ETORO BROKER REVIEW FOR 2025Explore eToro’s innovative social trading features, platforms like eToro App, its regulatory framework (FCA, CySEC, ASIC), and account types. Discover if eToro is the right broker for you in 2025.

Last updated

06.01.2025

Important Notice for U.S. Clients:

The information provided in this review does not apply to U.S. clients. If you are a U.S. citizen, please

visit eToro USA for detailed information about eToro's services available in the United States.

Key highlights:

Why Choose eToro?

Established in 2007, eToro has redefined online trading by combining traditional financial markets with cutting-edge innovation. Known as a pioneer in social trading, eToro stands out with its game-changing CopyTrader feature, allowing you to replicate the strategies of top-performing traders with just a few clicks. This unique capability opens doors for beginners to trade confidently while seasoned investors can build their own follower base. eToro offers access to a wide array of markets, including stocks, forex, cryptocurrencies, ETFs, and CFDs, catering to traders of all skill levels. Regulated by respected authorities such as the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and ASIC in Australia, it ensures a secure and transparent trading experience. In this review, we’ll explore what makes eToro a standout choice in 2025—from its user-friendly platforms to its innovative features—helping you decide if this platform fits your trading goals.

What is eToro?

eToro is a globally recognized trading platform with over 30 million registered users across more than 100 countries. Renowned for its user-friendly interface and innovative trading features, eToro has redefined online trading by making financial markets more accessible to everyone.

Key Offerings:

Regulatory Compliance:

eToro operates under stringent regulatory oversight from top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). With its innovative features and commitment to compliance, eToro continues to empower traders worldwide, making it a top choice for beginners and professionals alike.

Features and Benefits

When it comes to versatility and innovation, eToro stands out with its cutting-edge trading platforms and diverse account types, ensuring that traders of all experience levels can find tools that suit their needs.

Trading Platforms

eToro’s trading platforms are designed to make trading accessible, efficient, and even social. Whether you’re a beginner or a seasoned investor, here’s what you can expect:

The eToro mobile app is your trading companion on the go. With its intuitive interface, you can access all trading features, monitor markets in real time, and execute trades with just a few taps.The app also integrates social features, allowing you to interact with other traders and discover trending strategies. Example: Imagine following a top investor’s trades directly from your phone during your morning coffee.

This browser-based platform eliminates the need for downloads,making trading seamless and accessible from any device.With advanced charting tools, real-time data, and a customizable workspace, WebTrader is perfect for those who prefer trading on a desktop.

The revolutionary CopyTrader feature enables you to mimic the trades of successful investors. Perfect for beginners looking to learn from the pros, this tool also provides performance transparency, so you can choose who to copy based on verified results. Example: Follow a seasoned crypto trader and replicate their strategies to learn and potentially profit alongside them.

For hands-off investing, Smart Portfolios offer pre-built, automated portfolios aligned with specific themes like renewable energy or tech stocks. These portfolios are professionally managed, making them a great option for diversification without the stress of manual stock picking. Pro Tip: If you’re passionate about green energy, Smart Portfolios let you invest in the sector without extensive research.

Account Types

eToro offers a variety of account options designed to cater to different trader profiles, ensuring a seamless experience for everyone—from complete beginners to seasoned professionals.

Standard Account

The Standard Account is the default choice for retail traders,

granting access to eToro’s extensive suite of features, including:

This account is for most traders, offering full functionality and flexibility with no additional requirements.

Professional Account

For experienced traders, the Professional Account provides access to higher

leverage and advanced trading tools. However, this account comes with

specific eligibility criteria to ensure it’s suited for financially capable individuals.

To qualify, traders must be able to answer "yes" to at least two of the following questions:

Note: While the Professional Account offers enhanced features, it also waives some protections provided to retail clients, such as negative balance protection. Ensure you understand the risks before applying.

Demo Account

The Demo Account is perfect for beginners or anyone looking to test

new strategies. Key features include:

This account is a stress-free way to familiarize yourself with trading before committing real funds.

