CMTrading Review 2025Explore CMTrading’s trading platforms, account options, fee structure, and regulatory compliance. Find out if it’s the right broker for your trading goals in 2025.

Last updated

03.02.2025

Key highlights:

Why Choose CMTrading?

Founded in 2012, CMTrading is a globally recognized online brokerage firm specializing in forex, CFDs, commodities, indices, and cryptocurrencies. Headquartered in South Africa, CMTrading operates under the regulation of the Financial Sector Conduct Authority (FSCA) and the Financial Services Authority (FSA) in Seychelles, ensuring a secure and transparent trading environment.

CMTrading has established a strong presence in regions such as Africa, the Middle East, Asia, and Latin America, catering to both beginner and professional traders. The broker is known for its user-friendly platforms, including MetaTrader 4 (MT4) and its proprietary WebTrader, designed to meet the diverse needs of global clients.

With competitive spreads, flexible account options, and leverage up to 400:1 for professional traders, CMTrading aims to support traders at every stage of their journey. The broker also offers free trading signals, educational resources, and strong customer support to enhance the overall trading experience.

Regulatory Compliance and Security

CMTrading operates under the oversight of two regulatory bodies:

Clients have the option to register under either regulatory framework, depending on their preferences and regional considerations. Notably, CMTrading assures clients that there is no reporting to tax authorities, providing a layer of privacy in financial transactions.

To ensure the safety of client funds, CMTrading implements strict security measures, including the segregation of client funds from the company's operational accounts. This practice ensures that client assets are protected and managed separately, adhering to industry standards for financial security.

