How to Trade Stocks Like Tesla, Nvidia, and Apple

Learn how to trade Tesla, Nvidia, and Apple stocks with expert insights on market trends, trading strategies, and risk management.

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

Tesla, Nvidia, and Apple are at the forefront of cutting-edge industries such as artificial intelligence (AI), electric vehicles (EVs), and digital services. These industry giants continue to show strong growth potential, making them attractive for both short-term traders and long-term investors.

Over the past five years, Nvidia has outperformed the Magnificent 7, delivering an astonishing return of nearly 3,000%. Tesla follows closely with a remarkable gain of over 1,200%, driven by its dominance in the EV sector. Apple, known for its iconic brand and integrated ecosystem, has provided steady yet significant returns, often influenced by key events such as product launches and earnings reports.

Despite their growth potential, trading these tech giants comes with risks. Factors such as market volatility, technological advancements, and global economic conditions can impact their stock prices. However, their strong market presence, innovation-driven growth, and liquidity make them appealing to traders looking to capitalize on their price movements.

Why Trade Tesla, Nvidia, and Apple?

- Market Leadership: These companies dominate their respective sectors, providing stability and consistent performance.

- High Liquidity: Large trading volumes ensure quick entry and exit opportunities with minimal slippage.

- Volatility: Price swings driven by earnings, product launches, and industry trends create opportunities for both short- and long-term trading.

- Innovation-Driven Growth: Ongoing advancements in AI, EVs, and consumer electronics fuel long-term potential.

By understanding the unique characteristics of each stock and leveraging strategic trading approaches, investors can take advantage of the exciting opportunities that Tesla, Nvidia, and Apple present in today’s market.

Why Trade Tesla, Nvidia, and Apple Stocks?

Trading Tesla, Nvidia, and Apple stocks presents exciting opportunities due to their market dominance, innovation, and strong investor interest. Each company offers unique characteristics that attract different types of traders and investors.

Tesla (TSLA)

Tesla's stock is known for its high volatility, driven by factors such as market demand for electric vehicles (EVs), regulatory changes, and its charismatic CEO, Elon Musk. The stock frequently reacts to Musk's announcements

and developments in the EV market, such as competition from Hyundai and China's BYD. This volatility makes Tesla a prime choice for day traders and swing traders looking to capitalize on price swings.

Nvidia (NVDA)

Nvidia has emerged as a dominant force in the AI and semiconductor industry. In 2024, it was the most heavily invested stock among retail investors, with $30 billion in investments as of December 17th.

Nvidia boasts an Earnings Per Share (EPS) Rating of 99 and a Composite Rating of 98, highlighting its financial strength.

Analysts suggest that its high-profit margins may help it outperform competitors amid rising interest rates in 2025, making it an attractive pick for long-term growth investors.

Apple (AAPL)

Apple offers stability and consistent growth, making it a preferred choice for conservative investors. The company's ecosystem, spanning Mac, iPhone, and iPad, fosters strong customer loyalty. With robust institutional backing and a growing services segment, Apple remains a reliable stock for those seeking steady returns with lower volatility.

By trading these industry leaders, investors can leverage Tesla’s volatility, Nvidia’s growth potential, and Apple’s stability to build a well-balanced trading strategy.

Key Factors to Analyze Before Trading Tesla, Nvidia, and Apple Stocks

Before trading Tesla, Nvidia, or Apple stocks, it's essential to analyze various factors that influence their price movements. A comprehensive approach involves monitoring market news, earnings reports, sector trends, and technical analysis.

Market News and Events

Stock prices of high-profile companies are significantly influenced by market news. Monitoring news related to product launches, technological advancements, regulatory changes, and economic conditions can help anticipate price movements.

- Earnings Reports: Quarterly earnings releases often trigger price fluctuations. Reviewing historical earnings performance can reveal trends. For example, Apple's 2024 earnings exceeded expectations, resulting in a 5% surge in stock price.

- Sector Trends: Tesla is impacted by EV market expansion, Nvidia thrives on AI developments, and Apple's performance depends on consumer tech demand. Tracking industry-specific trends provides valuable insights for informed trading decisions.

- Company-Specific News: Statements from CEOs, partnerships, and competitive moves can create short-term volatility.

Technical Analysis

Technical analysis helps identify price trends and potential entry or exit points. Traders use charts and indicators such as:

- Support and Resistance Levels: Identifying price floors and ceilings to plan trades.

- Moving Averages: Common indicators like the 50-day and 200-day moving averages help spot trends.

- Breakout Patterns: Recognizing breakouts can signal potential upward or downward momentum.

