How to Choose the Right Forex, Stocks, and Crypto Broker for Your Trading Success

Discover how brokers simplify trading in Forex, stocks, and cryptocurrencies by providing market access, tools, and risk management features. Learn how platforms like AVATrade, and eToro can enhance your trading journey.

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

Imagine stepping into a bustling marketplace filled with endless opportunities but no clear guide to navigate it—this is what trading might feel like without brokers. Whether you're trading Forex, stocks, or cryptocurrencies, brokers act as your bridge to the global financial markets, simplifying complex processes and enabling you to seize trading opportunities with ease.

Brokers are more than middlemen; they provide the tools, platforms, and insights that make trading accessible to everyone, from beginners to seasoned investors. For example, a broker offering a user-friendly platform with low spreads can be the difference between a profitable Forex trade and a missed opportunity. In stocks, brokers often provide real-time data and expert analysis, helping traders make informed decisions. In crypto, brokers play a pivotal role in offering secure transactions and liquidity in a market that can be highly volatile.

Did you know that Forex trading involves over $7.5 trillion in daily transactions? Or that Bitcoin alone has a market cap of over $700 billion? Brokers are crucial in facilitating these massive flows of funds, ensuring traders can participate seamlessly.

Choosing the right broker isn't just about trading; it's about unlocking your potential to grow in the financial markets. So, whether you're eyeing a bullish crypto trend or a steady stock portfolio, a reliable broker is your ticket to making it happen.

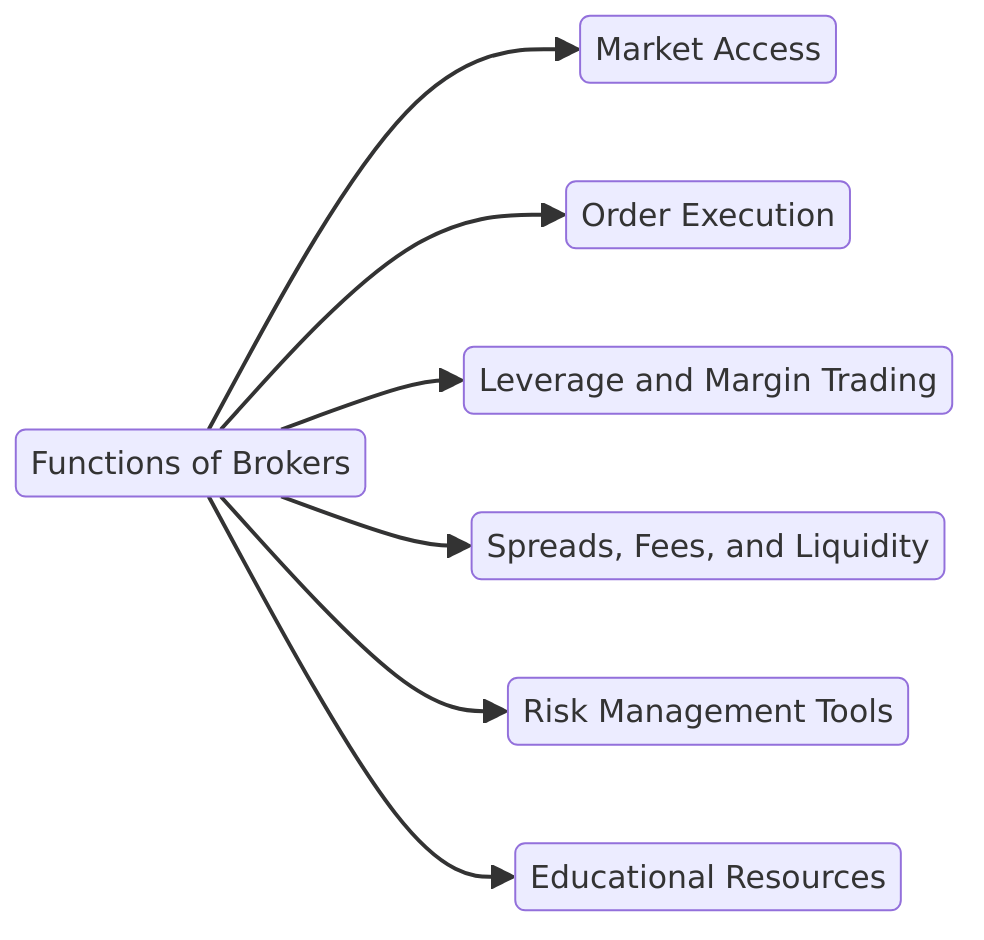

Functions of Forex, Stocks, and Crypto Brokers

Brokers are essential for accessing financial markets, offering tools and services to trade Forex, stocks, and cryptocurrencies. Here's how they empower traders:

-

Market Access

Brokers provide platforms for buying and selling assets. Forex brokers offer access to currency pairs like EUR/USD, stock brokers connect traders to exchanges like NASDAQ, and crypto brokers enable trading of assets like Bitcoin and Ethereum.

