What Is Trading: A Beginner's Guide

Learn everything about trading in this comprehensive guide—strategies, markets, tools, and risks. Start your journey with insights from WhereToTrade to find the perfect broker tailored to your needs.

Writen by:

Arslan Ali But

07 January 2025

8 minutes read

Writen by:

Arslan Ali But

07 January 2025

8 minutes read

Trading is the process of buying and selling financial assets—such as stocks, forex, commodities, and cryptocurrencies—with the aim of generating profits. It’s not just about transactions; trading is a vital mechanism in the global financial system, driving liquidity, price discovery, and wealth creation for investors.

At its core, trading is about understanding how market forces, such as supply and demand, impact asset prices. For instance, when demand for a company’s stock surges due to positive earnings, its value typically rises, offering opportunities for traders. Similarly, price dips, often feared, can present golden chances to buy assets at lower costs.

For beginners, trading opens doors to financial literacy, wealth-building, and diversified income streams. Imagine investing in a high-performing stock and watching your portfolio grow. However, it’s equally important to recognize the risks—volatility, market downturns, and emotional decisions can impact outcomes.

To make your trading journey smoother, WhereToTrade connects you with brokers tailored to your specific needs and objectives. Let this guide and WhereToTrade be your companions as you step into the world of trading and unlock its potential.

What is Trading?

Trading is the act of buying and selling financial assets—such as stocks, currencies, commodities, or cryptocurrencies—to profit from price fluctuations. For instance, traders might buy shares in a company expecting their value to increase, or trade forex pairs like EUR/USD to take advantage of currency movements. Unlike long-term investing, trading often involves shorter time horizons and more frequent transactions.

Key Types of Trading Markets

- Stocks: Shares of companies traded on exchanges like NASDAQ or NYSE. Example: Buying Tesla (TSLA) shares in anticipation of a new product launch.

- Forex: Currency pairs such as EUR/USD or GBP/JPY traded in the foreign exchange market, which operates 24/5.

- Commodities: Physical assets like gold, oil, or agricultural products. Example: Trading crude oil futures in response to global supply changes.

- Cryptocurrencies: Digital assets such as Bitcoin (BTC) and Ethereum (ETH), traded 24/7 in a decentralized market.

Why is Trading Important?

Trading is vital to the financial ecosystem because it:

- Facilitates Price Discovery: Determines the fair value of assets through supply and demand.

- Provides Liquidity: Ensures assets can be easily bought and sold without significant price changes.

- Supports Economic Growth: Helps businesses and governments raise capital through investments.

Trading also offers individuals a way to grow wealth, hedge against risks, and diversify income. However, success requires understanding market mechanics and managing risks effectively. For anyone looking to leverage financial opportunities, a solid grasp of trading fundamentals is a must.

Different Types of Trading Strategies

Trading strategies vary based on risk levels, time commitments, and financial goals, offering flexibility to cater to diverse trader preferences. Here’s an overview of the major types

- Overview: Involves short-term buying and selling of assets, with all positions closed by the end of the trading day.

- Key Features: Relies heavily on technical analysis, quick decision-making, and real-time market monitoring.

- Objective: To profit from small price movements within a single day.

- Popular Markets: Stocks and forex, where high liquidity allows swift entry and exit.

- Example: A trader might buy shares of Tesla (TSLA) at the market open and sell them hours later after a small price uptick.

- Overview: Positions are held for several days or weeks to capture larger price movements.

- Key Features: Combines technical and fundamental analysis to identify trends and opportunities.

- Objective: To benefit from medium-term price fluctuations without the need for constant monitoring.

- Popular Markets: Stocks, commodities, and forex.

- Example: A swing trader might hold gold futures for two weeks, anticipating price increases due to geopolitical tensions.

- Overview: Focuses on a buy-and-hold approach, retaining assets for months or even years.

- Key Features: Based on fundamental analysis, emphasizing the market potential or financial health of an asset.

- Objective: To achieve long-term wealth growth through compounding and capital appreciation.

- Popular Markets: Equities and cryptocurrencies.

- Example: Buying Bitcoin (BTC) during a market dip and holding it for years to capitalize on adoption growth.