Combining technical analysis with fundamental insights and sector trends allows traders to create a well-rounded strategy for maximizing profits.

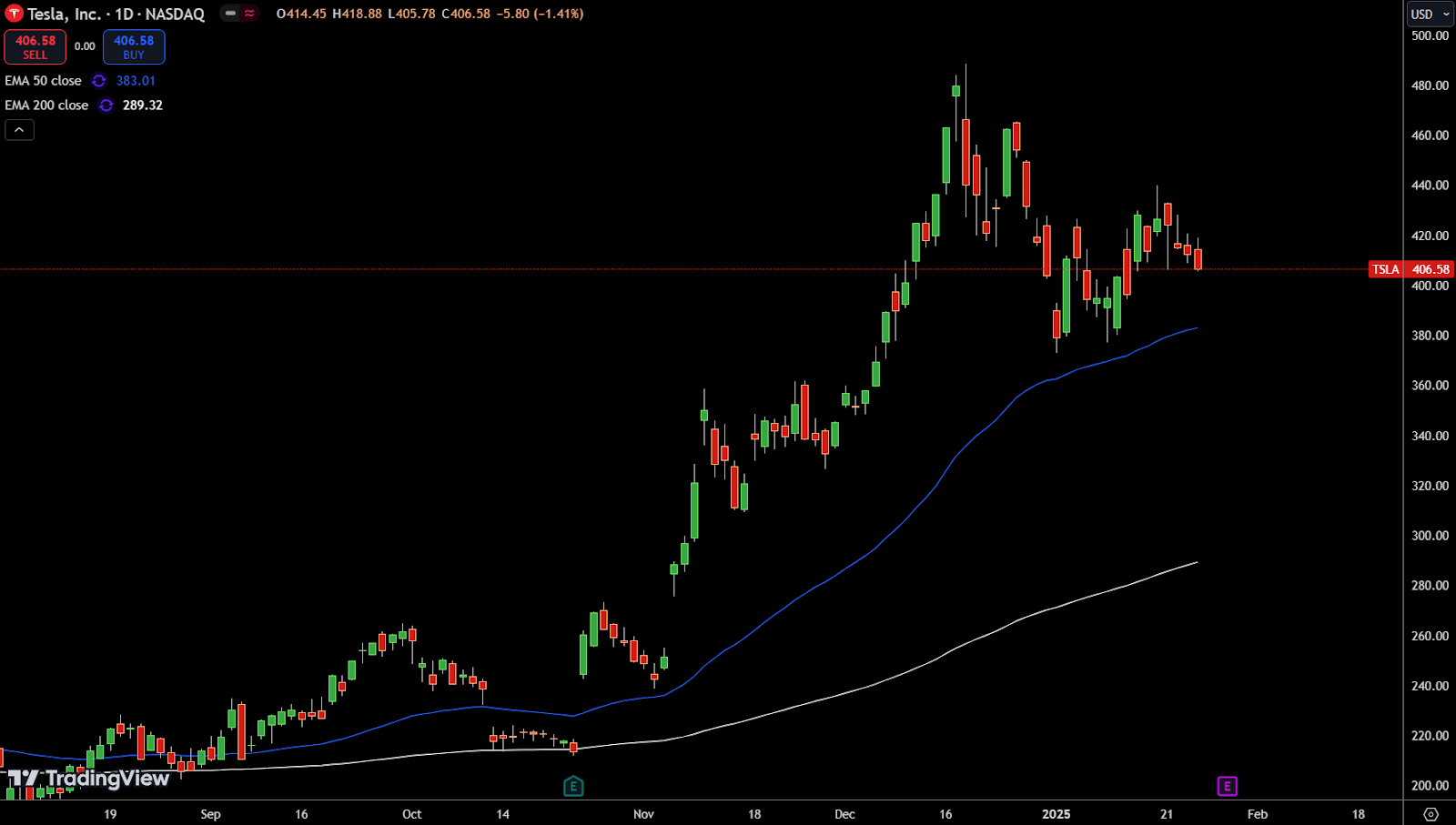

Trading Tesla Stock (TSLA)

Tesla (TSLA) remains the global leader in the electric vehicle (EV) industry despite facing increased competition and a slight loss of market share in recent years. However, with the planned launch of a more affordable EV and advancements in autonomous driving and robotics, the company is positioned for potential growth in 2025.

Elon Musk announced that Tesla aims for 20-30% growth in 2025, driven by innovations in self-driving technology and cost-efficient vehicles.

Why Trade Tesla?

