CPT Market Review 2025Explore CPT Markets' trading platforms, account types, fee structures, and regulatory compliance. Determine if it's the right broker for your trading journey in 2025.

Last updated

17.02.2025

Key highlights:

Why Choose CPT Markets?

CPT Markets – Introduction & Overview

CPT Markets is a globally recognized multi-asset brokerage offering leveraged trading across forex, commodities, indices, stocks, and crypto CFDs. Founded in 2014 and further expanding in 2017, the company has positioned itself as a trusted financial service provider, emphasizing fund security, cutting-edge technology, and a client-centric trading experience.

Global Presence & Headquarters

CPT Markets operates in multiple financial hubs, with registered headquarters in:

In addition to its core headquarters, CPT Markets has international offices in Thailand and the United Arab Emirates, expanding its global reach to serve traders in Europe, Africa, the Middle East, and Asia.

Commitment to Security & Regulation

CPT Markets is a regulated broker, holding licenses from multiple financial authorities. The company prioritizes fund safety by offering segregated client accounts, negative balance protection, and strict compliance with regulatory standards. Additionally, CPT Markets has confirmed that its CySEC license is in process, further enhancing its regulatory credibility in Europe.

Who is CPT Markets For?

CPT Markets caters to:

Offers an intuitive trading environment with educational resources.

Provides ECN execution, competitive spreads, and professional account features.

Delivers tailored liquidity solutions, advanced trading platforms, and customizable account types.

With a mission to create a secure, transparent, and efficient trading ecosystem, CPT Markets continues to evolve as a leading global brokerage committed to empowering traders worldwide.

