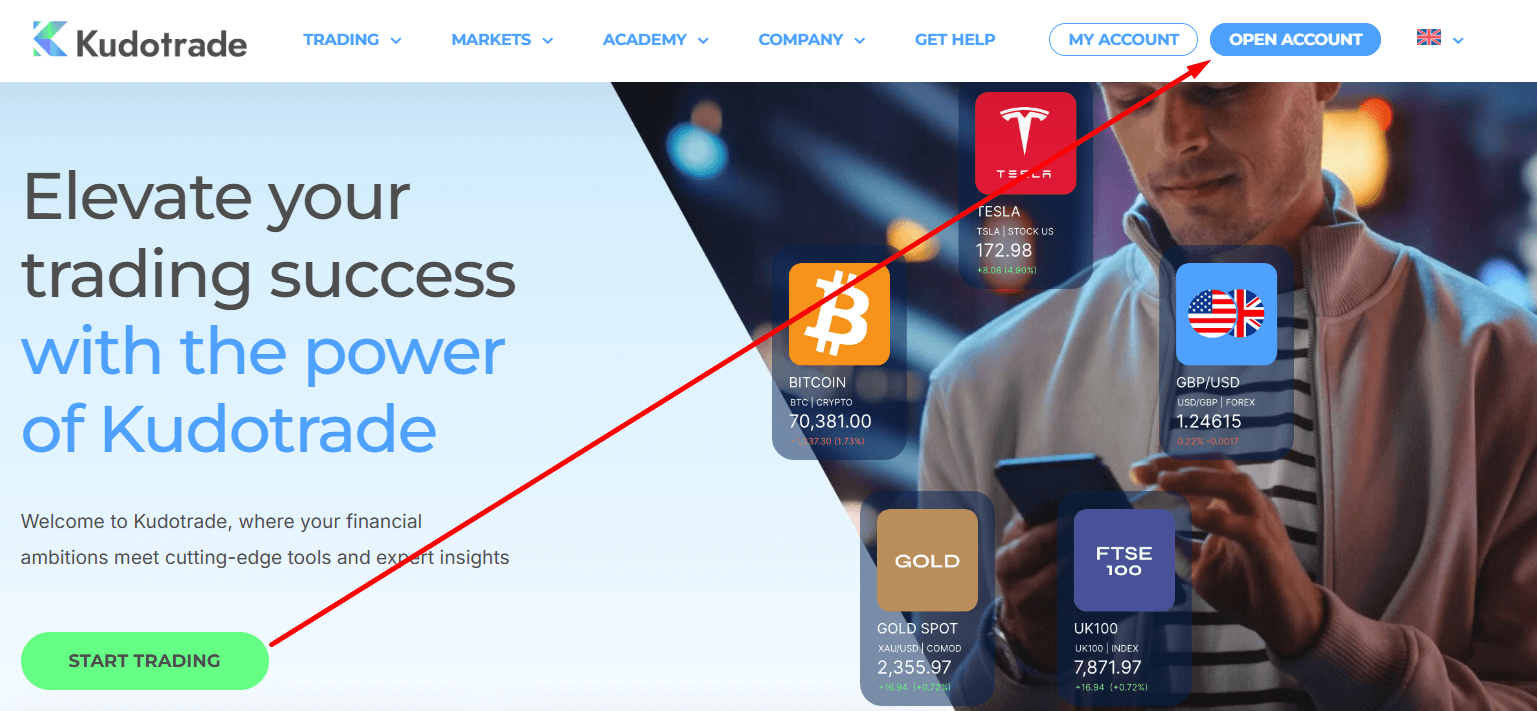

KudoTrade Review 2025Explore Kudotrade’ trading platforms, account options, fee structures, and regulatory compliance. Determine if it’s the right broker for your trading goals in 2025.

Last updated

26.02.2025

Key highlights:

Why Choose KudoTrade?

