Top Forex Pairs for Beginners to Trade

Explore the best forex pairs for beginners, like EUR/USD and GBP/USD. Learn why they’re ideal with 2024 market stats, liquidity insights, and trading tips for success.

Writen by:

Arslan Ali But

07 January 2025

8 minutes read

Writen by:

Arslan Ali But

07 January 2025

8 minutes read

Did you know the forex market trades over $7.5 trillion daily, making it the most liquid financial market in the world? A significant portion of this volume comes from a handful of currency pairs like EUR/USD, USD/JPY, GBP/USD, and AUD/USD. For example, EUR/USD alone accounts for over 25% of daily forex trades in 2024, showcasing its dominance and liquidity.

These pairs aren’t just popular; they’re also beginner-friendly due to their stability and predictable movements. If you’re new to forex trading, starting with the right pairs can boost your confidence and minimize risks. Ready to dive in? Let’s explore the top forex pairs for beginners.

What Are Forex Pairs?

Forex pairs, or currency pairs, represent the exchange rate between two currencies and form the cornerstone of all forex trading activities. Whether you're buying, selling, or exchanging currencies in the forex market, transactions always occur in pairs. Each currency in a pair has a unique value relative to the other, known as the exchange rate.

The Structure of a Forex Pair

A currency pair is made up of two components:

- Base Currency: The first currency in the pair, representing the unit being bought or sold.

- Quote Currency: The second currency, indicating how much of it is needed to buy one unit of the base currency.

Example: In the EUR/USD pair, EUR is the base currency, and USD is the quote currency. If the exchange rate is 1.10, it means 1 EUR equals 1.10 USD.

How Exchange Rates Fluctuate

Exchange rates are influenced by factors such as economic data, central bank policies, and global events. A currency pair's value depends on the relative strength of the two currencies involved. For example, if the euro strengthens against the US dollar, the EUR/USD pair will rise.