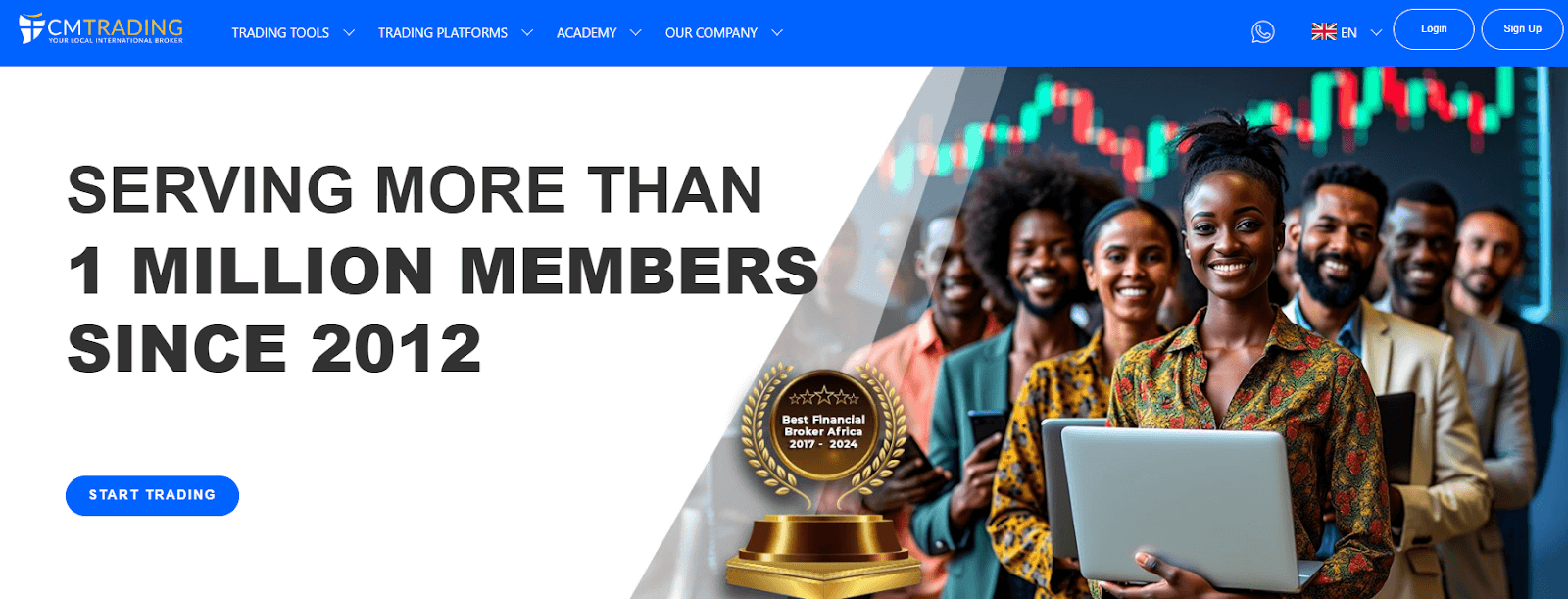

Account Types and Features

CMTrading offers a range of account types designed to cater to traders with varying levels of experience and investment capacity. Each account type comes with specific features and benefits to support different trading strategies.

- Investment Amount: $299 – $1,999

-

Features:

- Welcome Bonus

- Demo Account

- Regular Spreads

- Daily Market Reviews

- Trading eBooks

- Beginner’s Video Education Package

- 1 Risk-Free Trade

- Session with Market Analyst

- Live Webinars with Senior Trading Strategist

- Investment Amount: $2,000 – $9,999

-

Features:

- Welcome Bonus

- Demo Account

- Regular + Spreads

- Daily Market Reviews

- Trading eBooks

- Online Video Lessons: Introduction to Trading

- 2 Risk-Free Trade

- Session with Market Analyst

- Live Webinars with Senior Trading Strategist

- Live Trading Signals by Trading Central

- Investment Amount: $10,000 – $50,000

-

Features:

- Welcome Bonus

- Demo Account

- Spreads (EUR/USD) as low as 1.9 pips

- Daily Market Reviews

- Trading eBooks

- Online Video Lessons: Advanced Trading Course

- 3 Risk-Free Trade

- Dedicated Market Analyst

- Live Webinars with Senior Trading Strategist

- Market Analysis by Trading Central

- Cash Back Rebate

- ECN Account

- Investment Amount: $50,000+

-

Features:

- Welcome Bonus

- Demo Account

- Spreads (EUR/USD) as low as 1.9 pips

- Daily Market Reviews

- Trading eBooks

- Online Video Lessons: Expert Trader Course

- 3 Risk-Free Trades

- Dedicated Market Analyst

- Live Webinars with Senior Trading Strategist

- Live Trading Signals by Trading Central

- Market Analysis by Trading Central

- Cash Back Rebate

- ECN Account

- Customized Account

- Access to Trading Room

- Special Offers

- Availability: Upon Request

-

Features:

- Compliant with Sharia law

- No interest-based overnight swaps

- Retains most features of other account types

Professional Trader Status: CMTrading offers professional trader status upon request for individuals who meet specific criteria, such as significant trading experience, large investment portfolios, or professional certifications. This status provides access to advanced trading conditions, higher leverage, and personalized account management.

Trading Platforms

CMTrading offers two robust trading platforms designed to cater to the needs of traders at all levels:

Both platforms are designed to enhance user experience with intuitive interfaces and robust trading tools.

Tradable Instruments and Leverage

CMTrading offers flexible leverage to accommodate different trading strategies and regulatory requirements:

This leverage structure enables both conservative and aggressive trading strategies while maintaining appropriate risk controls based on client status and jurisdiction.