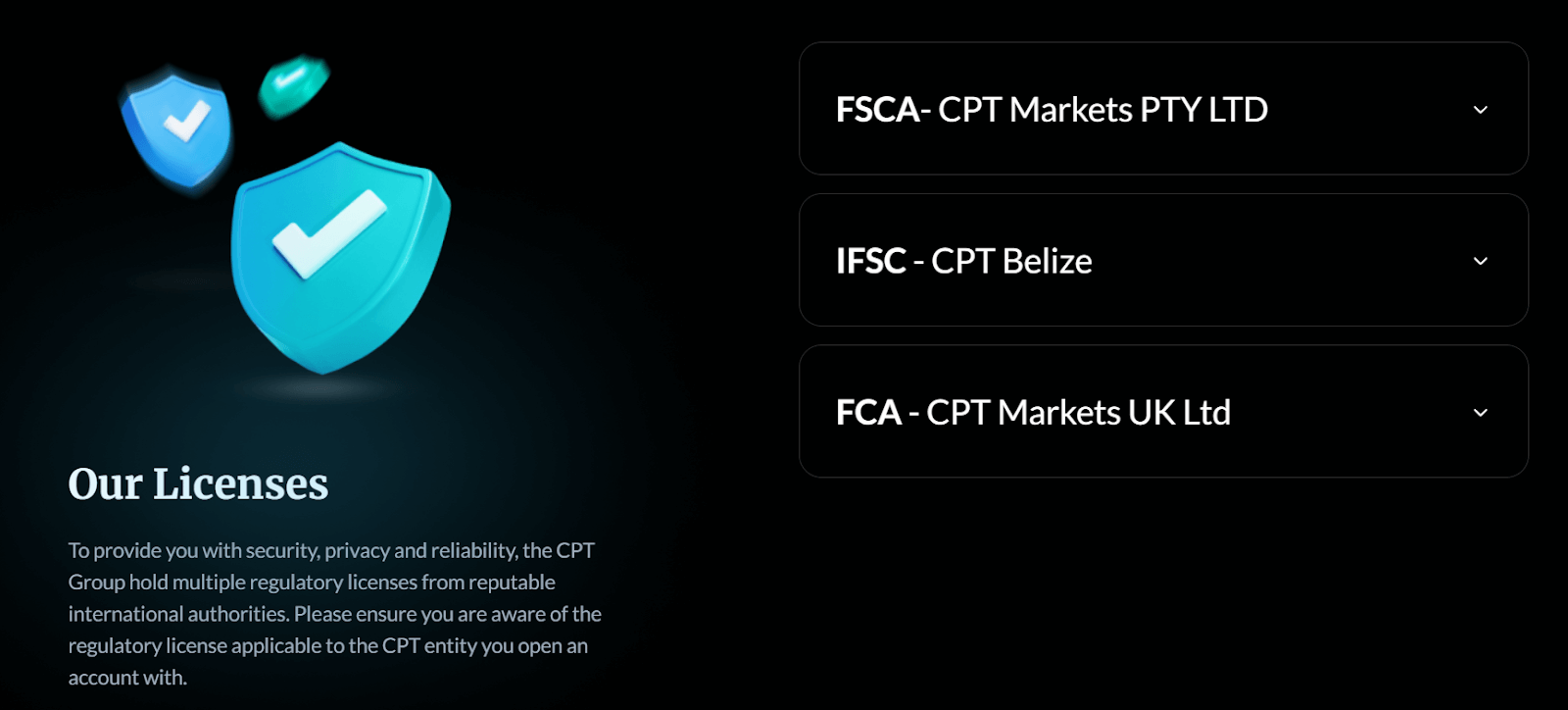

Licensing and Regulation

CPT Markets operates under a multi-regulated framework, ensuring compliance with financial regulations across different jurisdictions. The broker holds licenses from reputable regulatory authorities, reinforcing its commitment to transparency, fund security, and fair trading practices.

Regulatory Oversight

CPT Markets is authorized and regulated by the following financial authorities:

License No: 45954

Oversees the broker’s operations in South Africa, ensuring compliance with strict financial standards.

License No: FSC000314/17

Regulates the broker’s global operations, allowing it to serve international clients.

License No: 6707165

Regulates operations in the UK, ensuring compliance with the UK’s financial laws and investor protection policies.

CPT Markets has confirmed that it is in the process of obtaining a CySEC license, which will allow it to expand its services within the European Economic Area (EEA) under MiFID II regulations.

Security Measures and Client Fund Protection

CPT Markets prioritizes the security of its traders by implementing strict fund protection policies:

All client funds are held in separate accounts with top-tier banks, ensuring they are not used for company operations.

Traders are safeguarded from losing more than their initial deposits, protecting them from market volatility.

Regular audits and compliance checks ensure transparency and adherence to global financial laws.

Restricted Jurisdictions

CPT Markets does not provide services to clients from:

With a strong regulatory framework and an upcoming CySEC license, CPT Markets continues to establish itself as a secure, transparent, and globally compliant broker, making it a reliable choice for traders worldwide.