Corporate Account

Designed for businesses, the Corporate Account offers tailored solutions and full

access to eToro’s trading features. This account requires additional documentation,

including proof of company registration and ownership.

Why eToro’s Account Options Stand Out

Whether you’re just starting or are a seasoned investor, eToro provides the flexibility and tools to suit your needs. Explore your options and discover why millions of traders trust eToro. Ready to get started? Open your account today!

Fees and Charges

eToro maintains a transparent fee structure designed to cater to diverse trading needs, making it easy for traders to understand and manage costs effectively.

Trading Costs

eToro offers competitive trading fees that align with industry standards while providing attractive features for traders:

Non-Trading Fees

eToro’s non-trading fees are minimal, but understanding them is essential for cost management:

A $10 monthly fee is applied after 12 months of inactivity. To avoid this, ensure you log in periodically.

A flat fee of $5 per withdrawal applies, making it easy to calculate costs when withdrawing funds.

For accounts not denominated in USD, conversion fees are applied to deposits and withdrawals. For example, depositing in EUR will incur a conversion fee to USD, which is eToro’s base account currency.

Regulation and Security

eToro’s commitment to regulatory compliance and security measures ensures a regulated trading environment for users worldwide.

Regulatory Oversight

eToro is monitored by multiple top-tier regulatory authorities, reinforcing its credibility and commitment to compliance.

Why it matters: Regulatory oversight ensures eToro’s operations are transparent, funds are protected, and clients receive fair treatment in all transactions.

Security Measures

eToro employs robust security protocols to safeguard client funds and personal information:

All client funds are stored in segregated accounts at tier-1 banks, ensuring they remain separate from the company’s operational accounts.

Authentication (2FA):

AAdds an extra layer of account protection by requiring a verification code during login.

All data exchanges on the platform are encrypted with advanced SSL technology, preventing unauthorized access and data breaches.

Your Funds, Protected: With industry-leading security measures and regulatory backing, eToro provides a secure environment for trading. Whether you’re a seasoned investor or a beginner, you can trade with confidence knowing your funds and data are well-protected.