Day Trading

Swing Trading

Long-Term Trading (Investing)

Additional Insights: Stock Markets vs. Other Markets

- Stock Markets: Defined trading hours make them less demanding but can lead to emotional challenges, such as reacting to news or earnings reports.

- Forex Markets: Operate 24/5, requiring traders to manage positions during varying global time zones.

By understanding and aligning with these strategies, traders can better manage risks, seize opportunities, and work towards their financial objectives.

Popular Markets for Trading

Trading spans multiple markets, each offering unique opportunities and strategies for traders with diverse goals and risk preferences. Here’s an overview of the most popular markets:

1. Stock Market

- Overview: The stock market enables the buying and selling of shares in publicly listed companies like Tesla (TSLA) and Apple (AAPL).

- Opportunities: Price fluctuations are driven by company earnings, news, and broader economic trends.

- Example: A trader might buy Apple shares before an anticipated positive earnings report, aiming to profit from a price increase.

2. Foreign Exchange Market (Forex)

- Overview: Forex trading involves currency pairs like EUR/USD or GBP/JPY, making it the world’s largest and most liquid market.

- Opportunities: Traders speculate on exchange rate movements based on economic data, geopolitical events, or central bank policies.

- Example: A trader might sell GBP/USD if they expect the pound to weaken against the dollar following a poor economic report in the UK.

3. Cryptocurrency Market

- Overview: This market focuses on digital assets like Bitcoin (BTC) and Ethereum (ETH), known for high volatility and growth potential.

- Opportunities: Traders capitalize on price swings driven by adoption trends, technological updates, or market sentiment.

- Example: Buying Bitcoin during a dip, anticipating a price surge following a major institutional investment.

4. Commodities Market

- Overview: This market includes physical goods like gold, oil, and agricultural products (e.g., wheat).

- Opportunities: Prices are influenced by supply and demand, geopolitical events, and seasonal factors.

- Example: An oil trader might purchase futures contracts during high-demand seasons, betting on a price increase.

5. Options Market

- Overview: Options trading involves contracts that grant the right, but not the obligation, to buy or sell assets at a specified price.

- Opportunities: Traders use options to hedge risks or speculate on price movements with limited upfront investment.

- Example: A trader could buy a call option on Amazon, anticipating its stock price will rise after a successful product launch.

Understanding Trading Strategies: Your Blueprint for Market Success

Trading strategies are the foundation of navigating financial markets effectively. They help traders balance risk, seize opportunities, and make informed decisions. Whether you’re a beginner or a seasoned investor, having a well-defined strategy tailored to your goals is essential.

Let’s dive into some popular strategies and how they can work for you.

1. Technical Analysis: Navigating Market Trends

Technical analysis involves examining price charts and patterns to anticipate future movements. By identifying trends, traders can make informed decisions about when to enter or exit a position.

Key tools include indicators like Moving Averages, Bollinger Bands, and RSI, which help visualize momentum and potential reversals.