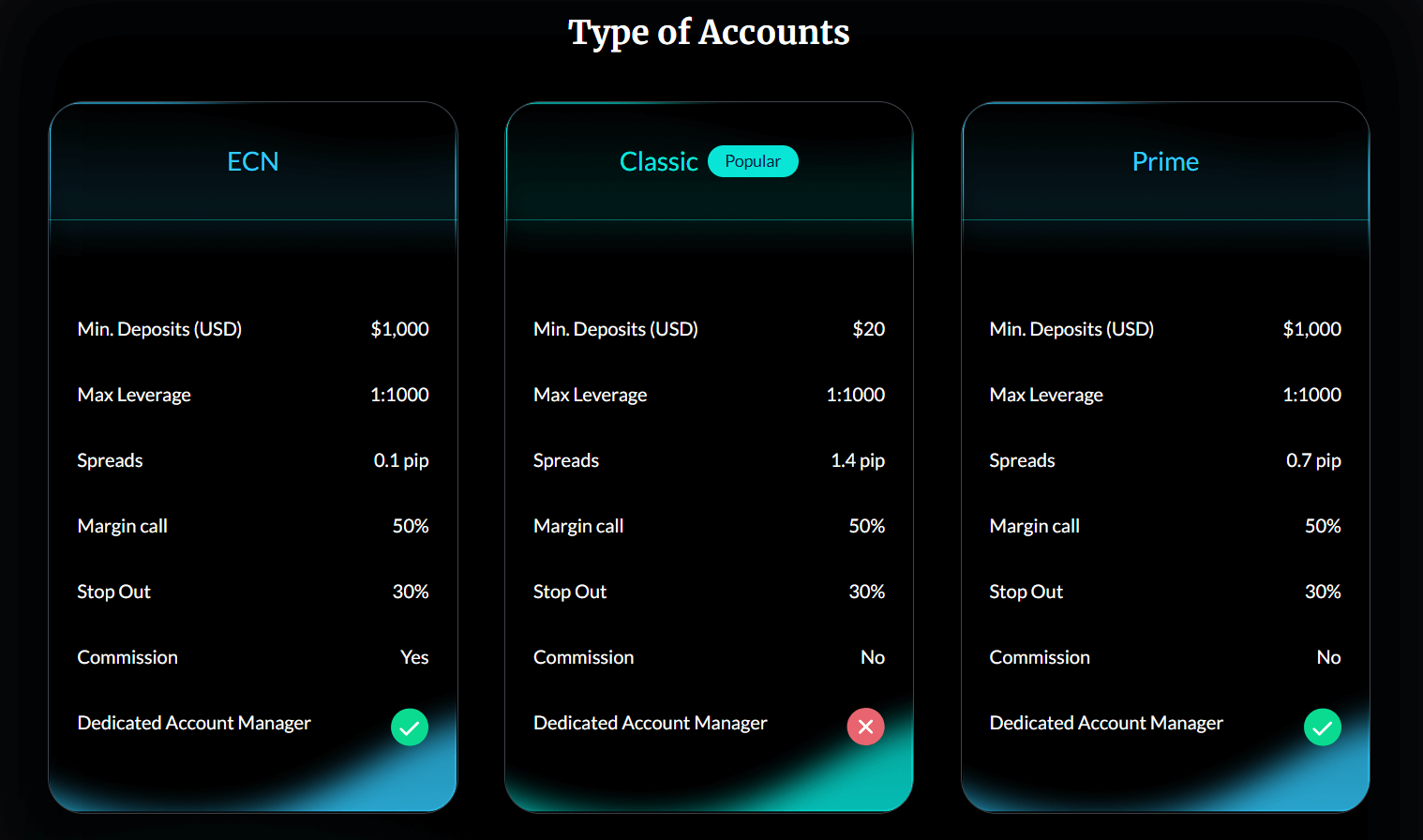

Trading Account Types, Leverage, and Margin Requirements at CPT Markets

Trading Account Types

CPT Markets offers three distinct account types, catering to traders of all experience levels. Each account differs in terms of minimum deposit, spreads, commission structure, and trading benefits.

ECN Account (For Professional Traders)

Minimum Deposit: $1,000

Maximum Leverage: 1:1000

Spreads: From 0.1 pips

Margin Call Level: 50%

Stop-Out Level: 30%

Commission: Yes (Commission-based pricing for tighter spreads)

Dedicated Account Manager: ✅ Available

This account is best suited for high-frequency traders and professionals who require raw spreads and institutional-grade execution.

Classic Account (For Beginner Traders)

Minimum Deposit: $20

Maximum Leverage: 1:1000

Spreads: From 1.4 pips

Margin Call Level: 50%

Stop-Out Level: 30%

Commission: No (Spread-based pricing)

Dedicated Account Manager: ❌ Not Available

This is an ideal account for beginners who want low-cost trading with no commission fees.

Prime Account (For Experienced Traders)

Minimum Deposit: $1,000

Maximum Leverage: 1:1000

Spreads: From 0.7 pips

Margin Call Level: 50%

Stop-Out Level: 30%

Commission: No (Lower spreads with no commission)

Dedicated Account Manager: ✅ Available

The Prime account balances low spreads and commission-free trading, making it ideal for swing traders and long-term investors.

Corporate Account (For Companies)

CPT Markets offers a Corporate Account designed for businesses and professional trading firms, providing institutional-grade trading conditions. This account allows companies to trade a wide range of instruments, including stocks, forex, commodities, and indices, through a single, user-friendly platform.

Key Benefits:

With diversified market access and dedicated support, CPT Markets’ Corporate Account ensures businesses can manage their investments efficiently while leveraging market opportunities.

Leverage and Margin Requirements

CPT Markets provides flexible leverage of up to 1:1000, allowing traders to amplify their market exposure. However, leverage availability depends on the client’s regulatory jurisdiction.

