockchains, attracting both developers and traders.

Key Features of Solana:

Unmatched Speed & Cost-Effectiveness:

- Processes thousands of transactions per second.

- Minimal fees, making it an attractive choice for dApps and NFT projects.

Expanding Web3 and NFT Ecosystem:

- Hosts $1 billion+ in NFT sales, driving demand and adoption.

- Preferred by developers for scalable, low-cost solutions.

High Market Liquidity & Volatility:

- Regular price swings create opportunities for short-term traders.

- Growing institutional interest strengthens its market position.

Whether trading short-term price movements or investing for long-term growth, Solana's performance and growing adoption make it a standout asset in the crypto market.

Emerging Cryptocurrencies to Watch

As the cryptocurrency market evolves, emerging projects like Polygon (MATIC), Ripple (XRP), and Aptos (APT) are capturing attention, offering traders promising opportunities and unique value propositions.

Key Emerging Cryptocurrencies:

Polygon (MATIC)

- A leading scaling solution for Ethereum, facilitating faster and cheaper transactions.

- Supports over 37,000 dApps, enhancing its role in DeFi and Web3 applications.

- Strategic partnerships with major brands such as Disney and Starbucks boost adoption and credibility.

Ripple (XRP)

- Focused on institutional adoption and cross-border payments, handling transactions in 3-5 seconds with minimal fees.

- Despite regulatory challenges, XRP remains resilient, with legal clarity potentially driving long-term growth.

- Used by over 300 financial institutions globally, making it a reliable option for risk-averse traders.

Aptos (APT)

- A next-generation blockchain emphasizing scalability, security, and high-speed transactions.

- Capable of processing up to 160,000 transactions per second (TPS), positioning it as a competitor to Solana.

- A strong developer ecosystem and increasing institutional interest indicate significant growth potential.

Why These Cryptos Matter:

These emerging cryptocurrencies offer distinct use cases that align with the evolving demands of the crypto landscape. As interest in DeFi, scalable networks, and innovative blockchain technology grows, MATIC, XRP, and APT are well-positioned to play key roles in the future of digital assets. Whether you’re seeking diversification or targeting high-growth potential, keeping an eye on these assets could provide exciting trading opportunities.

Trading Strategies for 2025

Navigating the cryptocurrency market successfully requires a solid strategy that aligns with your goals and risk tolerance. Whether you're aiming for short-term gains or long-term growth, here are key trading strategies explained in simple terms with examples.

1. Day Trading – For Quick Profits

Day trading involves buying and selling cryptocurrencies within a single day to take advantage of small price movements.

Why it works: High liquidity (lots of buying and selling activity) and stable price patterns make assets like Bitcoin (BTC) and Ethereum (ETH) ideal for day trading.

Example: If Bitcoin’s price fluctuates between $40,000 and $41,000, a day trader might buy at the lower price and sell when it reaches a higher point, making a small but quick profit.

Key Tip: Use stop-loss orders to limit potential losses if the market moves against your trade.

2. Swing Trading – Taking Advantage of Market Swings

Swing trading focuses on holding assets for a few days or weeks, aiming to profit from larger price movements.

Why it works: Volatile cryptocurrencies like Solana (SOL) experience sharp price swings due to trends like NFT and Web3 adoption.

Example: A swing trader might buy Solana at $100 after a dip and sell when it reaches $120, capitalizing on short-term trends.

Key Tip: Monitor news and trends that can impact prices, such as partnerships or regulatory updates.

3. Long-Term Investing (HODLing) – Patience Pays Off

Long-term investing involves buying cryptocurrencies and holding them for months or years, focusing on their potential for future growth.

Why it works: Some cryptocurrencies, like Polygon (MATIC), have strong fundamentals with real-world use cases, such as making Ethereum faster and cheaper.

Example: An investor who bought Polygon at $0.50 and held it for several years could see it rise to $5 or more, thanks to its growing adoption.

Key Tip: Diversify your portfolio to spread risk across multiple promising projects.

4. Risk Management – Protecting Your Investments

Regardless of your trading strategy, managing risk is essential to avoid major losses.

Diversification: Don't put all your money into one coin; spread your investments across different cryptocurrencies to reduce risk.

Stop-Loss Orders: Automatically sell your holdings if the price drops to a certain level, helping to limit losses.

Example: If you set a stop-loss for Ethereum at $2,800, it will automatically sell if the price falls to that level, preventing further losses.

Conclusion

The cryptocurrency market in 2025 offers exciting opportunities, with established leaders like Bitcoin, Ethereum, and Solana, alongside promising emerging projects such as Polygon. Each cryptocurrency brings unique strengths—Bitcoin’s unmatched liquidity, Ethereum’s smart contract capabilities, and Solana’s high-speed performance—providing traders with diverse options to explore.

To achieve success in this evolving market, traders must:

- Utilize risk management tools, such as stop-loss orders and portfolio diversification.

- Leverage technical analysis to identify trends and optimize entry and exit points.

- Stay informed about project updates, regulations, and market trends to make well-informed decisions.

As the crypto landscape continues to grow, making informed trading decisions will be key to thriving in one of the world's most dynamic financial markets.

Ready to trade cryptocurrencies with confidence? Explore trusted platforms at WhereToTrade and take the first step toward achieving your trading goals today.

Table of contents

1. Best Cryptocurrencies for Beginners to Trade in 2025 2. Factors to Consider When Choosing Cryptocurrencies to Trade in 2025 3. Best Crypto for Beginners to Watch in 2025 4. Emerging Cryptocurrencies to Watch 5. Trading Strategies for 2025 6. Conclusion