How to Choose the Right Trading Market: Forex, Crypto, or Commodities

Discover which trading market—forex, crypto, or commodities—best suits your goals, risk tolerance, and trading style.

Writen by:

Arslan Ali But

12 February 2025

8 minutes read

Writen by:

Arslan Ali But

12 February 2025

8 minutes read

Today's financial markets offer exciting opportunities across forex, crypto, and commodities, each catering to different trader profiles and risk appetites.

Forex, the world’s largest market with a daily turnover exceeding $7.5 trillion, provides high liquidity and leverage, making it ideal for short-term strategies.

Cryptocurrencies have experienced significant growth, with the total market capitalization reaching approximately $3.91 trillion in mid-December 2024. Bitcoin, the leading digital asset, surpassed the $100,000 milestone in December 2024, driven by factors such as the approval of spot exchange-traded funds (ETFs) and a favorable regulatory environment under the new U.S. administration.

The crypto market's 24/7 operation and pronounced volatility attract traders seeking high-risk, high-reward opportunities.

Commodities, like gold and oil continue to offer long-term stability and serve as hedges against inflation. For instance, gold prices rose by 15% in 2024, providing a safe haven during economic uncertainties. The commodities market is generally less volatile than forex or crypto, appealing to investors with a lower risk tolerance.

Choosing the right market depends on your goals, risk tolerance, and time commitment. This guide explores the key features of each market to help you make an informed decision.

The Forex Market

The forex market is the largest and most liquid financial market, operating 24 hours a day, five days a week. As of 2024, the market sees daily transactions exceeding $7.5 trillion, making it an attractive choice for traders seeking liquidity and leverage.

Key Benefits:

- Liquidity: The high trading volume ensures that major currency pairs, such as EUR/USD, can be traded seamlessly, allowing for quick entry and exit with minimal price slippage.

- Leverage: Forex brokers often offer leverage, enabling traders to control larger positions with a relatively small capital outlay. For instance, a 50:1 leverage ratio allows a trader to manage a $50,000 position with just $1,000 of their own funds.

- Accessibility: The forex market's continuous operation accommodates various trading styles, including day trading and scalping, making it suitable for individuals who thrive in fast-paced environments.