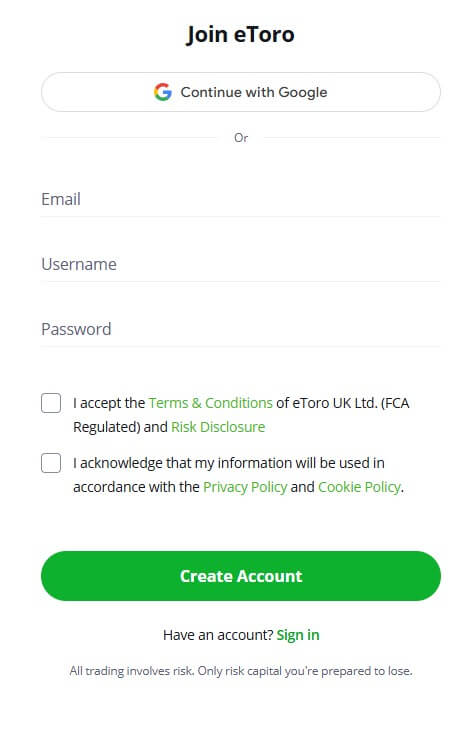

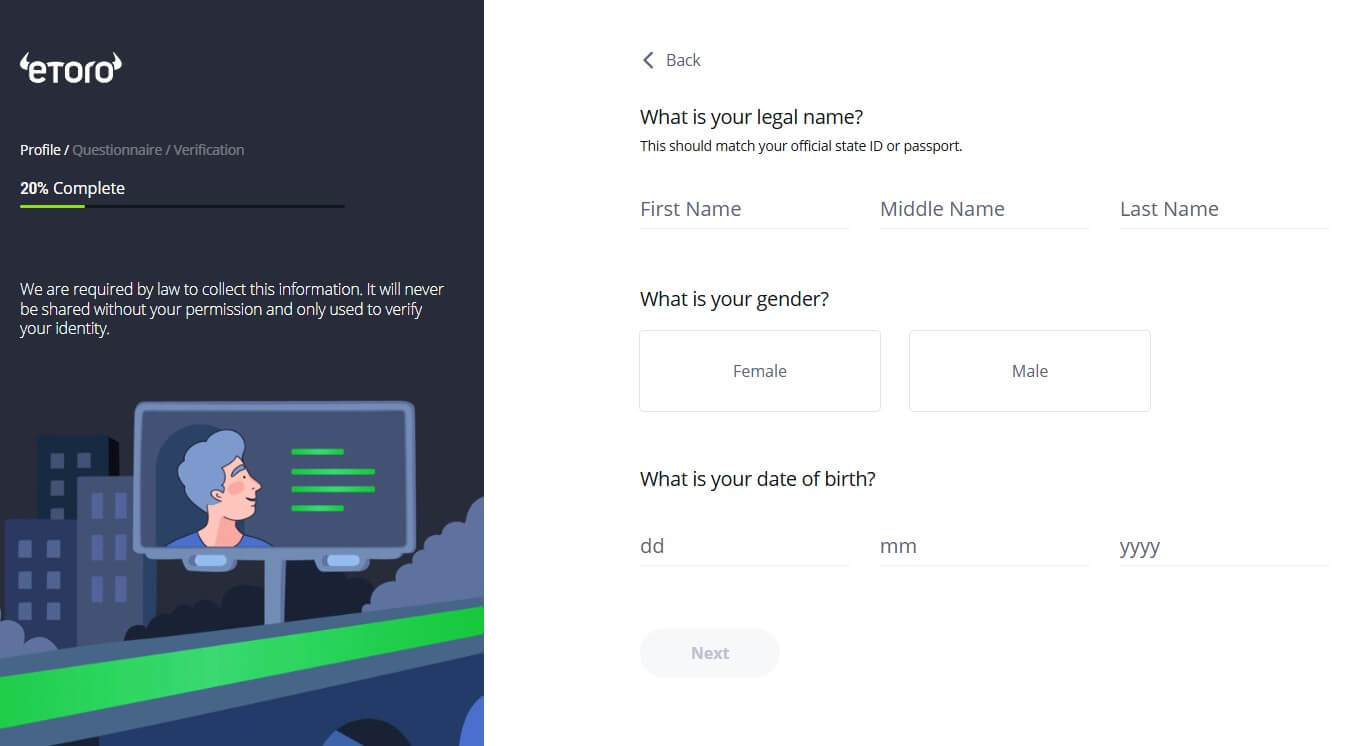

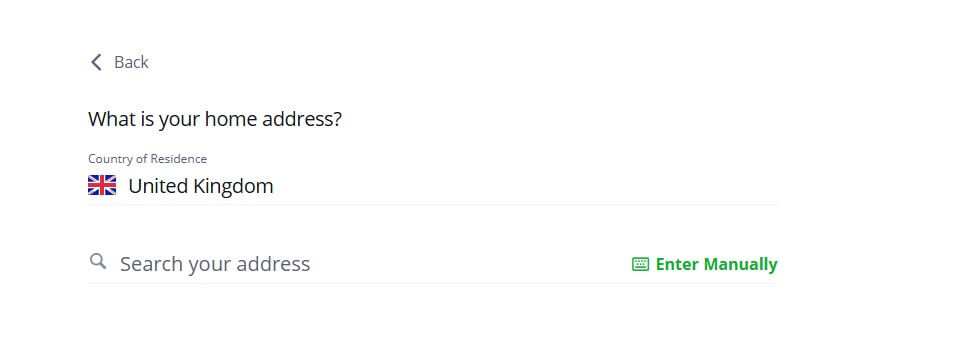

Onboarding Process: How to Open an Account

Sign-Up Process

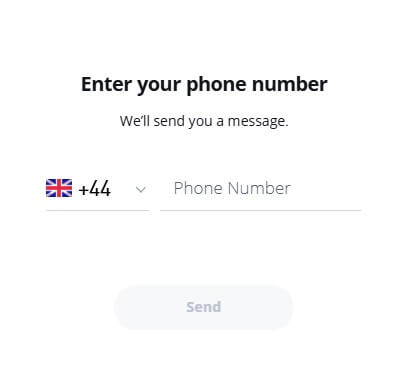

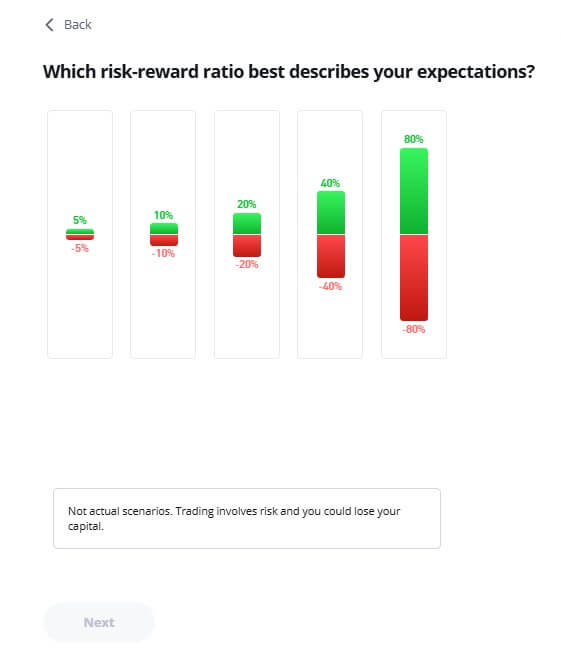

