AvaTrade Review 2025Explore AvaTrade’s offerings, including its secure trading platforms (MT4, AvaTrade App), account types, fee structures, and global regulatory compliance. Find out if it’s the right broker for you in 2025.

Last updated

06.01.2025

Key highlights:

Why Choose AvaTrade?

Introduction

Established in 2006, AvaTrade has grown to become a trusted name in the world of online trading, offering a seamless and innovative experience to traders across the globe. With a focus on accessibility, AvaTrade empowers its users to trade confidently in a variety of markets, including forex, CFDs, cryptocurrencies, and options. One of AvaTrade’s standout features is its diverse selection of platforms, such as the user-friendly AvaTrade App and the advanced MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms cater to traders of all levels, providing robust tools and real-time insights to help users make informed decisions. Backed by regulatory oversight from top-tier financial authorities, AvaTrade ensures a secure and transparent trading environment. This review delves into AvaTrade’s key strengths, features, and benefits to help you decide whether it’s the right broker to support your trading journey in 2025.

What is AvaTrade?

Founded in 2006, AvaTrade has established itself as a globally trusted online broker, offering a diverse range of trading instruments and innovative platforms.

Key Offerings:

- WebTrader: A user-friendly, web-based platform ideal for beginners.

- AvaOptions: Specialized platform for options trading.

- AvaTrade App: Mobile app designed for trading on the go.

With a commitment to innovation and accessibility, AvaTrade continues to empower traders worldwide by providing secure and advanced trading environments.

Features and Benefits

AvaTrade offers a comprehensive suite of features designed to enhance the trading experience, from innovative platforms to tailored account types. Let’s explore what makes AvaTrade stand out.

Trading Platforms

AvaTrade provides an impressive selection of trading platforms to suit various trading styles and preferences, ensuring accessibility for both beginners and experienced traders.

Designed for traders on the go, this mobile-friendly app delivers real-time market updates, intuitive charting tools, and built-in educational resources. AvaTrade App simplifies trading for beginners while offering robust features for seasoned traders.

As industry-leading platforms, MT4 and MT5 are perfect for advanced traders. They feature customizable charting options, algorithmic trading capabilities through Expert Advisors (EAs), and in-depth technical analysis tools, making them a top choice for professionals.

This platform combines spot forex with options trading, providing flexibility and enhanced risk management. It’s ideal for traders looking to diversify their strategies and leverage the unique advantages of options.

A browser-based platform that requires no downloads, WebTrader offers essential tools and a user-friendly interface, making it an excellent choice for quick and seamless trading directly through your web browser.

AvaTrade supports copy trading via AvaSocial and DupliTrade, allowing beginners to follow the strategies of experienced traders. This feature is perfect for those who prefer guided trading while learning from experts.

AvaTrade’s platforms cater to every trading need, combining ease of use with advanced functionality for a dynamic trading experience.

Account Types

AvaTrade offers a range of account types tailored to meet the needs of different traders:

With a variety of accounts and platforms, AvaTrade ensures flexibility and accessibility for all traders, regardless of experience level or trading goals.

Fees and Charges

AvaTrade maintains a competitive and transparent fee structure that suits a wide range of traders, ensuring cost-effectiveness without compromising on service quality. Here’s a breakdown of the trading and non-trading fees you should know about:

Trading Costs:

AvaTrade offers tight spreads starting from as low as 0.9 pips on major forex pairs like EUR/USD. These competitive spreads make AvaTrade an attractive choice for cost-conscious traders looking to maximize their returns.

If you hold a position past 22:00 GMT, overnight swap fees (also called rollover fees) apply. These reflect the cost of maintaining leveraged positions overnight. For positions held over the weekend, a three-day swap rate is charged on Wednesdays.

AvaTrade operates on a spread-only pricing model, which means you won’t encounter additional commissions on trades. This setup is particularly appealing to traders who prefer straightforward cost structures.

By keeping trading costs competitive and predictable, AvaTrade allows you to focus on executing your strategies without worrying about hidden fees.

Non-Trading Fees

AvaTrade does not charge any fees for deposits, giving you a cost-free way to fund your account.

Similarly, there are no withdrawal fees on AvaTrade’s side. However, payment providers like banks or e-wallet services may impose their own charges.

Accounts inactive for three consecutive months are charged a $50 inactivity fee, ensuring resources are allocated to active traders. After 12 months of inactivity, an annual administration fee of $100 is also applied.