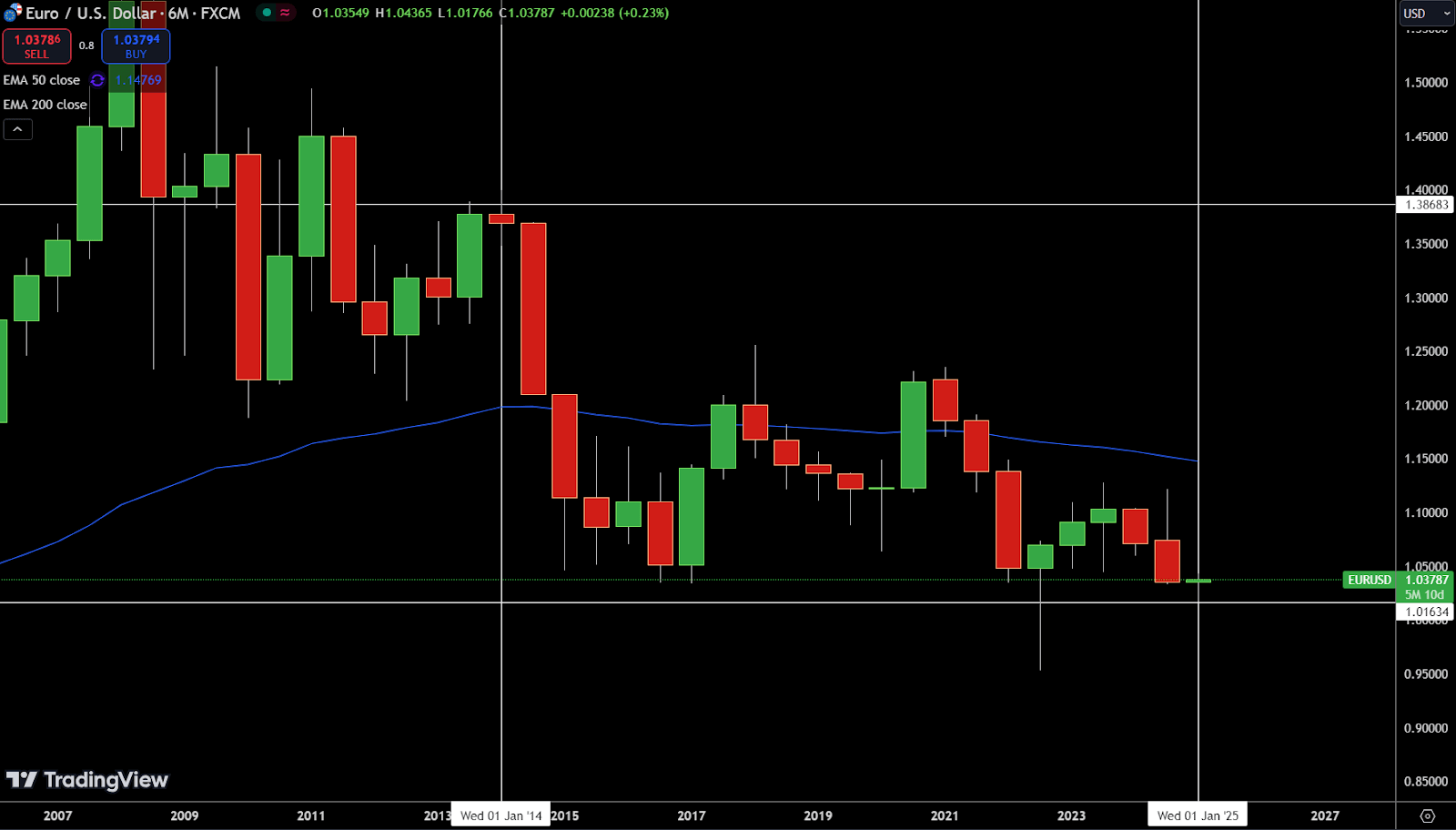

For example: A day trader utilizing 50:1 leverage on the EUR/USD pair could capitalize on price fluctuations. As of January 2025, the EUR/USD pair is trading around 1.03787, with recent highs of 1.04365 and lows of 1.01766 recorded within the same timeframe. Looking at historical data, significant resistance was seen around 1.38683 in January 2014, while the current support level sits at 1.01634, indicating key zones for potential trading opportunities.

The EUR/USD pair has shown consistent downward pressure since 2021, trading below the 200-period exponential moving average (EMA), suggesting a long-term bearish trend. This emphasizes the importance of trend analysis when making trading decisions.

While the forex market offers profit opportunities through leverage, it also carries significant risks, necessitating strong risk management strategies.

Best suited for: Traders looking for high liquidity and quick execution, particularly those proficient in technical analysis and risk management.

The Cryptocurrency Market

Cryptocurrency trading offers unmatched volatility and the ability to trade 24/7, with assets like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) leading the way. Unlike traditional markets, cryptocurrencies provide unique opportunities but also come with substantial risks.

Key Benefits:

- High Volatility: Crypto markets experience dramatic price swings, creating opportunities for substantial profits.

- Decentralization: Operates outside traditional financial systems, offering financial independence and security.

- Innovative Products: Access to decentralized finance (DeFi), cross-border payments (Ripple), and staking options for diversified strategies.