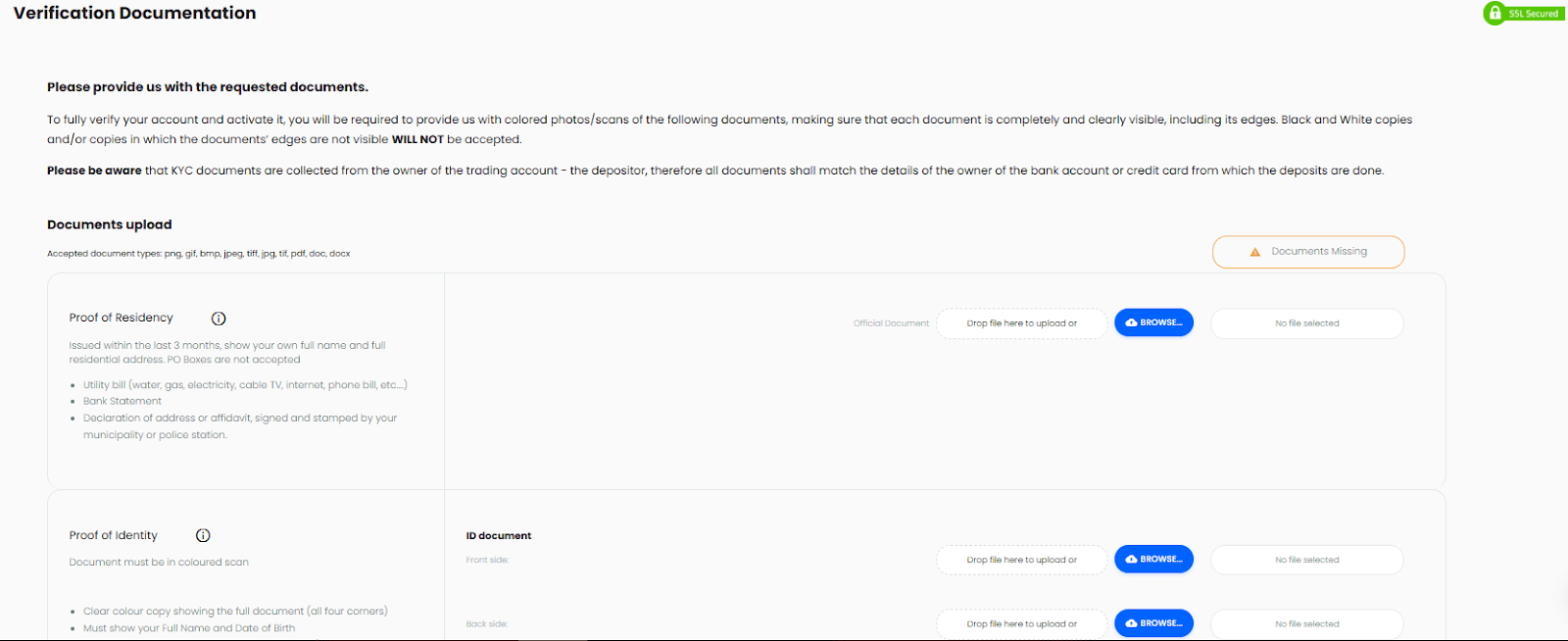

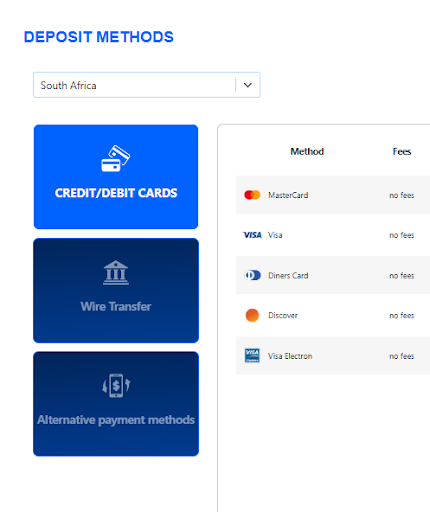

Deposit and Withdrawal Methods

CMTrading offers a wide range of deposit and withdrawal methods to cater to its global client base. The minimum deposit and withdrawal amount is $300, ensuring accessibility for traders of all levels.

- Credit/Debit Cards

- Bank Transfers

- Cryptocurrencies

- Processing Time: Withdrawals are processed within 3 business days after approval.

- Fees No withdrawal fees from CMTrading, but external banking fees may apply.

- Minimum Withdrawal: $20

- Withdrawals must be made to the same account used for deposits.

- Proof of ownership is required for wire transfers and crypto withdrawals to ensure security.

- Withdrawals can only be processed if the margin level exceeds 80% for accounts with open positions.