By understanding AvaTrade’s fee structure, you can manage your trading expenses effectively and enjoy a cost-efficient trading experience.

Regulation and Security

AvaTrade maintains high standards of regulatory compliance and robust security measures to provide a safe trading environment for its clients.

Regulatory Oversight

AvaTrade operates under the supervision of leading financial regulators worldwide, ensuring adherence to stringent regulatory requirements:

of Ireland (CBI):

AvaTrade EU Ltd is regulated under the Markets in

Financial Instruments Directive (MiFID) framework

(License No.: C53877), ensuring transparency

and investor protection in Europe.

Investments

Commission (ASIC):

AvaTrade is licensed in Australia (License No.: 406684),

ensuring fair practices and compliance with

Australian financial laws.

Agency (FSA) and

Financial Futures

Association of Japan (FFAJ):

AvaTrade Japan K.K. is regulated in Japan

(License Nos.: 1662 and 1574), adhering to

strict local financial standards.

Sector Conduct

Authority (FSCA):

Australia Pty Ltd is regulated by the Australian

Securities and Investments Commission (ASIC),

ensuring adherence to Australian financial laws and regulations.

Global Markets (ADGM):

Ava Trade Middle East Ltd is authorized by

the Financial Regulatory Services Authority

(License No.: 190018).

Financial Services

Commission (BVI FSC):

Ava Trade Ltd operates globally under

License No.: SIBA/L/13/1049.

These licenses demonstrate AvaTrade’s commitment to maintaining a secure and transparent trading environment.

Security Measures

AvaTrade employs robust measures to safeguard client funds and personal information:

Client funds are held in segregated accounts with top-tier banks,

ensuring they remain separate from company operational accounts.

Authentication (2FA):

An additional security layer that protects accounts

from unauthorized access.

Prevents traders from losing more than their account balance,

protecting clients during market volatility.

These security protocols highlight AvaTrade’s focus on client safety and trust, ensuring a reliable and secure trading experience for all users.