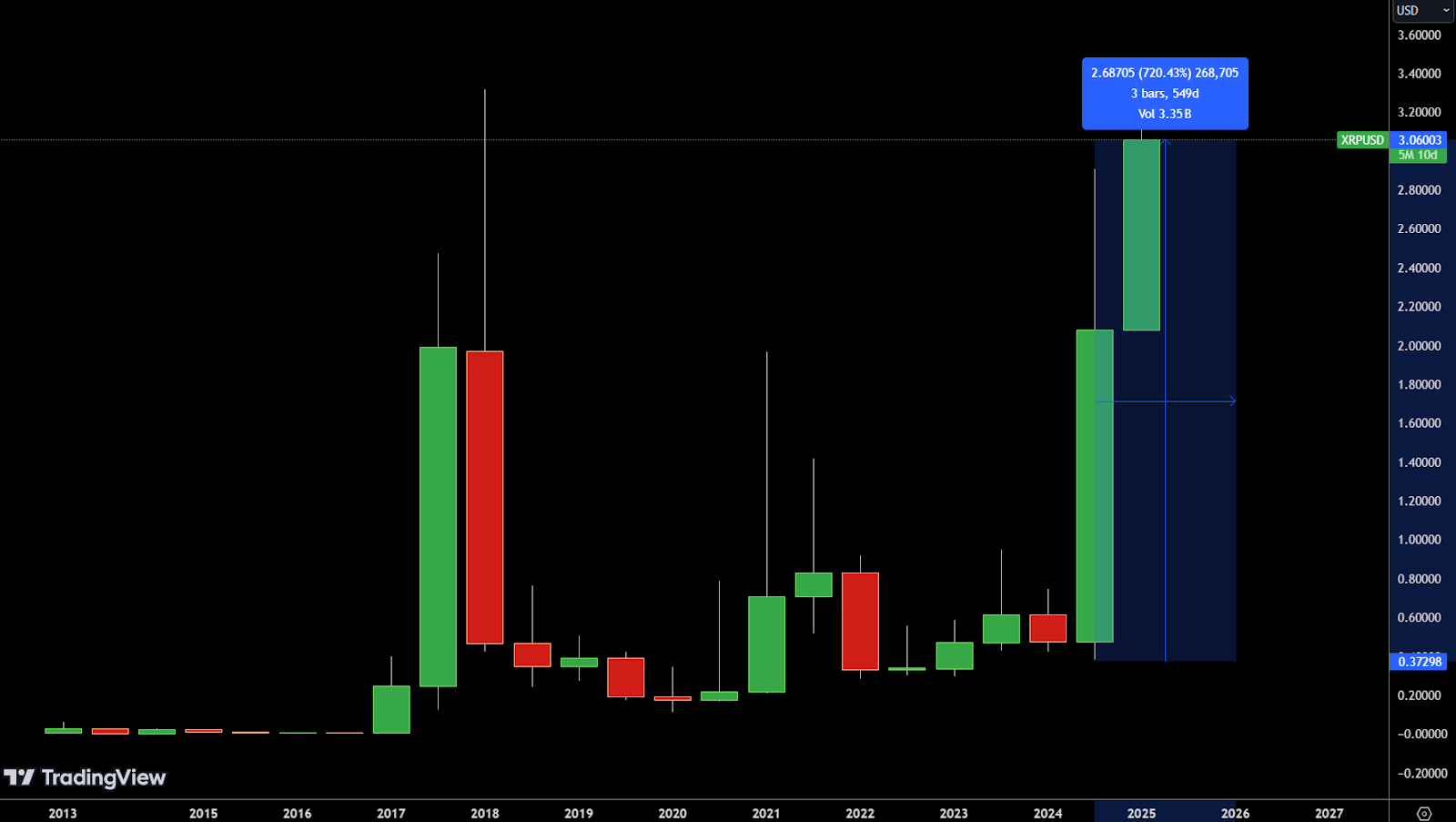

For Example: In 2024, XRP surged from $0.37298 to a recent high of $3.06003, representing an astonishing 720.43% increase. This rally underscores the potential for significant gains in the crypto market. However, the price volatility highlights the importance of strategic entry and exit points to avoid losses.