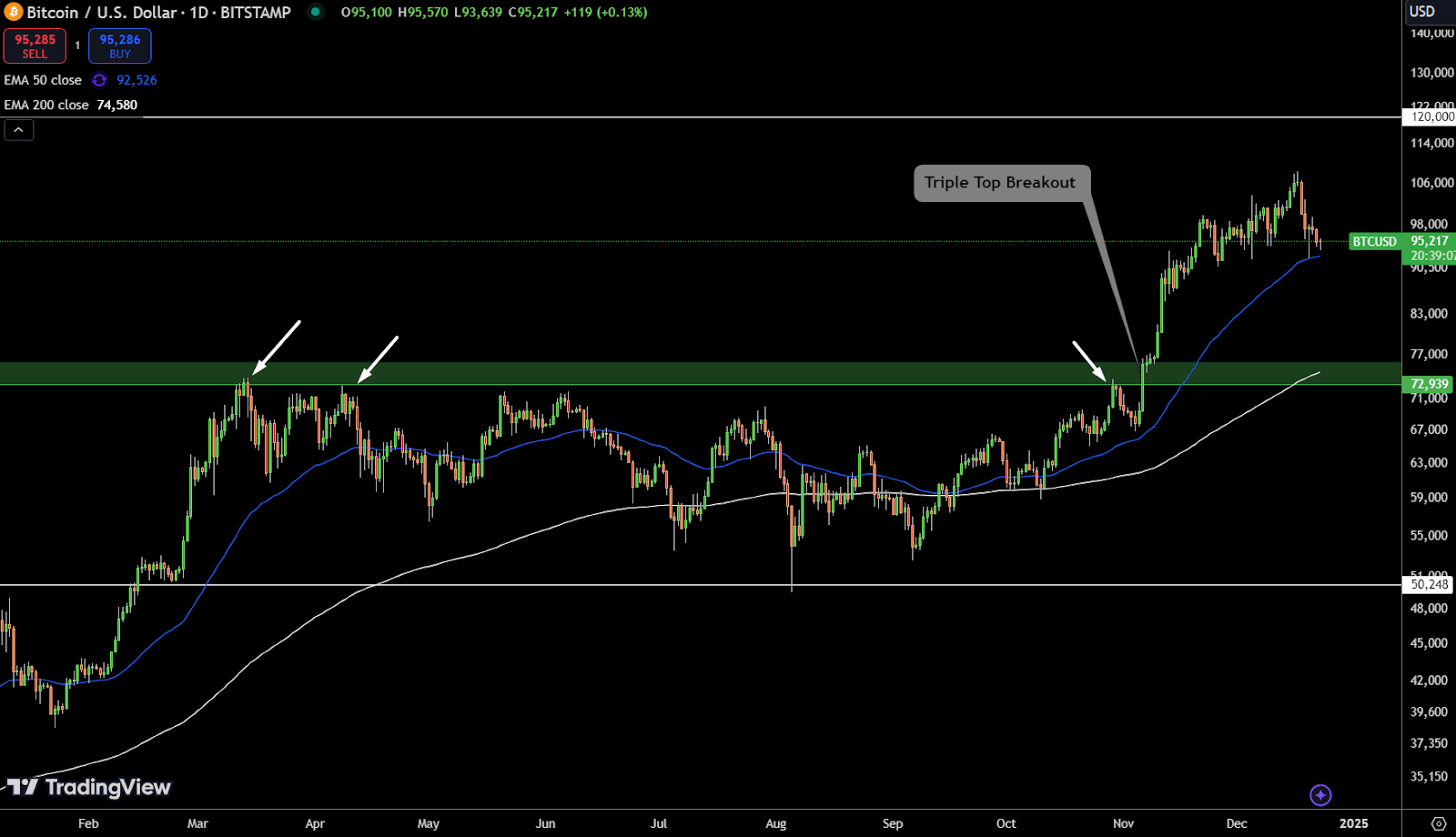

For instance: Consider Bitcoin's recent Triple Top breakout near $73,000. For months, BTC tested this resistance, creating a clear pattern. When it finally broke through, it surged to $95,000. If you recognized this chart pattern, you could have entered early and capitalized on the rally.

By mastering chart patterns and technical tools, traders can navigate volatile markets confidently and maximize profit opportunities during critical price movements.

2. Fundamental Analysis: Investing in Value

Fundamental analysis digs deeper into the intrinsic value of an asset, focusing on economic indicators, financial health, and industry dynamics. It’s ideal for long-term investors aiming to identify undervalued opportunities.

Key Focus Areas:

- Economic Indicators: Metrics like GDP growth, CPI, and unemployment rates can influence asset prices. For example, a robust U.S. Non-Farm Payrolls (NFP) report often strengthens the USD, offering trading opportunities.

- Industry Trends: Staying informed about regulatory changes or breakthroughs in industries like tech or renewable energy can signal growth potential.