-

Order Execution

Brokers ensure orders are executed quickly and accurately. For example, if you buy Tesla shares at $250 or Ethereum at $1,600, a broker ensures minimal delay and price changes.

-

Leverage and Margin Trading

Leverage allows traders to control larger positions with less capital. Forex brokers may offer 1:100 leverage, while stock and crypto brokers provide margin trading or leverage up to 100x, amplifying both profit and risk.

-

Spreads, Fees, and Liquidity

Brokers connect traders to liquid markets while earning through spreads or fees. For instance, a 1-pip spread on EUR/USD or a 0.1% crypto trading fee keeps trading accessible.

-

Risk Management Tools

Features like stop-loss and take-profit orders protect traders in volatile markets. For example, setting a stop-loss for Apple shares at $300 limits potential losses.

-

Educational Resources

Brokers offer tutorials, market reports, and insights. A crypto broker might provide weekly Bitcoin price trends, while stock brokers supply earnings updates.

Whether in Forex, stocks, or crypto, brokers simplify trading, ensuring access, execution, and security for traders.

Facilitating Trades: Market Access and Order Execution

Brokers play a crucial role in providing traders and investors with seamless access to financial markets and ensuring efficient order execution. Whether it's Forex, stocks, or cryptocurrencies, brokers make market participation easier and more effective.

Market Access:

Forex brokers AVATrade offer access to the global currency market, enabling trades on popular pairs such as EUR/USD or GBP/JPY. For stocks, platforms like eToro connect traders to major exchanges, allowing them to invest in companies like Apple and Tesla.

Crypto brokers, including Binance and Coinbase, provide a gateway to the digital asset market, making it easy to trade Bitcoin, Ethereum, and other cryptocurrencies, however, now it’s possible to trade these cryptocurrencies via CFD brokers using leverage, that can enhance explore.

Order Execution:

The ability to execute trades quickly and accurately is essential in financial markets. For example, AVATrade ensures minimal slippage when trading EUR/USD at 1.1050, while eToro’s instant trade execution allows users to buy Tesla shares at $250 without delays. Similarly, crypto brokers like Binance help traders capture Bitcoin at $25,000 before price fluctuations occur.

Choosing the right broker is critical to your success. That’s why our expert team at WhereToTrade is dedicated to helping you find the broker best suited to your trading needs—whether you prioritize tight spreads, fast execution, or comprehensive market tools.

Pricing and Liquidity: Aggregation and Provision

Brokers are essential for providing traders with competitive pricing and reliable liquidity, ensuring seamless trade execution across Forex, stocks, and other CFD instruments.

Pricing Aggregation:

CFD brokers like AVATrade, and eToro aggregate prices from multiple liquidity providers, ensuring real-time and accurate rates for traders. Similarly, AVATrade ensures transparent pricing for stock CFDs such as Tesla, which might trade at $250.50 bid and $250.55 ask, keeping spreads tight and competitive. Such aggregation minimizes discrepancies, particularly in volatile markets, where pricing accuracy is critical.

Liquidity Provision:

Liquidity is the lifeblood of trading, ensuring trades can be executed with minimal slippage, even during high volatility. Brokers like eToro tap into liquidity pools worth billions, allowing traders to execute large orders seamlessly.

For instance, during earnings season, a high-volume Tesla trade of $100,000 through eToro ensures minimal impact on market price. In Forex, AVATrade provides access to liquidity for pairs like GBP/USD, even during spikes in volatility driven by major events, ensuring efficient order execution without significant price fluctuation.

Risk Management: Margin and Risk Warnings

Managing risk is essential for successful trading, especially when dealing with leveraged instruments like CFDs. Brokers such as AVATrade, and eToro provide tools and safeguards to help traders protect their capital and stay informed about potential risks.

Margin trading enables traders to control large positions with a fraction of the total value. For example, AVATrade offers leverage of up to 1:400 on Forex pairs, allowing a $500 margin to control a $200,000 trade. While this can significantly enhance potential profits, it also increases exposure to losses. To mitigate these risks, brokers enforce margin requirements and issue margin calls when account balances fall below the required maintenance level.

Here are some additional risk management tools brokers provide:

- Stop-Loss Orders: Automatically close trades if the price hits a predefined loss limit.