Tesla’s stock is highly volatile, making it ideal for swing trading and day trading. Price movements are often influenced by:

- Elon Musk’s public statements and social media activity. For example: In August 2018, Tesla's share price surged after Musk’s tweet about taking the company private at $420 per share.

- Product launches and earnings reports, which can trigger sharp movements.

- Market trends in EV adoption and competition from brands like BYD and Hyundai.

How to Trade Tesla Stock

Successful trading requires a combination of fundamental and technical analysis.

Fundamental Analysis: Assess Tesla’s valuation, revenue growth, and innovation pipeline to determine if the stock is overvalued or undervalued.

Technical Analysis:

- Use indicators like Bollinger Bands to identify price volatility and breakout points.

- Monitor support and resistance levels to time entry and exit points effectively.

By combining these strategies, traders can capitalize on Tesla’s dynamic stock movements while managing risk effectively.

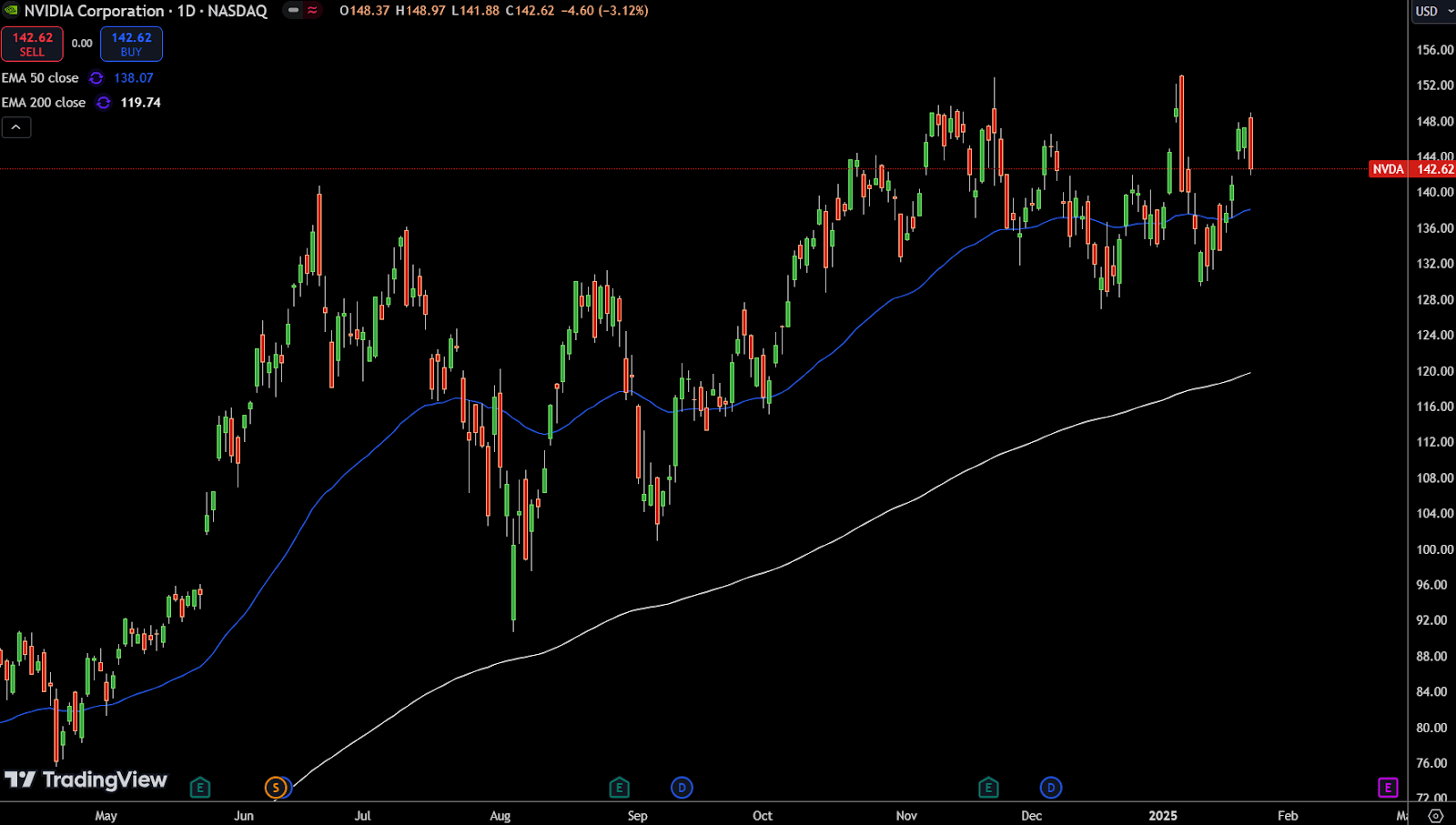

Trading Nvidia Stock (NVDA)

Nvidia (NVDA) is a global leader in graphics processing units (GPUs) and AI computing, playing a pivotal role in the advancement of artificial intelligence, gaming, and data centers. As one of the Magnificent Seven tech giants, Nvidia remains a favorite among investors.