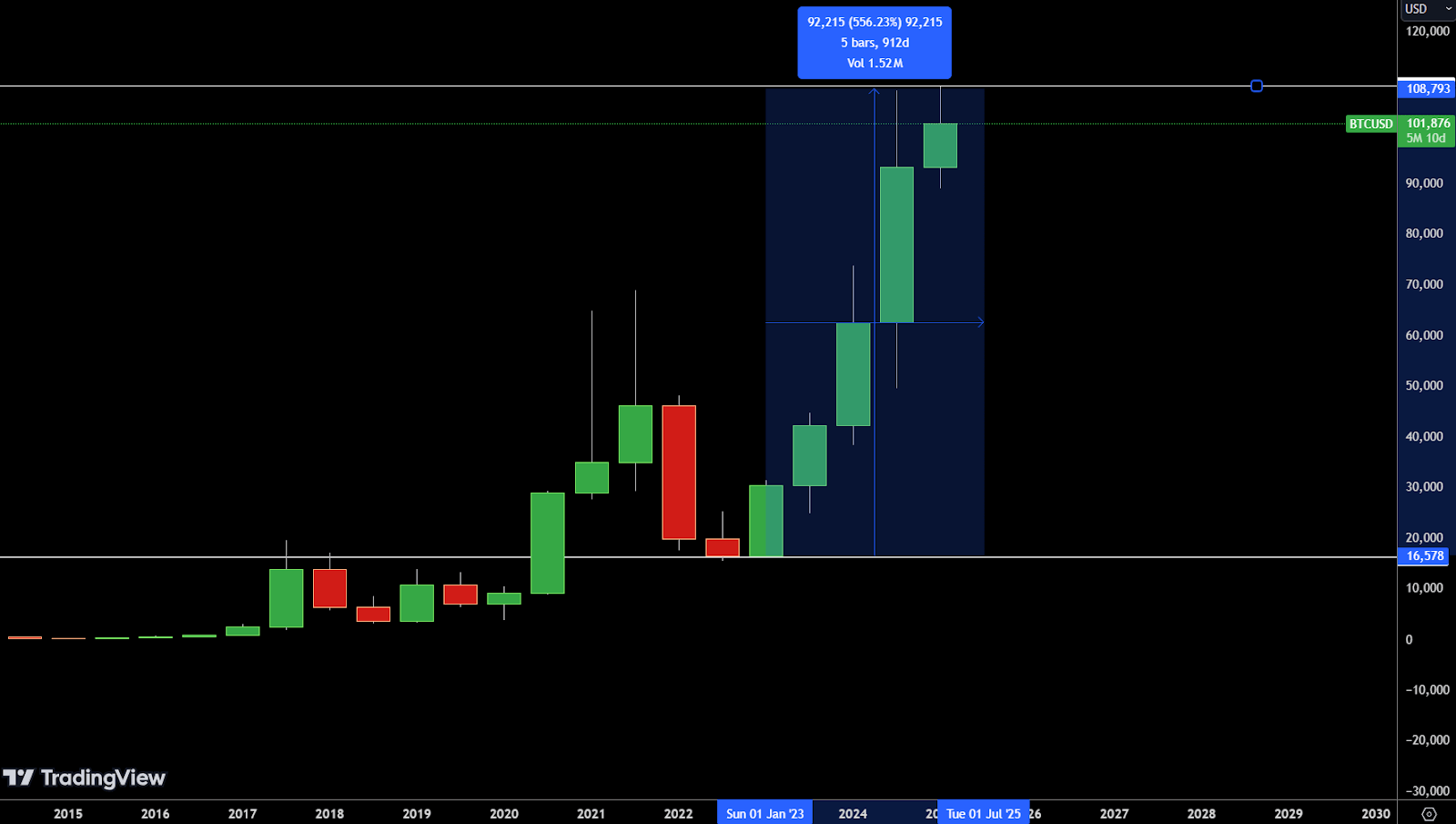

Similarly, Bitcoin (BTC) saw impressive growth from $16,578 in January 2023 to a peak of $108,793 by Jan 2025, showcasing a 556.23% gain. This growth reinforces Bitcoin’s position as a key asset in the crypto space.

Challenges:

- Regulatory Uncertainty: Ongoing legal battles, such as XRP’s case with the SEC, create market instability.

- Cybersecurity Threats: Hacking incidents and security breaches pose risks to investors.

Best Suited For:

Tech-savvy traders comfortable with high volatility, who stay informed on regulatory developments and manage risk effectively.

The Commodities Market

Commodities trading involves tangible assets such as gold, oil, and agricultural products, offering stability and diversification opportunities. Unlike forex and crypto, commodities are influenced by economic cycles, supply-demand dynamics, and geopolitical events.

Key Benefits:

- Inflation Hedge: Gold is a go-to asset during economic uncertainty.

- Lower Volatility: Commodities tend to move more predictably over the long term.

- Portfolio Diversification: Adds a defensive component to investment strategies.