- Take-Profit Orders: Lock in profits by closing trades once a specific target price is reached.

- Risk Warnings: Platforms like eToro inform users that "67% of retail CFD accounts lose money," highlighting the risks involved in trading.

Research and Analysis: Market Information and Trading Tools

Research and analysis are crucial for making informed trading decisions. Brokers like AVATrade, and eToro provide essential tools to help traders stay ahead in volatile markets.

Key resources include:

- Economic Calendars: Highlight major events like central bank rate decisions or GDP reports. For instance, a U.S. non-farm payroll report can cause a 0.5% move in USD pairs within minutes.

- Advanced Charting Tools: Platforms like AVATrade offer indicators such as Bollinger Bands and RSI, helping traders identify trends and potential entry points.

- Market News and Insights: Real-time updates keep traders informed of breaking events that can impact Forex, stocks, and CFDs.

- Copy Trading Features: eToro allows beginners to replicate strategies of successful traders, making it easier to learn and trade simultaneously.

Exploring Types of Forex Brokers

Forex brokers play an essential role in connecting traders to the currency market, and understanding their types is critical to selecting the right one for your trading needs. The three primary types of Forex brokers are Market Makers (Dealing Desk Brokers), STP (Straight Through Processing) Brokers, and ECN (Electronic Communication Network) Brokers, each with unique features.

- Market Makers (Dealing Desk Brokers): These brokers create their own liquidity by taking the opposite side of your trades. For example, a Market Maker may quote EUR/USD at 1.1045/1.1047, profiting from the 2-pip spread. This model guarantees liquidity and stable execution, but it may lead to a conflict of interest.

- STP Brokers: STP brokers act as intermediaries, routing trades directly to liquidity providers like banks. They offer minimal spreads and no re-quotes, making them ideal for traders who value speed and transparency.

- ECN Brokers: ECN brokers connect traders to a network of financial participants, offering the tightest spreads and deep liquidity. For instance, during volatile market conditions, ECN brokers might offer spreads as low as 0.1 pips on major currency pairs.

Choosing the Best Broker for Your Trading Needs

Selecting the right broker is a critical step in your trading journey. Whether you trade Forex, stocks, or CFDs, the ideal broker should align with your goals, trading style, and market preferences. Here are key factors to consider:

- Regulation and Security: Ensure the broker is regulated by reputable authorities like the FCA, ASIC, or CySEC. For example, AVATrade is regulated globally, providing traders with security and trust.

- Leverage and Margin: Choose a broker offering leverage that suits your risk appetite. For instance, eToro provides leverage up to 1:30 for retail traders, striking a balance between opportunity and safety.

- Trading Platforms: User-friendly platforms like MetaTrader 4 or proprietary platforms from AVATrade ensure smooth execution and access to advanced tools.

- Customer Support: Reliable brokers provide 24/5 support via live chat, phone, or email to address issues promptly.

At WhereToTrade, our experts evaluate brokers based on these factors and more, helping you find the best fit for your needs.

Evaluating Regulation, Features, and Costs

Choosing the right broker begins with evaluating their regulation, features, and costs. These factors directly impact your trading experience and security.

- Regulation: A regulated broker ensures your funds are protected and trading practices are transparent. Look for brokers licensed by authorities like the FCA, ASIC, or CySEC.

- Features: The best brokers offer robust tools like advanced charting, economic calendars, and risk management features. For instance, AVATrade integrates popular indicators like RSI and Fibonacci Retracements, while eToro provides a copy trading feature ideal for beginners.

- Costs: Transparent pricing is crucial. Check for low spreads and commissions. For example, a broker offering 1-pip spreads on EUR/USD saves traders money compared to brokers with wider spreads.

Conclusion: Simplifying Trading with the Right Broker

Choosing the right broker can make Forex trading more accessible and profitable. Regulated brokers like AVATrade, and eToro provide the tools, security, and support traders need to succeed. From tight spreads to advanced platforms, the right broker simplifies your trading experience and enhances your potential for success.

At WhereToTrade, we specialize in matching traders with brokers that meet their unique needs, ensuring your trading journey starts on the right foot.

Table of contents

1. Functions of Forex, Stocks, and Crypto Brokers 2. Facilitating Trades: Market Access and Order Execution 3. Pricing and Liquidity: Aggregation and Provision 4. Risk Management: Margin and Risk Warnings 5. Research and Analysis: Market Information and Trading Tools 6. Exploring Types of Forex Brokers 7. Choosing the Best Broker for Your Trading Needs 8. Evaluating Regulation, Features, and Costs 9. Conclusion