Fees and Charges

-

Trading Fees:

- No Commissions: Most accounts operate on a spread-only model.

- Spreads: Vary based on account type, starting from as low as 1.9 pips for premium accounts.

-

Non-Trading Fees:

-

Inactivity Fee:

- $50 charged after 2 months of inactivity.

- $100 charged after 12 months of dormancy.

- Currency Conversion Fees: Apply when deposits/withdrawals are made in a currency different from the account base currency.

- Third-Party Transaction Fees: Although CMTrading doesn’t impose additional fees, external payment processors may charge transaction fees.

-

Inactivity Fee:

-

Important Notes:

- No fees are charged for deposits in the same currency as the trading account.

- Proportional withdrawal rules apply when multiple payment systems are used.

- Accounts with no trading activity before withdrawal may incur additional fees.

Trading Conditions and Policies

CMTrading offers flexible trading conditions designed to accommodate traders of all experience levels while maintaining a secure and regulated environment.

- Scalping: Fully allowed, making CMTrading suitable for traders who rely on short-term strategies to capture small price movements.

- Arbitrage: Not permitted, as it conflicts with the broker’s fair trading policies and regulatory guidelines.

- Stop-Out and Margin Call Levels: CMTrading adheres to industry and regulatory standards, ensuring traders are alerted when their account equity falls below the required margin. This helps prevent negative balances and protects both the trader and the broker from excessive risk.

- No Slippage Under Normal Conditions: Orders are executed at the requested price under stable market conditions. However, during periods of high volatility—such as major news releases or market openings—spreads may widen, and slippage can occur due to rapid price fluctuations.

- Expert Advisors (EAs) and Robot Trading: Fully supported on the MetaTrader 4 (MT4) platform. Traders can implement algorithmic strategies, enabling automated trade execution based on predefined criteria without manual intervention.

Educational Resources and Support

CMTrading is committed to empowering traders through comprehensive educational resources and dedicated customer support.

- Free Trading Signals: All CMTrading traders receive free trading signals directly on the platform via Trading Central, a leading analytics firm with over 25 years of experience. These signals provide valuable market insights and trade opportunities in real time. The one-click trade feature further enhances execution speed, making trading more efficient and user-friendly.

- In-House Trading Academy: Offers a wide range of learning materials, including eBooks, trading videos, and weekly webinars hosted by market experts. These resources cater to both beginners and advanced traders, covering topics like technical analysis, trading strategies, and risk management.

- Availability: CMTrading provides 24/5 customer support, ensuring assistance during global trading hours.

- Contact Methods: Traders can reach support via live chat, email, and phone, providing flexibility for immediate or detailed inquiries.

- Languages Supported: The support team is multilingual, catering to an international client base with services available in English, Arabic, French, Spanish, and more.

Pros and Cons

PROS

CONS

CMTrading balances strong features with specific limitations that traders should consider.

Conclusion

CMTrading stands out as a versatile broker, catering to both novice and experienced traders with its diverse range of account types, advanced trading platforms (MetaTrader 4 and CMTrading WebTrader), and comprehensive educational resources. Regulated by the FSCA (South Africa) and FSA (Seychelles), it offers a secure trading environment with segregated client funds and strong compliance measures.

The broker’s strengths lie in its user-friendly platforms, free trading signals, and tailored account options, including an Islamic (swap-free) account. Traders benefit from flexible leverage up to 400:1, competitive spreads, and a broad selection of tradable instruments across forex, commodities, indices, stocks, and cryptocurrencies.

However, inactivity fees and the restriction on arbitrage trading may be drawbacks for some traders. Despite this, CMTrading’s commitment to trader education and robust support makes it a strong choice for those seeking a reliable, feature-rich brokerage.Whether you're a beginner exploring the markets or an experienced trader seeking advanced tools, CMTrading offers the flexibility, security, and resources to support your trading ambitions in 2025.

Frequently Asked Questions (FAQs)

CMTrading is a globally recognized broker offering a diverse range of trading instruments, advanced platforms, and a strong regulatory framework, catering to traders of all experience levels.