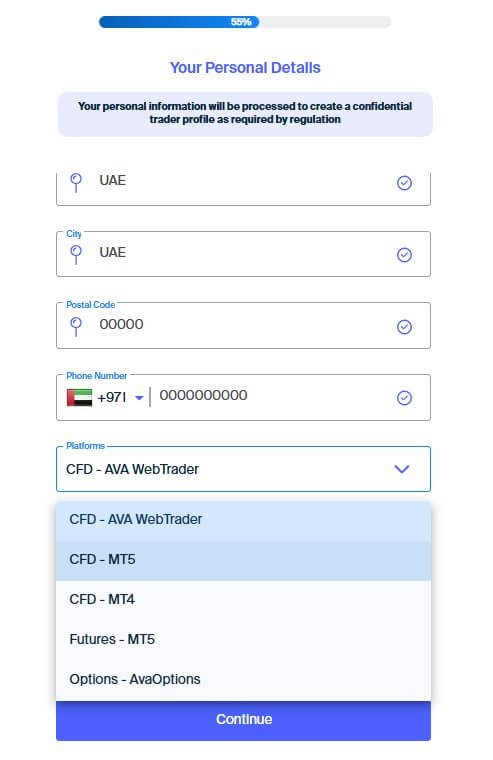

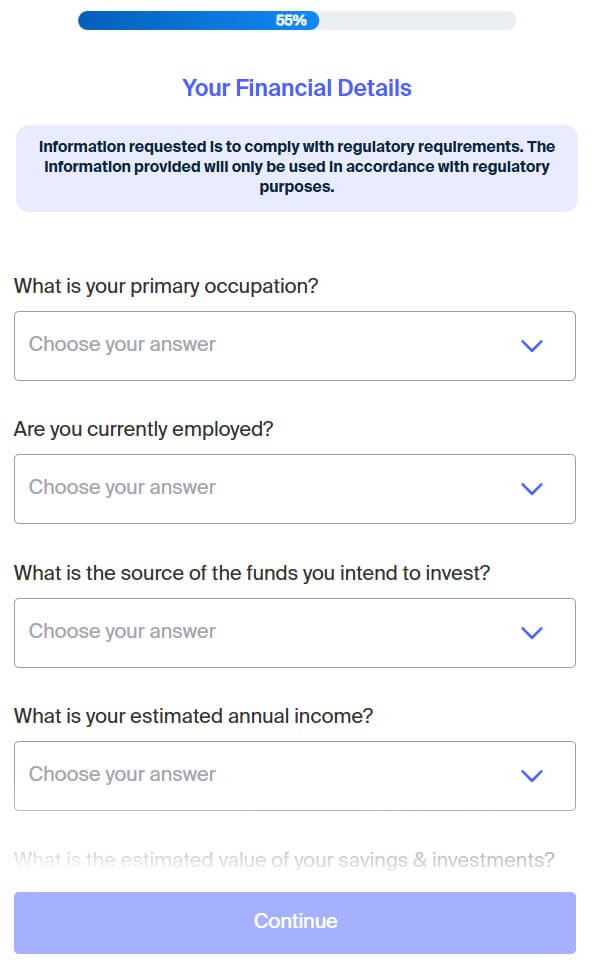

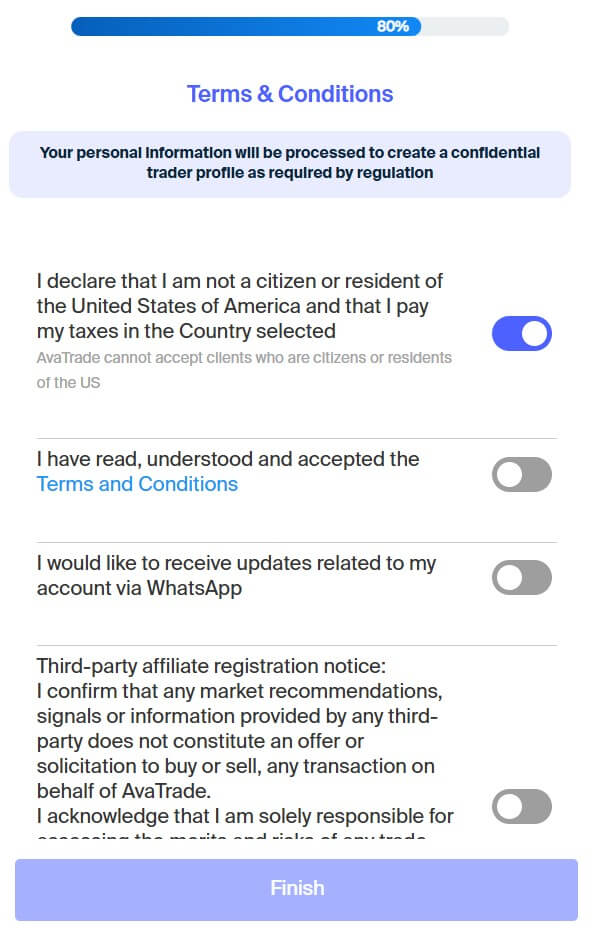

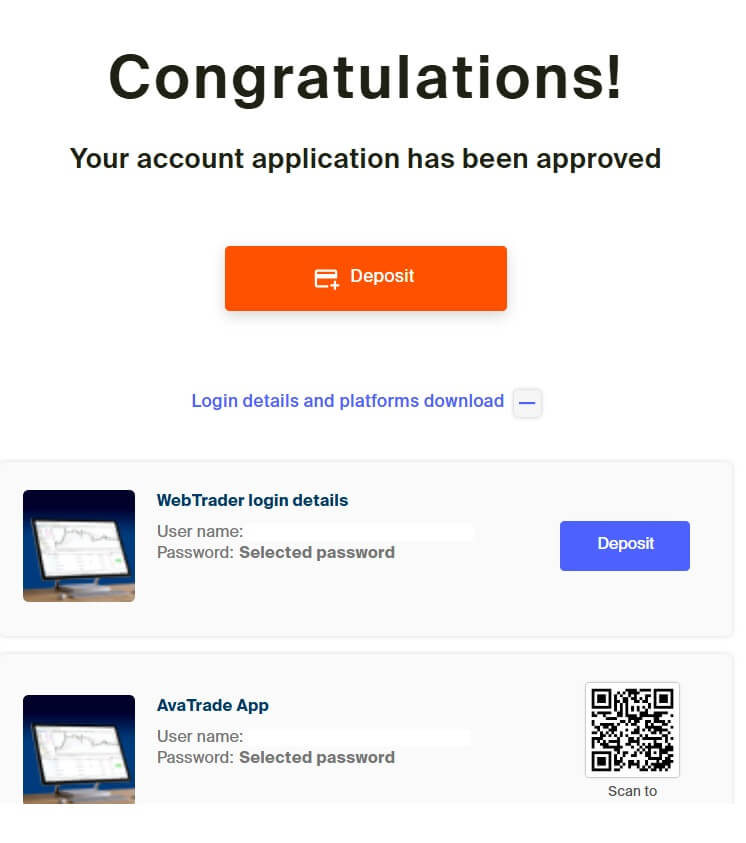

Onboarding Process: How to Open an Account

AvaTrade’s onboarding process is simple, efficient, and designed to accommodate traders of all experience levels. Here’s how to get started:

Sign-Up Process

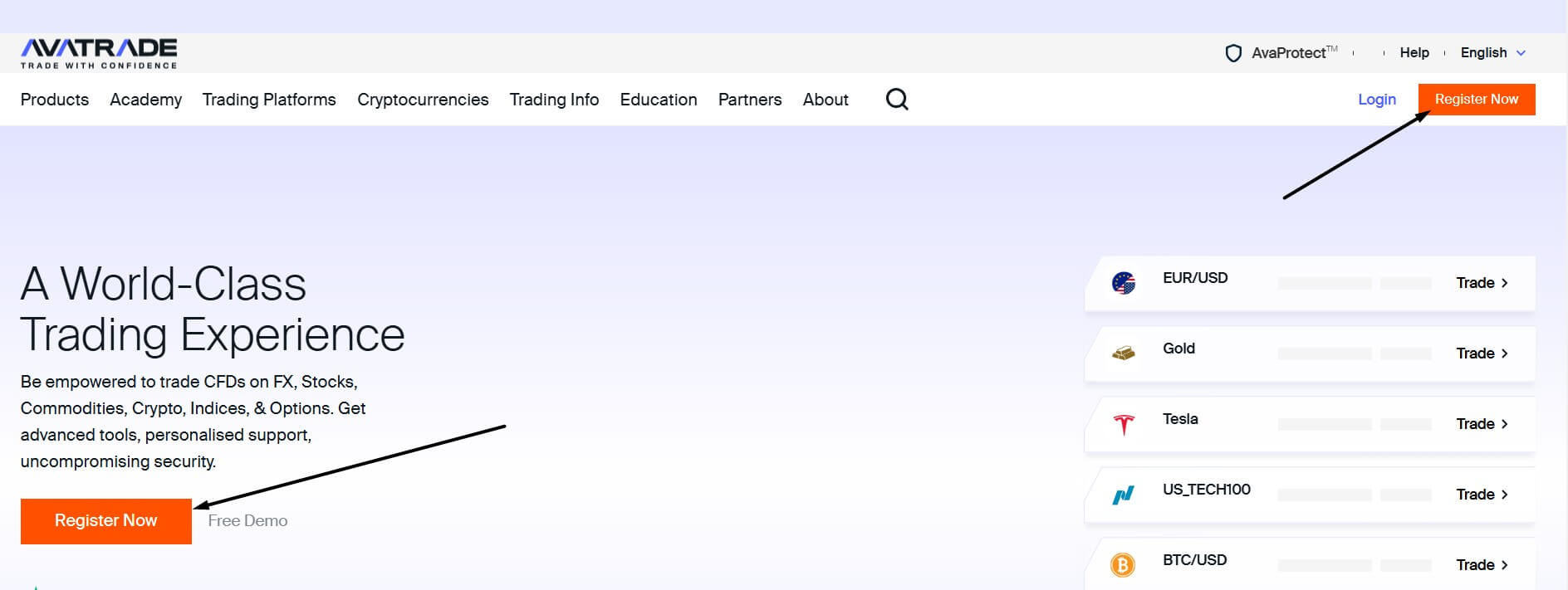

Navigate to AvaTrade’s official website and click the "Register Now" button prominently displayed on the homepage.