Maximum Leverage Based on Trader Category

Trader Type

Maximum Leverage

Margin Requirements & Risk Management

Margin Call Level: 50%

Stop-Out Level: 30% (Positions automatically closed to prevent excessive losses)

Negative Balance Protection: Ensures traders cannot lose more than their deposited funds

CPT Markets ensures a secure and competitive trading environment with high leverage, tight spreads, and advanced execution speeds, making it a strong choice for both retail and professional traders.

Trading Platforms at CPT Markets

CPT Markets provides access to three industry-leading trading platforms, ensuring traders can execute their strategies efficiently and effectively.

Available Platforms:

The most popular trading platform, known for its user-friendly interface, advanced charting tools, and Expert Advisors (EAs) for automated trading.

An upgraded version of MT4, offering more order types, enhanced charting capabilities, and support for additional asset classes.

A professional trading platform designed for institutional-level trading, featuring Level II pricing, advanced order execution, and an intuitive interface.

With these platforms, CPT Markets ensures a seamless trading experience across desktop, web, and mobile devices, catering to both beginner and advanced traders.

Tradable Instruments and Market Access

CPT Markets offers access to a wide range of financial instruments:

Markets Available

Forex Trading – Major, minor, and exotic currency pairs with leverage up to 1:1000.

Commodities – Trade gold, oil, and natural gas with competitive spreads.

Indices – Access FTSE 100, Nasdaq 100, and Nikkei 225 with zero commission.

Stocks – Trade major stocks like Amazon, Google, and Apple with leverage up to 1:20.

Cryptocurrency CFDs – Trade Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash with zero commission and leverage up to 1:10.

Deposit and Withdrawal Methods – CPT Markets

CPT Markets provides traders with multiple deposit and withdrawal options to ensure smooth and secure transactions. The broker adheres to strict AML (Anti-Money Laundering) policies, meaning that withdrawals must be processed through the same method used for deposits.

Deposit Methods

CPT Markets supports a variety of funding options, catering to different trader preferences:

Most deposit methods are processed instantly or within a few hours, ensuring traders can start trading without unnecessary delays. Additionally, CPT Markets does not charge deposit fees, though network fees may apply for cryptocurrency transactions.

Withdrawal Methods

Withdrawals at CPT Markets follow the same method as deposits due to AML compliance, preventing fraudulent transactions.

The fast withdrawal process and lack of additional fees make CPT Markets an attractive choice for traders looking for efficient fund management.

Fees and Costs – CPT Markets

CPT Markets offers a transparent fee structure, ensuring traders understand all trading and non-trading costs upfront.

Trading Costs

- ECN Account: Starts from 0.1 pips

- Classic Account: Starts from 1.4 pips

- Prime Account: Starts from 0.7 pips

- ECN Account: Commission applies(specific rates depend on trading volume).

- Classic & Prime Accounts: Zero commission: structure.

- Overnight positions incur swap/rollover charges, based on interest rate differentials between currency pairs.

- Islamic (Swap-Free) Accounts available upon request (7-day swap-free period for eligible traders). Islamic (Swap-Free) Accounts available upon request (7-day swap-free period for eligible traders).

Non-Trading Fees

No fees on deposits.

No internal fees, but standard bank charges may apply.

None – making it cost-effective for traders who take breaks.

Applies if trading in a different currency than the account base currency.

CPT Markets maintains a competitive and transparent pricing model, ensuring traders can access tight spreads, low commissions, and cost-efficient trading solutions.