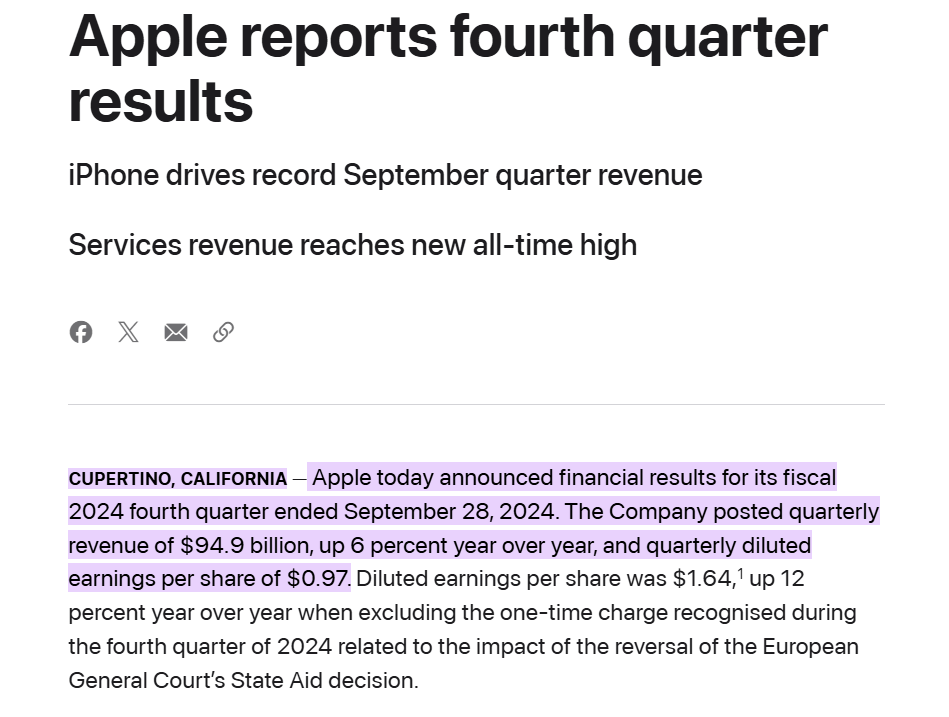

- Example: When Apple (AAPL) announced its fiscal 2024 earnings with a 6% revenue increase to $94.9 billion, it reflected strong financial health. Investors who bought early on the expectation of such results likely benefited from the subsequent stock appreciation.

3. Swing Trading: Capturing Bigger Moves

Swing trading bridges the gap between day trading and long-term investing.

How It Works: Positions are held for days or weeks to capitalize on larger price swings.

Blend of Strategies: Combines technical patterns with fundamental insights.

Example: A swing trader might buy gold during a dip, anticipating a rebound driven by geopolitical tension.

Why Trading Strategies Matter

Swing trading strikes a balance between day trading and long-term investing, focusing on holding positions for several days or weeks to capture larger price movements.

How It Works:

- Swing traders blend technical analysis (like identifying support and resistance) with fundamental insights (e.g., economic reports or earnings results).

- Example: During geopolitical tensions, gold prices often dip before rebounding. A swing trader could buy gold during the dip, anticipating its rise as a safe-haven asset.

By focusing on medium-term trends, swing trading allows for flexibility and offers significant profit potential without the pressure of daily monitoring.

Benefits of Trading

Trading offers immense potential for those willing to put in the time and effort to master financial markets. Whether you’re aiming to diversify income streams or achieve financial independence, the benefits are numerous:

- Financial Freedom: Trading provides the opportunity to earn substantial income, helping individuals achieve financial goals and independence. For example, skilled traders in forex or stocks can consistently grow their wealth.

- Diversification of Income: Trading offers a secondary income stream, complementing your main source of earnings and providing financial stability.

- Skill Development: Trading hones critical skills such as self-discipline, risk management, and decision-making, which can benefit other areas of life.

- Adaptable Lifestyle: Online trading platforms allow flexibility, enabling you to trade from anywhere with an internet connection, whether it’s from home or while traveling.

- Wealth Accumulation: With strategies like compounding and smart investments, trading can grow your capital significantly over the long term.

Risks of Trading and Market Volatility

While trading offers rewards, it also carries risks that require careful management. Being aware of these risks is vital for long-term success:

- Volatility: Markets like forex, stocks, and cryptocurrencies can experience rapid price swings, leading to potential losses if not managed carefully. For instance, during geopolitical tensions, oil prices can surge unexpectedly.