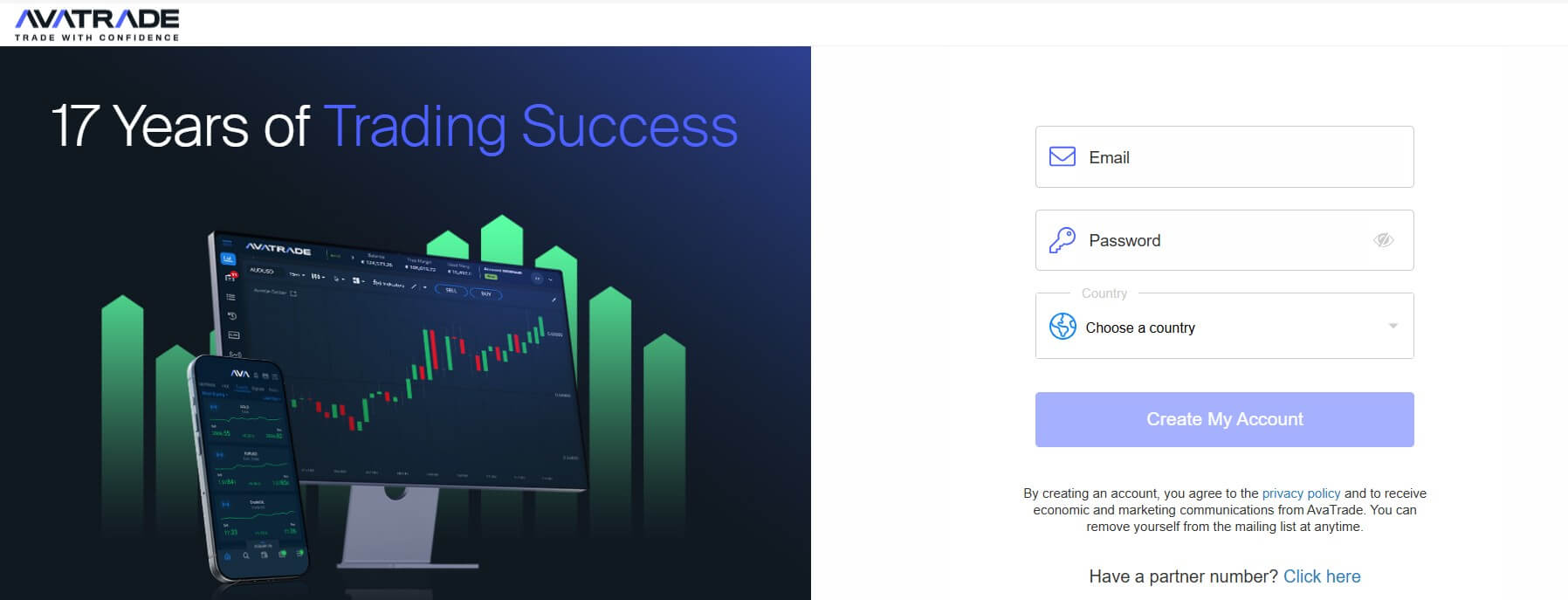

- Name (as per your government-issued ID)

- Email Address (ensure it’s active for verification)

- Phone Number (required for account security)

- Date of Birth (to verify eligibility based on legal trading age). Example: If your name is John Doe and you were born on January 1, 1990, fill in the details exactly as they appear on your ID to avoid verification delays.

- Government-Issued ID: Passport, national ID, or driver’s license.

- Proof of Address: A utility bill, bank statement, or similar document issued within the last 90 days. Example: A January 2025 electricity bill showing your name and address qualifies as proof.

- Email Verification: Check your inbox for a confirmation link and click it to activate your account.

- Phone Verification: Enter the code sent via SMS to ensure account security.