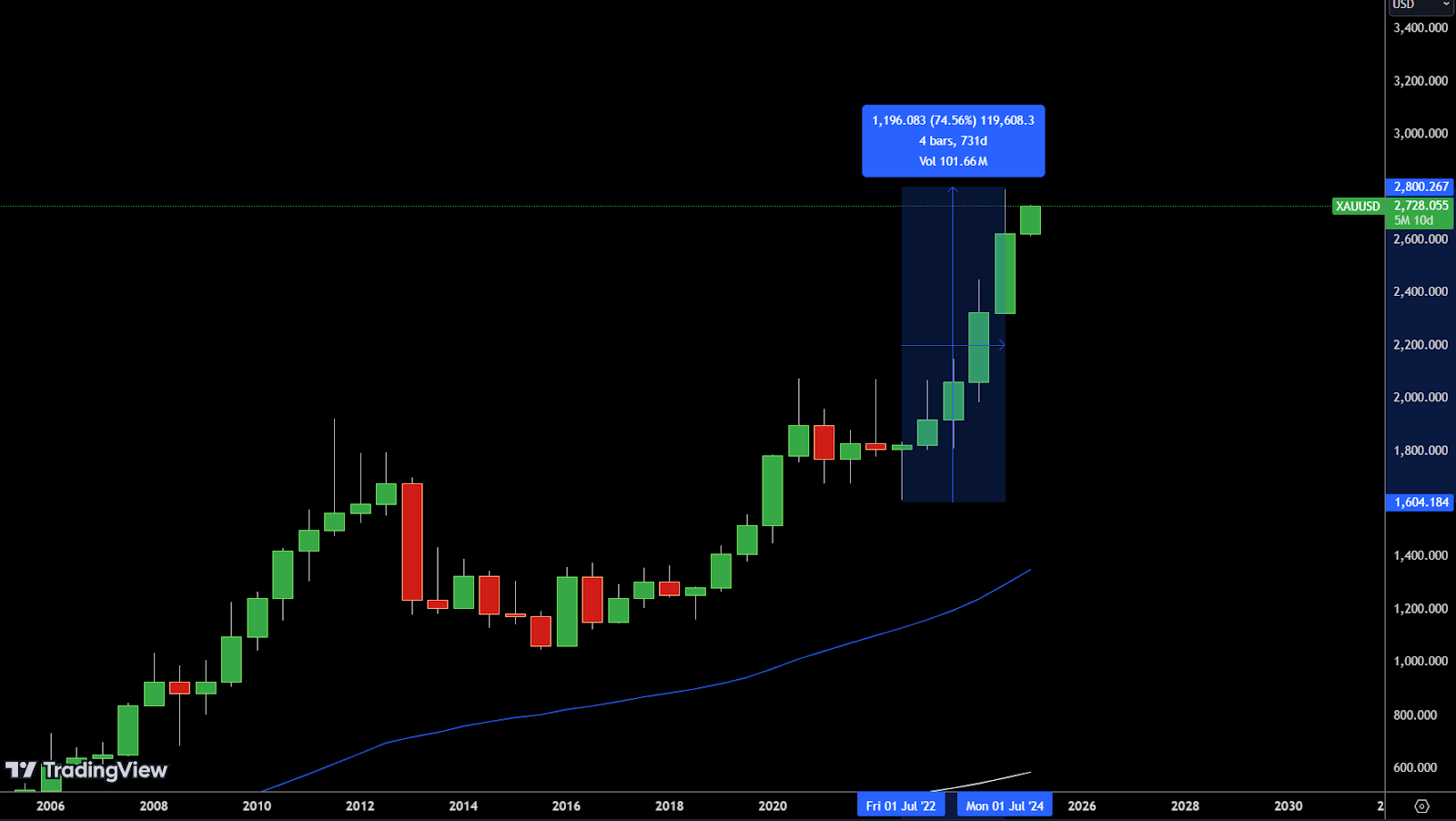

Example: Between July 2022 and July 2024, gold (XAUUSD) surged from $1,604.18 to a high of $2,800.26, marking a 74.56% increase. This strong upward movement highlights gold's role as a safe-haven asset, particularly in times of inflation and economic uncertainty.

Best for: Long-term investors seeking stability and lower risk exposure.

How to Choose the Right Market

Choosing the right trading market depends on several factors, including your:

-

Goals:

- Looking for quick profits? → Choose forex or crypto.

- Seeking long-term stability? → Commodities may be the better option.

-

Risk Appetite:

- High-risk takers: Crypto offers high returns but extreme volatility.

- Moderate-risk traders: Forex provides leverage with more predictability.

- Risk-averse investors: Commodities offer steady growth and lower exposure to market shocks.

-

Time Commitment:

- Active traders should consider forex or crypto, as they require constant monitoring.

- Passive investors might prefer commodities for a more hands-off approach.

Example: A cautious investor might prefer gold for portfolio diversification, while an aggressive trader could turn to Ethereum for speculative gains.

Conclusion

Each trading market—forex, crypto, and commodities—offers distinct opportunities and challenges. Forex provides unmatched liquidity and leverage, making it ideal for short-term strategies. Cryptocurrencies offer 24/7 access and high-return potential but come with significant volatility and regulatory risks. Commodities, such as gold and oil, provide long-term stability and act as a hedge against inflation.

Choosing the right market depends on aligning your trading goals, risk tolerance, and available time. Ready to take the next step? Start with a demo account to explore different markets and refine your strategy. Explore trusted trading platforms at WhereToTrade and start your trading journey today!

Table of contents

1. The Forex Market 2. The Cryptocurrency Market 3. The Commodities Market 4. How to Choose the Right Market 5. Conclusion