- Emotional Factors: Fear and greed can cloud judgment, often resulting in rash decisions like panic selling or overtrading.

- Market Risks: Economic data releases or unforeseen events (e.g., interest rate hikes, election results) can disrupt markets significantly.

- Over-Leveraging: While leverage amplifies gains, it can also magnify losses, potentially leading to account wipeouts if not used judiciously.

By adopting proper risk management strategies—like setting stop-losses and avoiding emotional trading—you can navigate these challenges and unlock trading’s full potential.

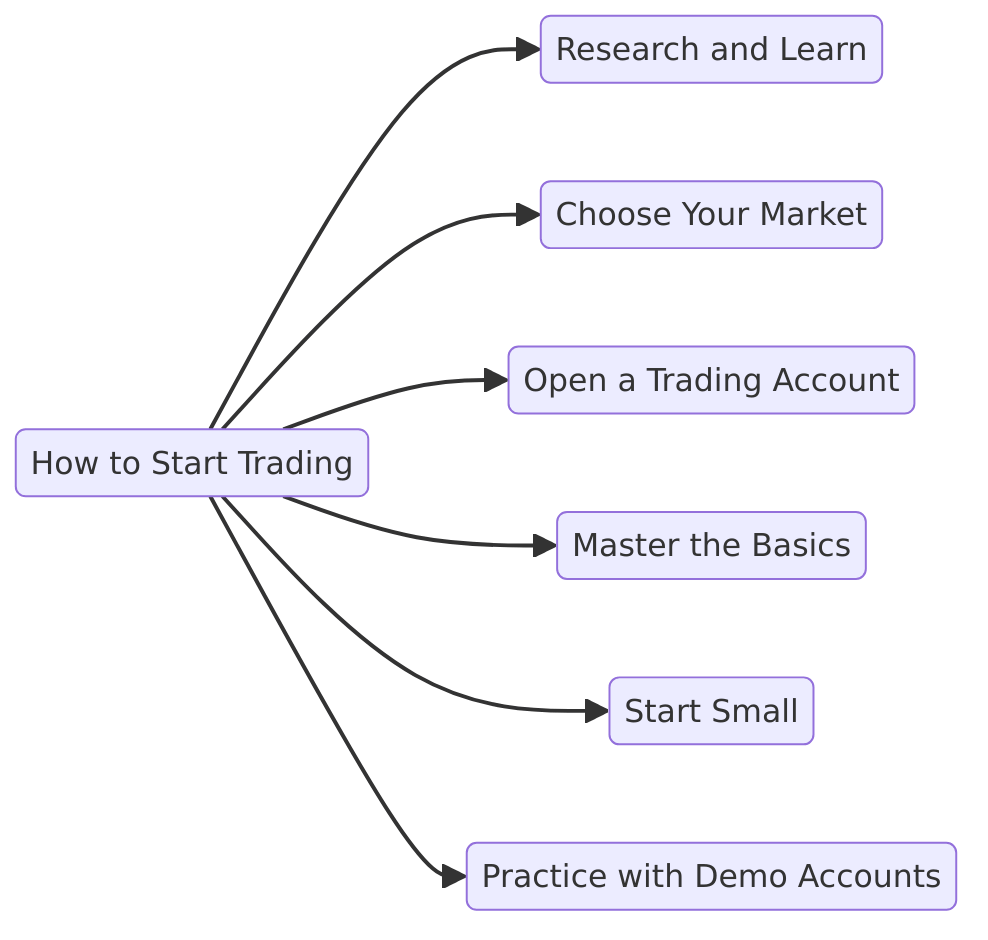

How to Start Trading

Starting your trading journey requires a thoughtful and structured approach to set yourself up for success. Here’s a practical guide to help you get started:

- Research and Learn: Begin by understanding the basics of trading. Dive into resources like books, online courses, or reputable websites to explore market types, strategies, and associated risks. For instance, knowing the difference between forex and stock markets can help you decide where to focus.