Key Onboarding Details

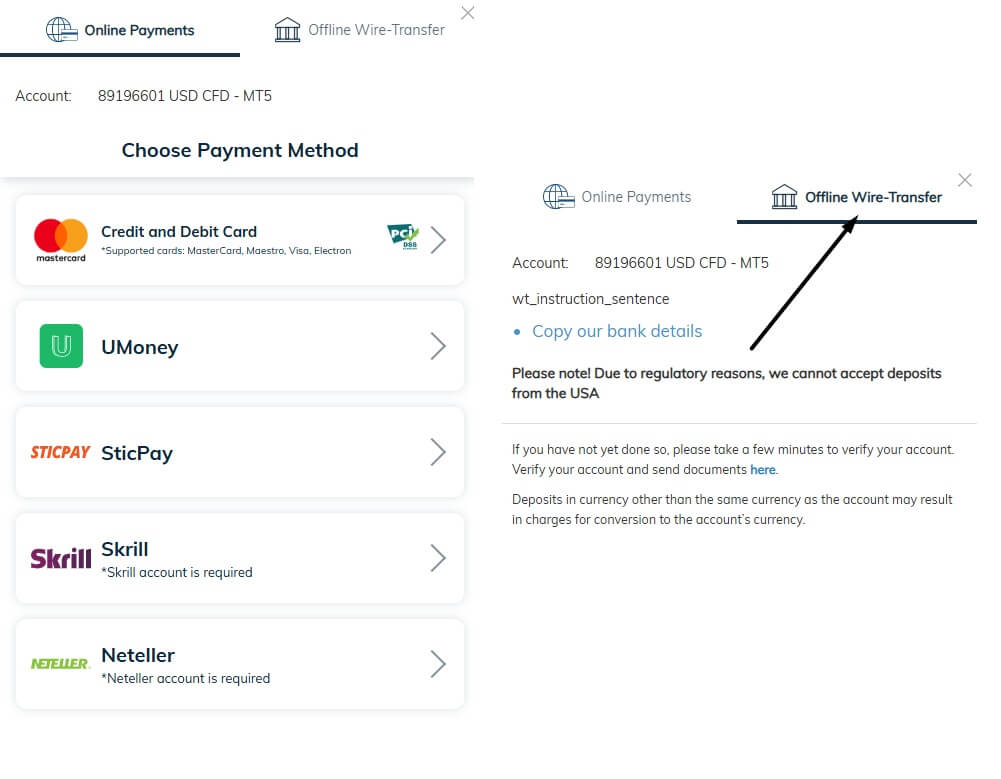

Deposits and Withdrawals

AvaTrade simplifies fund management with diverse payment methods and quick withdrawal processes, ensuring convenience for traders of all levels.

Deposit Methods

AvaTrade offers multiple deposit options tailored to your preferences:

The minimum deposit is $100 (or equivalent in your account’s base currency), making AvaTrade accessible to beginners and experienced traders alike.

Withdrawal Process

AvaTrade processes withdrawals swiftly, typically within 1 business day, while adhering to anti-money laundering regulations. Funds are returned to the original deposit method:

Pro Tip: Ensure your account is fully verified to avoid delays.

AvaTrade doesn’t charge fees for deposits or withdrawals,

but some banks or payment providers may apply their own charges.

AvaTrade’s straightforward processes and variety of methods allow you to manage your

funds effortlessly and focus on trading.

Customer Support and Education

AvaTrade emphasizes customer satisfaction and trader education, offering a range of support options and resources to enhance your trading journey.

Customer Support

AvaTrade offers multilingual customer support to assist traders worldwide:

Email: For detailed inquiries, reach out to [email protected]

For specific contact details tailored to your region, please visit AvaTrade's Contact Us page.

Educational Resources

AvaTrade empowers traders by offering a comprehensive suite of educational tools:

- Economic Calendars: Stay informed about upcoming economic events that could impact the markets.

- Trading Signals: Access to signals that help in making informed trading decisions.

These resources are designed to enhance traders' knowledge and confidence, enabling them to make informed decisions in the financial markets.

Pros and Cons of AvaTrade

PROS

For example: A trader can simultaneously trade Bitcoin CFDs and major forex pairs like EUR/USD on the same platform, maximizing flexibility.

CONS

Despite these considerations, AvaTrade remains a robust choice for traders seeking a secure and feature-rich platform.

Who Should Use AvaTrade?

AvaTrade is designed to meet the needs of a variety of traders with tailored features and resources.

AvaTrade’s features are carefully designed to cater to distinct trading styles, making it a platform suitable for a diverse range of users.

Conclusion: Is AvaTrade the Best Broker in 2025?

AvaTrade is a well-rounded option for traders in 2025, offering a range of platforms, fair pricing structures, and strong regulatory oversight. Its tools—such as AvaTrade App, MetaTrader 4/5, and educational resources—provide accessible solutions for beginners while supporting advanced strategies for experienced traders. The broker’s fee-free deposits and withdrawals, along with access to markets like forex, cryptocurrencies, and CFDs, add practical value. Global regulatory compliance ensures a secure trading environment, instilling confidence for clients across regions. That said, some traders may be deterred by the inactivity fees or limited leverage for retail clients due to regulatory restrictions. For those prioritizing a secure and versatile trading experience, AvaTrade meets the needs of a diverse range of users. Its focus on functionality and trader support makes it a dependable choice for individuals seeking to navigate financial markets effectively.

FAQs

Frequently Asked Questions (FAQs)

A leading global broker known for its advanced platforms, diverse instruments, and strong regulatory compliance, empowering traders of all levels