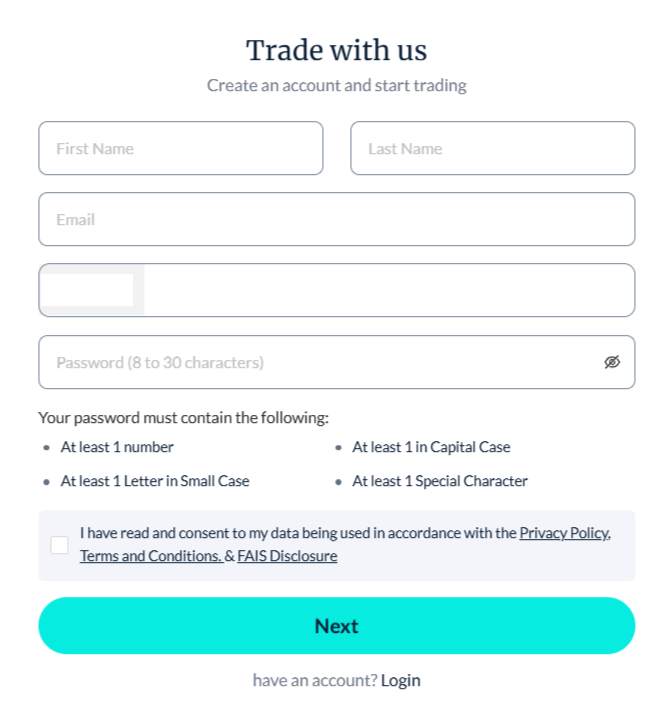

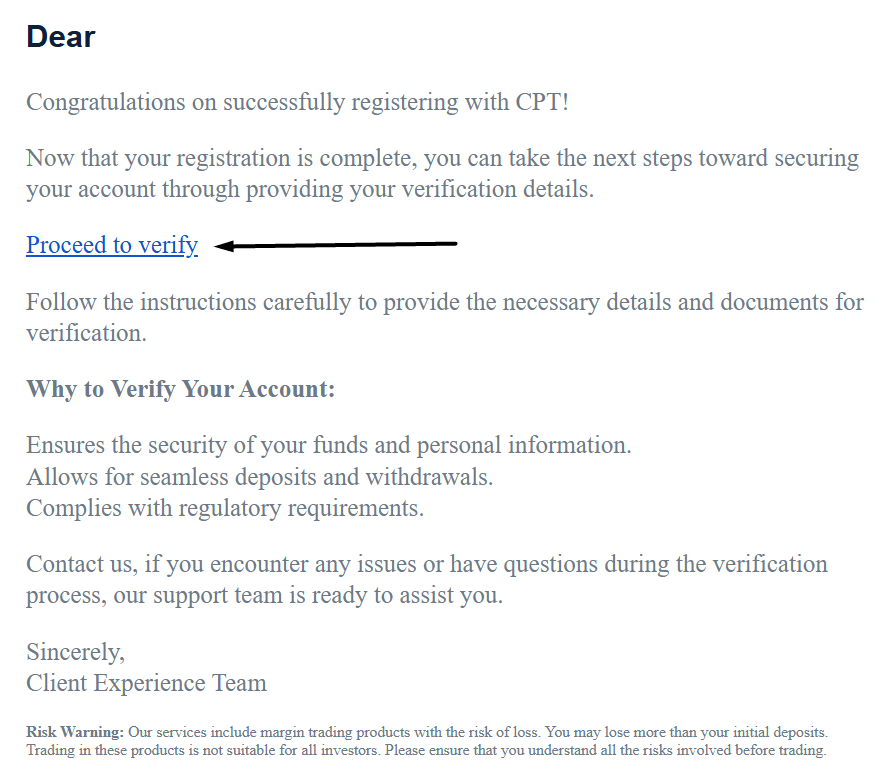

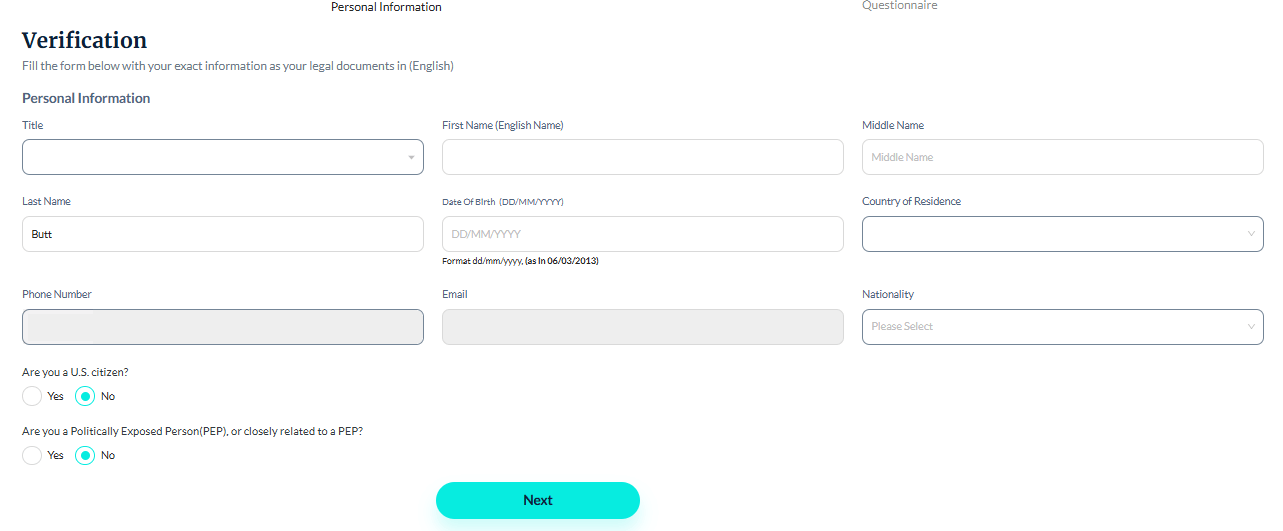

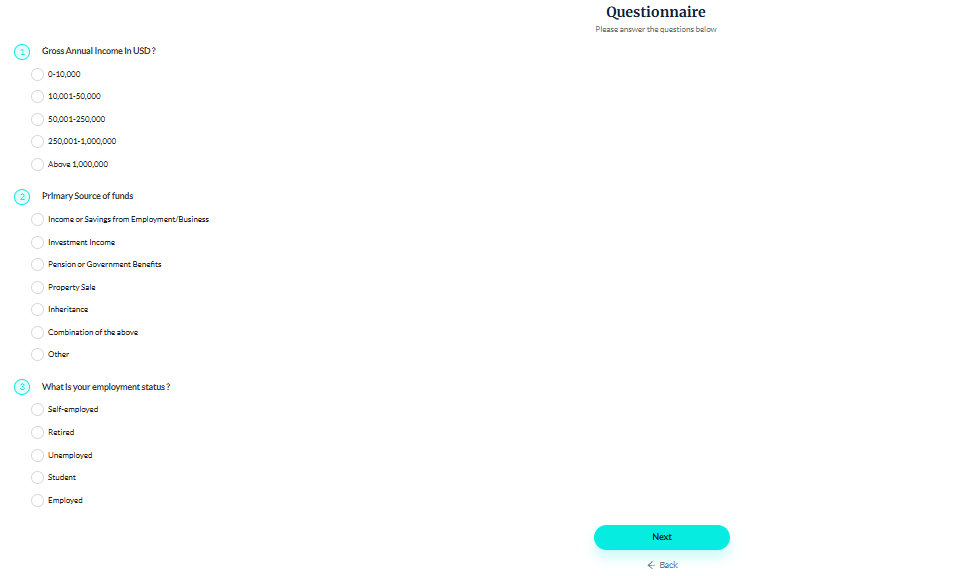

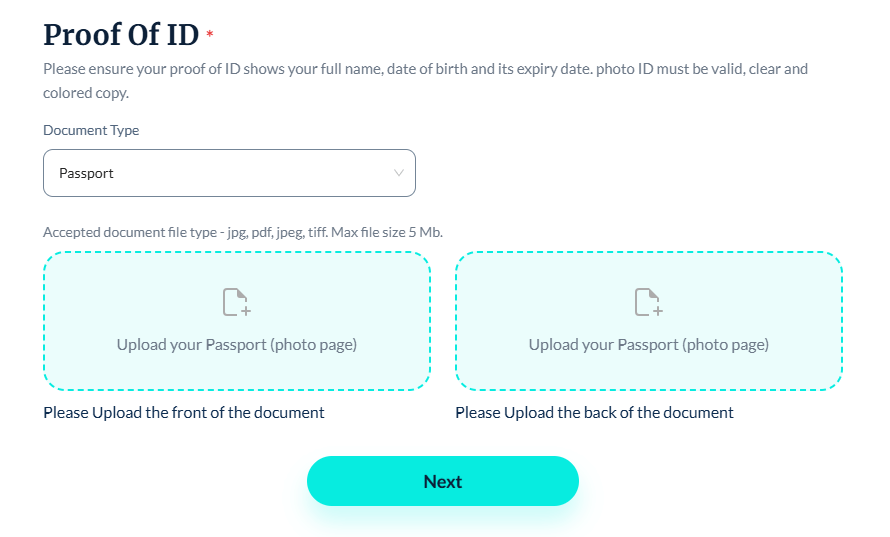

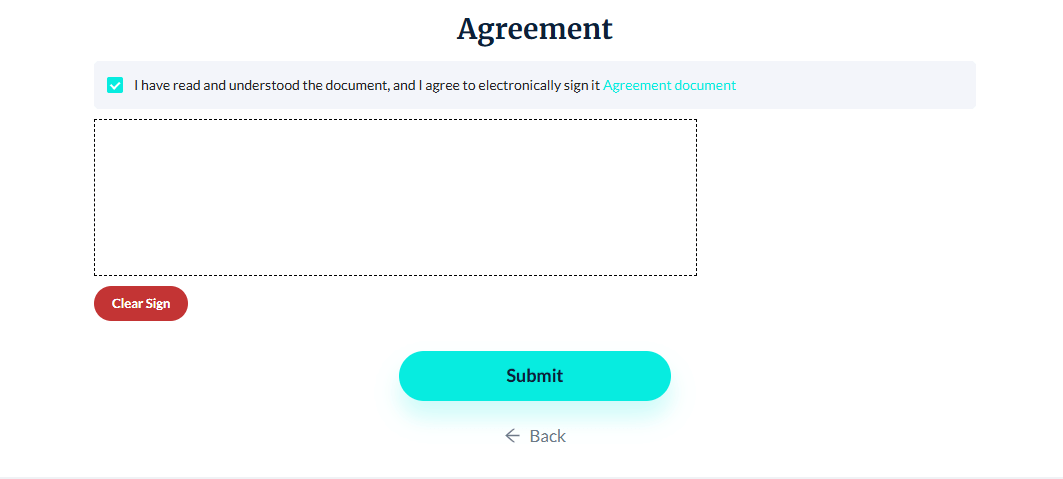

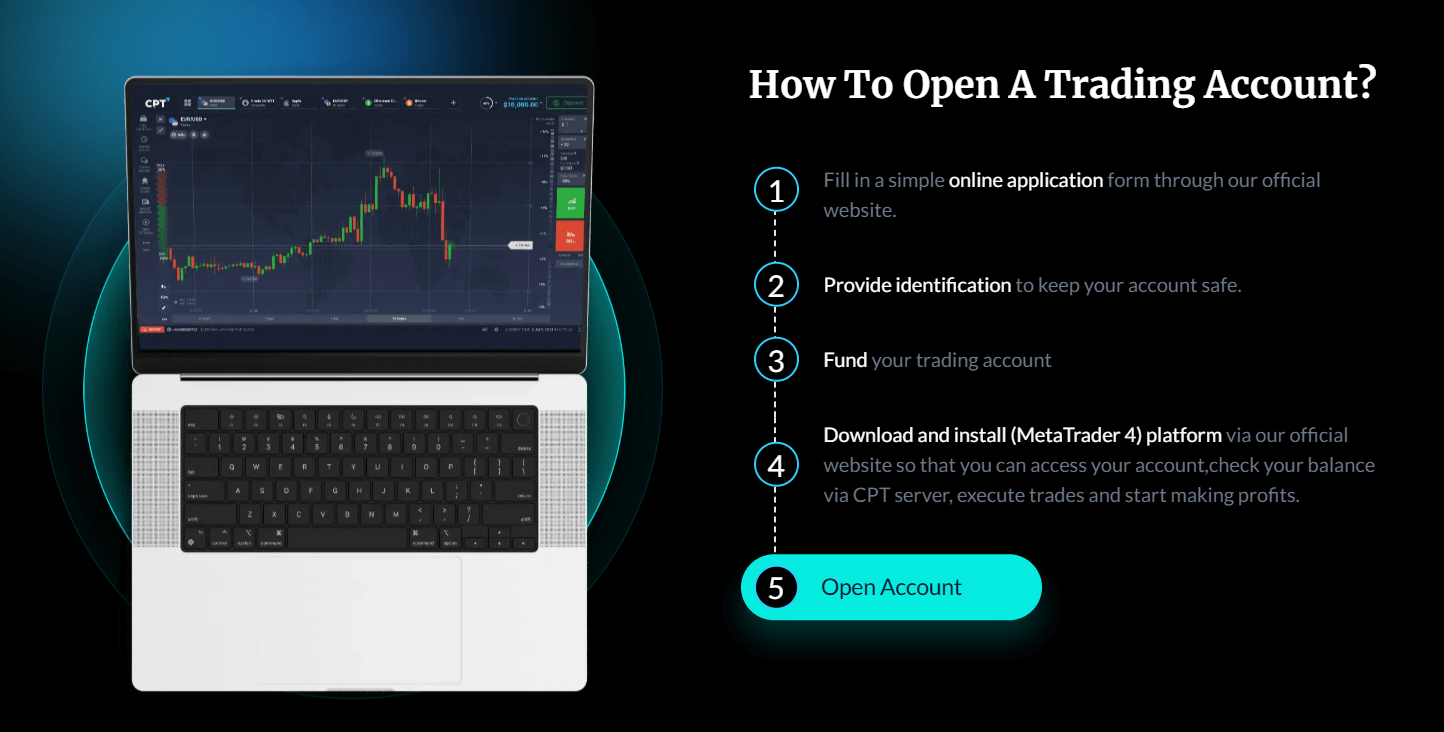

Onboarding and Account Setup – CPT Markets

CPT Markets provides a straightforward and efficient onboarding process, ensuring traders can set up their accounts quickly and securely.

Steps to Open an Account

Complete a simple account registration form on the CPT Markets website.

Time Required for Account Approval

Standard accounts are typically approved within 24 hours, provided all documents are in order.

Delays may occur if additional verification is required.

Upgrading to a Professional Account

Traders who meet certain criteria (e.g., high trading volume, financial expertise, or significant portfolio value) can request an upgrade via email.