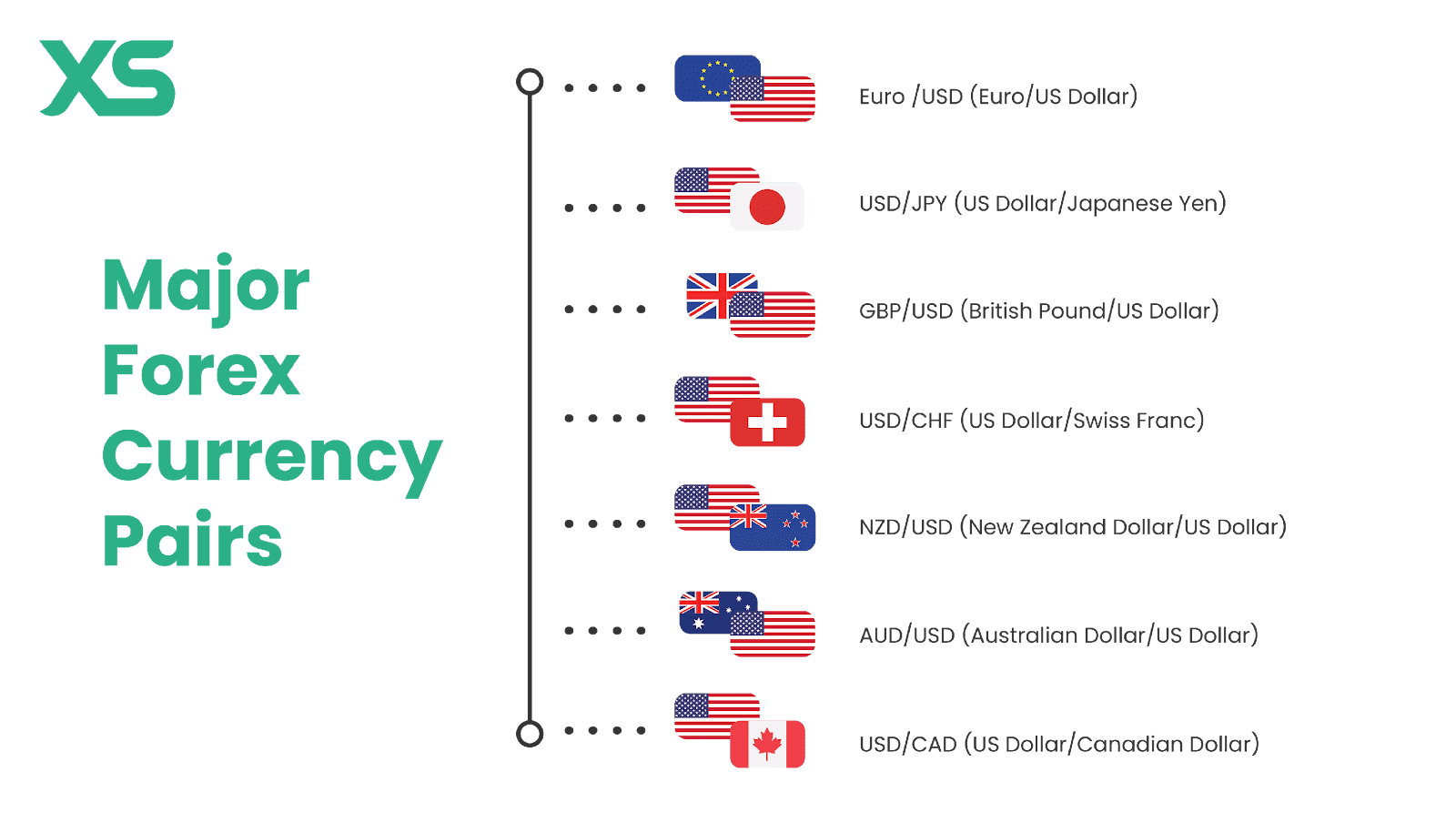

Top Forex Pairs for Beginners

Forex trading revolves around currency pairs, and beginners often find it challenging to decide where to start. Here’s a closer look at the most beginner-friendly pairs, highlighting their characteristics and why they’re popular among new traders.

EUR/USD (Euro/US Dollar)

Nicknamed "The Fiber," the EUR/USD is the most traded currency pair in the world.

Why It’s Ideal: It offers low spreads, high liquidity, and stability, making it beginner-friendly.

Volume Stats: This pair accounts for nearly 30% of global forex transactions.

Profit Potential: Stable markets allow for consistent, smaller earnings, ideal for scalping strategies.

Example: In 2024, the EUR/USD pair remained stable, fluctuating between 1.08 and 1.12, offering steady trading opportunities.

GBP/USD (British Pound/US Dollar)

Known as "The Cable," this pair is popular for its volatility and profit potential.

Why It’s Popular: Its frequent price movements make it perfect for day and swing trading.

Volatility: The average daily pip movement for GBP/USD is around 90-100 pips, higher than most pairs.

Note for Beginners: While the volatility can lead to significant profits, it also increases the risk of losses, requiring disciplined risk management.

USD/JPY (US Dollar/Japanese Yen)

Called "The Gopher," this pair is a staple for traders due to its liquidity and tight spreads.

Why It’s Beginner-Friendly: The pair's stability and predictable trends make it easier to analyze.

Liquidity: Its high trading volume ensures smooth transactions, even for large trades.

Interesting Fact: In 2024, USD/JPY averaged a daily movement of 40-60 pips, offering steady trading opportunities without extreme volatility.

AUD/USD (Australian Dollar/US Dollar)

The "Aussie" pair is closely linked to commodity prices, making it sensitive to global economic changes.

Unique Feature: Australia's reliance on exports means this pair is influenced by gold, coal, and iron ore prices.

Trading Tip: The best time to trade AUD/USD is during the London session, where global financial activity peaks.

Example: In 2024, AUD/USD saw significant movement as gold prices fluctuated by over 15% during the year.

USD/CAD (US Dollar/Canadian Dollar)

Nicknamed "The Loonie," this pair is influenced by oil prices, as Canada is a major oil exporter.

Why It’s Reliable: Its predictable movements make it easier to trade during the New York session.

Fact: In 2024, USD/CAD's correlation with oil saw prices fluctuate in line with crude oil’s 10% rise during the year.

