What Are KYC and AML Policies in Trading?

Learn how KYC and AML policies ensure secure trading. Discover their role in preventing fraud, building trust, and safeguarding financial markets.

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

Writen by:

Arslan Ali But

20 January 2025

8 minutes read

KYC (Know Your Customer) and AML (Anti-Money Laundering) are critical policies in financial trading

aimed at ensuring transparency and security.

KYC focuses on verifying a trader’s identity through documents like IDs and proof of

address, while

AML combats money laundering and related financial crimes by monitoring suspicious activities.

Together, these regulations protect traders, brokers, and the broader market from fraud, tax

evasion, and illegal activities.

By enforcing these standards, brokers build trust, maintain regulatory compliance, and

foster a safer trading environment for all participants. Understanding KYC and AML is essential for

anyone involved in the financial markets.

What is KYC in Trading?

KYC, or Know Your Customer, is a regulatory process used by brokers to verify the identity of their clients. It ensures that traders are legitimate and not using trading platforms for illegal activities such as money laundering or fraud.

Purpose:

- To confirm the identity of traders and ensure they are genuine individuals or entities.

- To assess and mitigate the risk of clients engaging in money laundering, terrorist financing, or other financial crimes.

Key Requirements:

To complete KYC, traders typically need to provide:

- Government-issued ID: Passport, driver’s license, or national ID card.

- Proof of Address: Utility bills, bank statements, or rental agreements.

- Source of Funds: Employment verification, salary slips, or income statements to ensure transparency about the origin of funds used for trading.

Example:

Brokers like eToro and AvaTrade require all users to complete KYC before they can begin trading or make withdrawals. This process helps ensure compliance with global regulations and fosters a secure trading environment.

By adhering to KYC standards, brokers protect their platforms and traders while maintaining regulatory compliance.

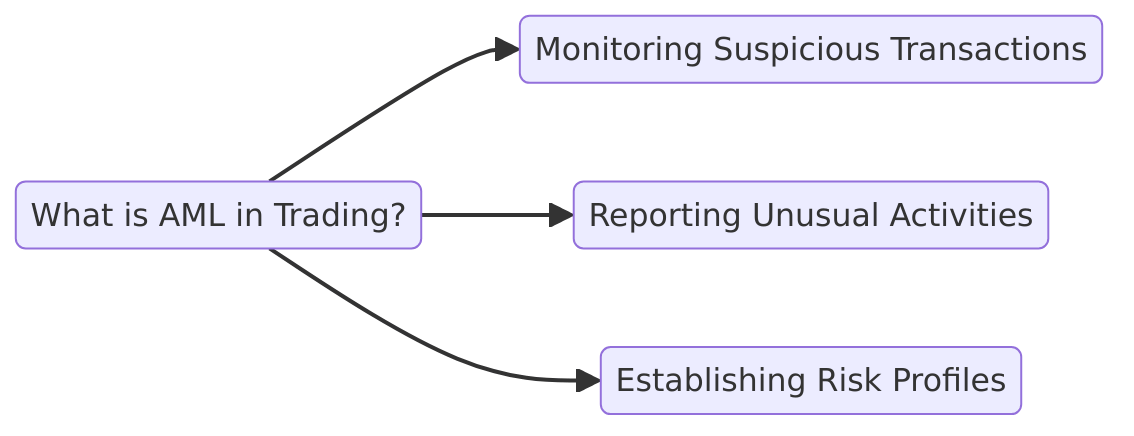

What is AML in Trading?

Anti-Money Laundering (AML) policies are regulatory frameworks designed to prevent financial systems, including trading platforms, from being exploited for illegal activities such as money laundering, terrorist financing, and tax evasion. These policies ensure transparency and compliance with international financial standards.

How it Works:

AML in trading involves several processes to detect and prevent suspicious activities:

- Monitoring Suspicious Transactions: Brokers continuously analyze transaction patterns to identify irregularities, such as unusually large or frequent trades.

- Reporting Unusual Activities: Any suspicious transactions or behaviors are reported to relevant authorities like the FCA (UK) or FINTRAC (Canada) for investigation.

- Establishing Risk Profiles: Brokers categorize clients based on their risk levels, with high-risk accounts subject to additional scrutiny and restrictions.

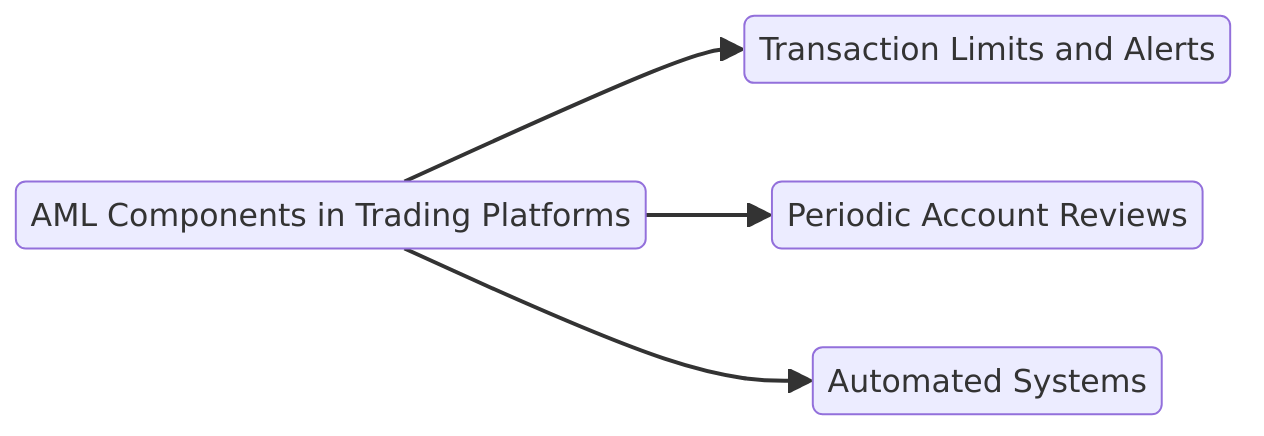

AML Components in Trading Platforms:

- Transaction Limits and Alerts: Platforms set transaction thresholds to flag unusually large trades or withdrawals that may indicate money laundering.