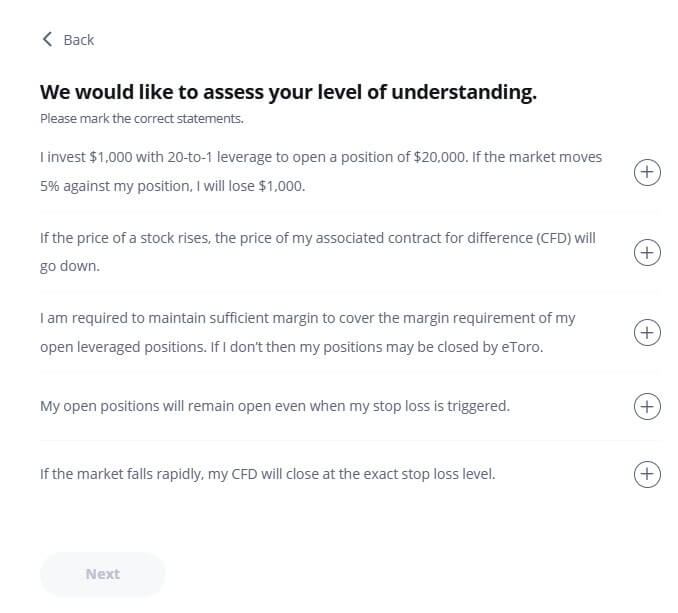

eToro makes opening an account a seamless experience, catering to both beginners and seasoned traders. Here’s how to get started:

Navigate to eToro's official website or download the app and click “Join eToro.”