USD/CHF (US Dollar/Swiss Franc)

The "Swissie" is considered a safe-haven pair, often sought after during market uncertainty.

Key Feature: The Swiss franc’s stability makes it a go-to option during economic or political turmoil.

Example: In 2024, USD/CHF became a favorite during periods of geopolitical tension, with the Swiss franc appreciating by 4% against the US dollar in Q3.

Why Beginners Should Focus on These Pairs

These pairs are highly liquid, stable, and widely traded, offering low spreads and predictable price movements. They allow beginners to practice strategies, manage risks effectively, and gain confidence in their trading skills. Starting with these pairs can help new traders navigate the forex market with greater ease and reduced risk.

Why These Forex Pairs Are Ideal for Beginners

Forex beginners are often advised to start with major currency pairs due to their unique characteristics that make trading more manageable and less risky. Here’s why these pairs are perfect for those new to the market:

1. High Liquidity

Major currency pairs like EUR/USD and USD/JPY are the most liquid in the forex market, meaning they can be easily bought or sold without causing significant price changes.

What It Means for Beginners: High liquidity ensures smoother trade execution, even for large volumes.

Example: In 2024, the EUR/USD pair accounted for over 25% of daily forex transactions, showcasing its dominance and ease of trading.

2. Low Spreads

Major pairs typically have the tightest spreads compared to minor or exotic pairs.

Cost Advantage: Low spreads reduce transaction costs, making trading more affordable.

Example: Many brokers offer spreads as low as 0.1 pips on EUR/USD during peak trading hours, significantly lowering costs for retail traders.

Common Mistakes to Avoid When Choosing Forex Pairs

Entering the forex market can be exciting, but beginners often make mistakes that can lead to significant losses. Here’s what to avoid when selecting forex pairs:

1. Trading Exotic Pairs Too Soon

Exotic pairs may seem attractive due to their potential profitability, but they come with low liquidity and high volatility, making them unpredictable and riskier.

Why It’s Risky: Wider spreads and erratic price movements can quickly erode beginner accounts.

Example: Trading pairs like USD/TRY (US Dollar/Turkish Lira) can lead to large losses if geopolitical tensions or unexpected economic shifts occur.

2. Ignoring Market News and Economic Factors

Forex prices are heavily influenced by geopolitical events, economic data, and central bank policies. Overlooking these factors can result in poorly timed trades.

Why It’s a Mistake: Economic announcements, like interest rate decisions, often cause sharp price movements in major pairs like EUR/USD or GBP/USD.

Tip: Monitor economic calendars to stay updated on key events that might impact your chosen pair.

3. Misusing Leverage

Leverage amplifies both profits and losses, making it a double-edged sword. Beginners often overestimate their ability to manage leveraged positions.

What Can Go Wrong: Without proper understanding, a small market movement can wipe out your trading account.

Example: A trader using 100:1 leverage on a $500 account risks losing the entire balance with just a 0.5% market movement in the wrong direction.

Solution: Start with lower leverage and only risk what you can afford to lose.

4. Trading Too Many Pairs at Once

Beginners often spread themselves too thin by trading multiple pairs simultaneously.

Why It’s Ineffective: Tracking multiple pairs requires advanced skills in analyzing different economic and technical factors.

Recommendation: Focus on one or two major pairs like EUR/USD or USD/JPY until you gain experience and confidence.

Conclusion

For beginners, starting with major forex pairs is a smart strategy. Their high liquidity, stability, and balanced volatility make them easier to trade while minimizing risks. Major pairs like EUR/USD and USD/JPY offer predictable price movements, allowing new traders to build confidence with smaller, consistent profits.

Focus on mastering one pair before expanding to others, and always stay informed about market trends and economic factors influencing currency movements.

Looking for the right broker to start your trading journey? At WhereToTrade, we guide you in finding reliable, regulated platforms tailored to your needs. Explore opportunities with trusted brokers and take your first step toward confident forex trading today!

Table of contents

1. What Are Forex Pairs? 2. Top Forex Pairs for Beginners 3. Why These Forex Pairs Are Ideal for Beginners 4. Common Mistakes to Avoid When Choosing Forex Pairs 5. Conclusion