In 2024, the company's market capitalization exceeded $3 trillion, driven by surging demand for AI chips. Its recent quarterly gross profit of $26.16 billion marked a 15.91% increase from the previous quarter, highlighting strong financial growth.

Why Trade Nvidia?

Nvidia’s stock offers lucrative opportunities due to its volatility and consistent earnings growth, making it ideal for both short-term traders and long-term investors. Key factors influencing its stock price include:

- Earnings Reports: Nvidia boasts an Earnings Per Share (EPS) Rating of 99 and a Composite Rating of 98, showcasing its financial strength. Its stock tends to react significantly to earnings announcements.

- AI and Tech Sector Trends: As AI adoption accelerates, Nvidia benefits from its leadership in cutting-edge chip technology.

- Investor Optimism: According to FactSet, Nvidia is projected to have the highest sales and earnings growth among S&P 500 companies through 2026.

How to Trade Nvidia Stock

To maximize profits, consider these strategies:

- Trade Around Earnings: Use the Post-Earnings Announcement Drift (PEAD) strategy to capitalize on price momentum following positive earnings surprises.

- Technical Analysis: Utilize the Relative Strength Index (RSI) to identify overbought or oversold conditions, helping to time entry and exit points effectively.

By combining earnings analysis with technical indicators, traders can take advantage of Nvidia’s market movements and growth potential.