- Choose Your Market: Select a market that aligns with your goals and interests. Whether it’s cryptocurrencies, stocks, forex, or commodities, ensure it matches your risk tolerance and investment capacity.

- Open a Trading Account: Partner with a reliable broker offering a user-friendly platform, essential tools, and competitive fees. Look for brokers regulated by reputable authorities to ensure security.

- Master the Basics: Familiarize yourself with key concepts such as risk management, order types (like stop-loss and limit orders), and market analysis techniques (technical or fundamental).

- Start Small: Limit your initial investment to minimize risks. For instance, allocate a manageable amount to test strategies before scaling up your positions.

- Practice with Demo Accounts: Many trading platforms provide demo accounts that simulate real market conditions. Use these to gain hands-on experience without risking actual funds.

By following this plan, you can build confidence and a solid foundation for your trading journey, minimizing risks while maximizing your learning curve.

Essential Tools for Trading

Having the right tools is critical for successful trading, as they enable effective market analysis, seamless trade execution, and consistent performance evaluation. Here's an overview of the must-have tools for traders:

- Trading Platforms: Platforms like MetaTrader 5 (MT5) and TradingView offer robust features, including real-time market data, advanced charting, and order execution tools. They cater to both beginners and experienced traders, providing a user-friendly interface and customization options.

- Charting Tools: Good charting tools allow traders to analyze historical price movements, identify patterns, and strategize effectively. Candlestick charts, Bollinger Bands, and RSI indicators are commonly used to spot trends and reversals, enabling precise trading decisions.

- News Sources: Staying informed is crucial. Reliable outlets like Bloomberg and Reuters provide timely updates on geopolitical events, economic releases, and corporate announcements. For instance, knowing about an upcoming Federal Reserve interest rate decision can help anticipate market movements.

- Reliable Brokers: A trustworthy broker ensures smooth access to markets, competitive spreads, and strong security. Always choose brokers regulated by authorities like the SEC, FCA, or ASIC.

- Trading Journals: Keeping a journal to track trades, strategies, and outcomes helps refine your approach. By analyzing past trades, you can identify strengths and weaknesses for continuous improvement.

Trading Regulations and Safety

Trading is governed by strict regulations to ensure market transparency and fairness. Bodies like the SEC (USA) and FCA (UK) monitor brokers and financial transactions to protect traders. Choosing a broker regulated by reputable authorities ensures your funds are secure and the trading environment adheres to industry standards.

Understanding your country's trading laws and adhering to risk management strategies, such as diversification and stop-loss orders, can protect you from market, liquidity, and operational risks.

Key Concepts Every Trader Must Know

- Risk Management: Set clear capital risk limits for each trade to safeguard your funds.

- Technical vs. Fundamental Analysis: Use charts and indicators for short-term trades and financial reports or macroeconomic trends for long-term strategies.

- Market Trends: Recognize upward, downward, or sideways trends to make informed decisions.

Common Mistakes Beginners Make

New traders often overtrade, ignore stop-loss strategies, and let emotions like fear or greed drive their decisions. These errors can lead to significant losses. Focus on education, discipline, and a clear strategy to build a strong foundation.

Tips for Beginners

- Stay consistent with your trading plan.

- Keep a journal to evaluate progress.

- Learn continuously by exploring market trends and strategies.

- Seek mentorship for expert guidance.

Conclusion

Trading offers a practical and dynamic way to grow wealth and diversify income. By focusing on the fundamentals, learning from mistakes, and utilizing the right tools, you can approach financial markets with clarity and confidence. Building consistency and adapting to market trends are key to long-term success in trading.

If you’re unsure about where to start or which broker aligns with your needs, WhereToTrade is here to help. Our experts can guide you in finding a broker tailored to your trading style, goals, and preferences. Explore WhereToTrade today or consult with an expert to make informed decisions and take the next step in your trading journey.

Table of contents

1. What is Trading? 2. Different Types of Trading Strategies 3. Popular Markets for Trading 4. Understanding Trading Strategies: Your Blueprint for Market Success 5. Benefits of Trading 6. How to Start Trading 7. Essential Tools for Trading 8. Conclusion