Documentation required: Proof of trading experience and financial capability to manage leveraged products.

Approval time: Typically processed within 1-2 business days, subject to review.

CPT Markets' efficient onboarding process ensures traders can quickly access global markets while maintaining compliance with industry regulations.

Trading Policies and Execution Model

CPT Markets offers a transparent and flexible trading environment, allowing traders to use various strategies while benefiting from fast execution speeds and deep liquidity.

Order Execution Model

🔹 Execution Type: CPT Markets operates on a Hybrid Model (ECN + STP), ensuring trades are executed directly in the real interbank market with no dealing desk intervention. 🔹 Slippage & Order Rejection:

- Orders are executed at market price with minimal slippage, especially during high volatility (news releases, economic events).

- CPT Markets strives to reduce order rejections, but extreme market fluctuations may lead to price requotes for fair execution.

By leveraging low-latency trading infrastructure, CPT Markets ensures institutional-grade trade execution for both retail and professional traders.

Educational Resources and Market Analysis

CPT Markets offers a comprehensive educational suite for traders:

CPT Academy – In-depth trading courses.

Live Webinars – Sessions from industry experts.

Economic Calendar – Key financial events and market updates.

Market Research & Daily Analysis – Technical and fundamental analysis reports.

Customer Support

CPT Markets provides multi-channel support with 24/5 availability:

With multilingual support and 24/5 availability, traders receive fast and efficient assistance.

Pros and Cons

PROS

CONS

Conclusion

CPT Markets is a multi-regulated broker that combines high leverage, fast execution speeds, and an ECN trading environment to provide a competitive trading experience. The broker offers a range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies, making it a versatile option for traders seeking diversification.

For traders looking for a low-cost entry, the Classic account provides a commission-free structure with a low minimum deposit. Meanwhile, day traders and scalpers may prefer the ECN and Prime accounts, which offer tighter spreads and professional-grade execution speeds. Institutional and high-volume traders can benefit from custom leverage and deep liquidity, making CPT Markets suitable for a wide range of trading profiles.

Overall, CPT Markets is well-suited for traders who prioritize tight spreads, fast trade execution, and a regulated trading environment.

For a detailed comparison of brokers and to find the best trading solutions, visit wheretotrade.ai.

Frequently Asked Questions (FAQs)

CPT Markets is a global brokerage firm offering a variety of financial instruments, advanced trading platforms, and a range of account types to cater to traders of all experience levels.