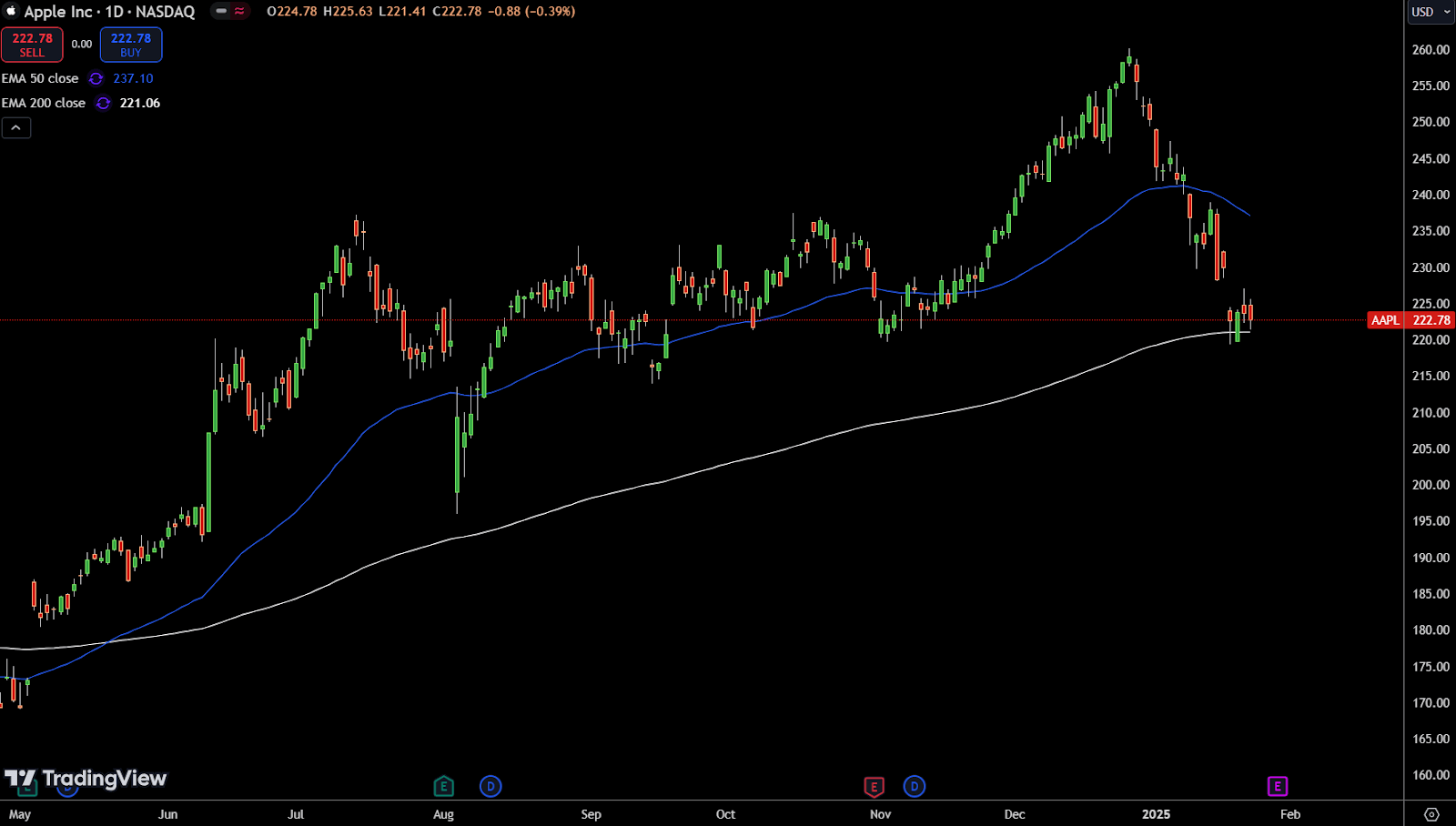

Trading Apple Stock (AAPL)

Apple (AAPL) is a market leader with a well-established ecosystem of hardware, software, and services, giving it strong brand authority and pricing power. Unlike more volatile stocks like Tesla and Nvidia, Apple stock has a relatively low volatility of 1.53%, making it an attractive choice for long-term investors and conservative traders. The company’s stock performance is primarily driven by product sales, earnings reports, and global demand for its ecosystem.

Why Trade Apple?

Apple stock offers stability and consistent growth, making it ideal for those seeking steady returns. Key factors that influence Apple’s stock price include:

- Product Cycles: Share prices often rise around major product launches such as new iPhones and MacBooks.

- Earnings Reports: Strong quarterly results can boost investor confidence and drive stock performance.

- Dividend Reinvestment: Apple’s dividend payouts provide additional returns for long-term investors.

How to Trade Apple Stock

Several trading strategies can be applied to Apple stock:

- Trend Following: Buy shares during an upward trend and hold until momentum slows.

- Reversal Trading: Enter positions when a trend shows signs of reversing.

- Candlestick Patterns: Use patterns like the doji, hammer, and shooting star to identify potential breakouts and trend changes.

- Scalping: Make quick trades by capitalizing on small price movements for incremental gains.

Best Trading Strategies for Popular Stocks

The best trading strategies depend on a stock’s characteristics and market behavior. Here are key strategies for trading Tesla, Nvidia, and Apple:

- Momentum Trading: Effective for Tesla and Nvidia, especially around earnings announcements and major news events. Traders capitalize on strong price movements driven by investor sentiment.

- Swing Trading: Works well with Apple and Nvidia, allowing traders to benefit from medium-term fluctuations, particularly during product launches or earnings cycles.

- Day Trading: Ideal for Tesla, which experiences high intraday volatility, offering opportunities to profit from rapid price swings within a single trading session.

- Correction-Based Trading: Identifying stocks that are technically oversold can provide strong entry points.

Using the Relative Strength Index (RSI), traders can analyze whether a stock is overbought or oversold relative to historical performance. A stock breaking above the RSI 30 level could indicate a potential trend reversal, signaling a buying opportunity.

Patience is key—waiting for the right signal can help traders avoid false breakouts and improve decision-making.

Conclusion

Popular stocks like Nvidia, Apple, and Tesla remain attractive to investors due to their market dominance, innovation, and profitability. However, it's crucial to understand the challenges associated with these stocks. The ever-evolving nature of the technology sector, regulatory scrutiny, and global economic factors—such as inflation and geopolitical tensions—can significantly impact their performance.

Moreover, high market valuations often create lofty investor expectations, and failing to meet them can lead to sharp stock price corrections. While these stocks hold strong growth potential, traders should adopt a balanced approach, incorporating thorough research and risk management strategies to mitigate potential downsides.

A well-structured trading plan, combining fundamental and technical analysis, stop-loss orders, and portfolio diversification, can help traders navigate market uncertainties and capitalize on opportunities effectively.

Ready to trade with confidence? Explore trusted platforms at WhereToTrade and take the first step toward achieving your financial goals today.

Table of contents

1. Why Trade Tesla, Nvidia, and Apple Stocks? 2. Key Factors to Analyze Before Trading Tesla, Nvidia, and Apple Stocks 3. Trading Tesla Stock (TSLA) 4. Trading Nvidia Stock (NVDA) 5. Trading Apple Stock (AAPL) 6. Best Trading Strategies for Popular Stocks 7. Conclusion