- Periodic Account Reviews: High-risk accounts undergo regular assessments to ensure compliance with AML standards.

- Automated Systems: Advanced algorithms and AI tools detect suspicious patterns, enabling brokers to act swiftly against potential money laundering attempts.

Why Are KYC and AML Policies Important?

KYC and AML policies are essential pillars of financial trading, ensuring market integrity and protecting all stakeholders involved. Here’s why they matter:

Preventing Financial Crime: These policies are designed to combat illegal activities such as money laundering, terrorist financing, and tax evasion. By verifying client identities (KYC) and monitoring suspicious activities (AML), brokers prevent their platforms from being exploited for illicit purposes. For instance, global money laundering is estimated to account for 2-5% of global GDP annually—policies like these help reduce that risk.

Building Trust in Markets: KYC and AML foster transparency and accountability, ensuring that trading platforms operate fairly and reliably. This builds trader confidence, especially when brokers comply with stringent regulations enforced by authorities like the FCA (UK) or CySEC (EU).

Protecting Traders: By verifying identities, KYC safeguards traders from fraud and identity theft. Similarly, AML measures prevent unauthorized access or misuse of trading accounts. These policies create a secure environment for legitimate traders to operate.

Regulatory Compliance: Brokers must adhere to international standards to maintain licenses and operate legally. Authorities like ASIC (Australia) and FINTRAC (Canada) impose strict penalties for non-compliance, ensuring brokers remain accountable.

KYC and AML policies are not just regulatory obligations—they are critical for maintaining the integrity of financial markets, protecting traders, and ensuring a safe and transparent trading ecosystem.

Challenges in Implementing KYC and AML

While KYC and AML policies are vital for maintaining a secure trading environment, their implementation comes with challenges:

- Complex Verification Processes: KYC requirements often involve time-consuming document checks, such as identity verification and proof of address. These processes can cause delays for traders eager to begin trading, potentially deterring some users from completing onboarding.

- Technological Gaps: Smaller brokers and financial institutions may lack the sophisticated tools needed to detect fraudulent activities effectively. Without advanced systems, such as AI-driven transaction monitoring or automated risk assessment tools, these firms struggle to identify and mitigate financial crime risks.

- Privacy Concerns: KYC and AML policies require traders to provide sensitive personal information, such as government-issued IDs and financial documents. This raises concerns about data security and privacy, especially for traders wary of how their information is stored or shared.

- Evolving Techniques by Criminals: Money launderers and fraudsters constantly adapt to bypass safeguards. They employ advanced methods, such as synthetic identities or layering transactions across multiple platforms, making it increasingly difficult for brokers to detect illicit activities.

Overcoming these challenges requires continuous investment in technology, staff training, and regulatory collaboration to ensure KYC and AML policies remain effective in combating financial crimes.

How to Ensure Compliance as a Trader?

Ensuring compliance with KYC and AML policies is critical for secure trading. Here are actionable steps with key data to emphasize their importance:

Complete KYC Promptly:

-

Traders who fail to complete KYC experience delays in up to 65% of account activations,

according to industry reports. - Submit required documents (e.g., ID, proof of address) promptly to avoid trading restrictions.

Submit Accurate and Up-to-Date Documents:

- 30% of KYC rejections occur due to mismatched or outdated information.

- Regularly update personal details, such as a change in address, to maintain seamless account operation.

Monitor Account Activity and Report Suspicious Transactions:

- A report by the Financial Crime Enforcement Network (FinCEN) highlights that 80% of fraud cases in trading platforms are detected through active monitoring by traders or brokers.

- Reviewing account activity can help identify unauthorized transactions early, reducing potential losses.

Choose Brokers Regulated by Reputable Authorities:

- Regulated brokers reduce the risk of fraud by 90%, compared to unregulated platforms.

- Authorities like the FCA (UK) and ASIC (Australia) impose strict compliance measures, including mandatory audits and transaction monitoring.

Conclusion

KYC and AML policies are essential for creating a secure and transparent trading environment. These measures protect traders from fraud, ensure brokers comply with regulations, and uphold market integrity.

Compliance benefits everyone by fostering trust and minimizing risks. Traders should prioritize working with regulated brokers that strictly adhere to KYC and AML standards to enjoy a safer and more reliable trading experience.

Ensure your trading success by choosing brokers committed to transparency and security. At WhereToTrade, we guide you in finding regulated platforms for a confident and secure trading experience.

Table of contents

1. What is KYC in Trading? 2. What is AML in Trading? 3. Why Are KYC and AML Policies Important? 4. Challenges in Implementing KYC and AML 5. How to Ensure Compliance as a Trader? 6. Conclusion