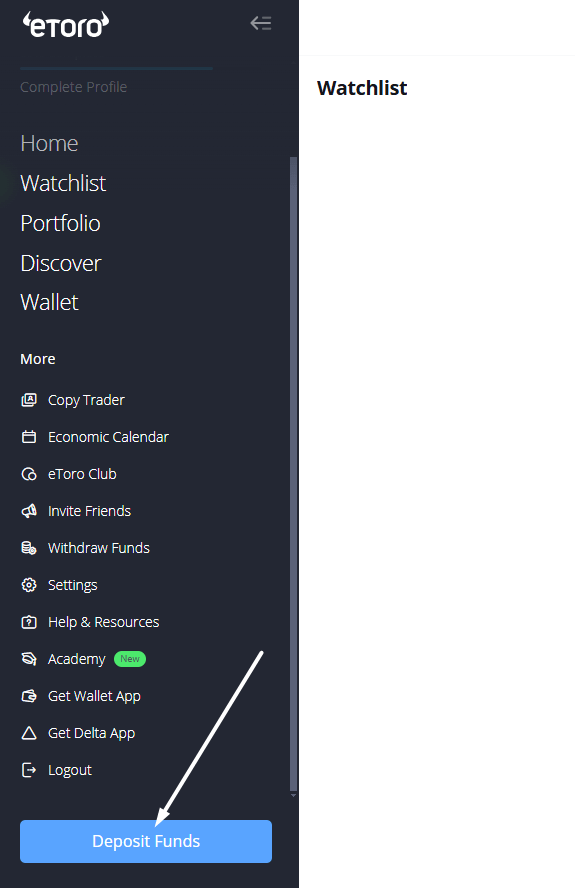

Deposits and Withdrawals

Deposit Methods

eToro offers a variety of deposit methods tailored to global users, ensuring convenience and accessibility:

The minimum deposit starts at $50 for most regions, though this can vary depending on your location. For instance, users in certain countries may face higher minimums, such as $500 for bank transfers. Check your region's specific requirements before initiating a deposit.

Withdrawal Process

Withdrawals on eToro are straightforward and typically processed within 1–2 business days. However, the time it takes for funds to reach your account depends on the payment method:

Customer Support

Contact Methods

eToro offers multiple support options to ensure seamless assistance for its users:

Pro Tip: Check the eToro Help Center for instant solutions before reaching out.

Educational Tools at eToro

eToro empowers users with robust educational resources to enhance trading skills and market knowledge:

Pro Tip: Use eToro’s webinars and CopyTrader to align with expert strategies while learning. Access these tools through the eToro Academy and start enhancing your trading skills today.

Pros and Cons of eToro

PROS

CONS

Conclusion: Is eToro the Best Broker in 2025?

eToro remains a standout option in 2025, particularly for beginners and social investors. Its social trading features, like CopyTrader, provide a unique edge, enabling users to follow and replicate other traders with ease. The platform’s diverse range of instruments, including stocks, cryptocurrencies, and ETFs, ensures ample opportunities for portfolio growth. Coupled with regulatory oversight from top-tier authorities, eToro offers a regulated and transparent trading environment that instills confidence in its users.

While its inactivity fee may be a consideration for occasional traders, the user-friendly interface makes it an attractive choice for active investors. Although eToro might lack advanced trading tools preferred by professionals, its focus on accessibility and innovation positions it as a reliable and forward-thinking broker. For those seeking a platform that combines regulation, social connectivity, and simplicity, eToro continues to be a top contender in 2025.

FAQs

Risk Warning: Copy Trading does not amount to investment advice. Includes Stocks & Crypto. Capital is at risk. Cryptos investing carries high risk and is highly volatile .Tax may apply. Past performance is not an indication of future results. Crypto investing carries a high risk and is highly volatile. The services offered here are provided by DLT Finance, a brand of DLT Securities GmbH, which has outsourced the provision of services or parts thereof to eToro (Europe) Ltd. eToro (Europe) Ltd. provides its own services from Cyprus. All activities requiring a license, in particular financial commission business and proprietary trading, including the execution of orders at suitable trading venues or against DLT Securities GmbH itself, for example in market making, are provided by DLT Securities GmbH. DLT Securities GmbH is a German investment firm pursuant to Section 2 (1) WpIG. Crypto custody is provided by Tangany GmbH. Tangany GmbH is a German crypto custodian pursuant to Section 1 (1a) sentence 2 no. 6 KWG. Taxes on profits may be incurred. ASIC disclaimer: Stocks via eToro Service ARSN 637 489 466 Capital at risk. See PDS and TMD Copytrading allows you to ‘copy’ or ‘follow’ others. Assets held in your name, including OTC Derivatives (leveraged financial products) and crypto assets (unregulated). Past performance is not an indicator of future results. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

eToro is a globally recognized social trading platform, combining innovative features like CopyTrader™ and Smart Portfolios with top-tier regulatory compliance.