Kudotrade is a Mauritius-based forex and CFD broker regulated by the Financial Services Commission (FSC), offering a secure and flexible trading environment. With a global reach, the broker provides a diverse selection of tradable assets, including forex, indices, stocks, commodities, and cryptocurrency CFDs.

A standout feature of Kudotrade is its crypto-friendly approach, allowing traders to deposit and withdraw funds using digital assets like Bitcoin and Ethereum. This gives traders an added layer of flexibility, making it easier to fund accounts and access markets without relying solely on traditional banking methods.

The broker operates on MetaTrader 5 (MT5), a powerful and feature-rich platform known for advanced charting tools, technical indicators, and algorithmic trading support. Additionally, Kudotrade prioritizes fast execution speeds, hosting its servers in Equinix data centers, where its liquidity providers and tech infrastructure are located—ensuring minimal latency and efficient order execution.

This review will explore Kudotrade’ account types, trading policies, costs, regulatory compliance, and platform features, helping traders determine if it aligns with their trading needs.

Company Background and Regulation

Kudotrade presents itself as a brokerage firm offering trading services across forex, commodities, indices, stocks, and cryptocurrencies. The company claims to be regulated by the Financial Services Commission (FSC) of Mauritius under license number GB24203599 and is registered under the Saint Lucia Register of International Business Companies with registration number 2024-00239.

Additionally, Kudo Systems Ltd in Cyprus is listed as an appointed representative of Kudo Trade (Mauritius) Ltd.

Regulatory Oversight

While Kudotrade asserts compliance with FSC Mauritius, concerns have emerged regarding its actual regulatory standing. The broker is not registered under major global financial regulators like the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or the U.S. Commodity Futures Trading Commission (CFTC). The Saint Lucia registration does not provide regulatory oversight for forex trading, raising questions about client fund protection.

Regulatory Considerations

Security Measures

Kudotrade advertises security practices, but reports suggest potential withdrawal issues and lack of transparency.

Claimed security measures include:

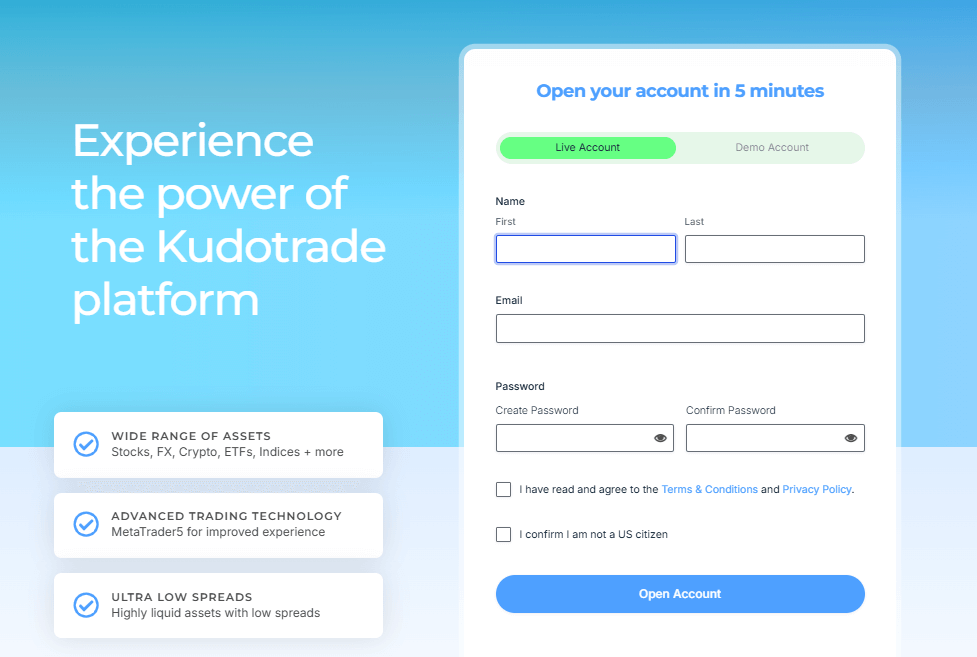

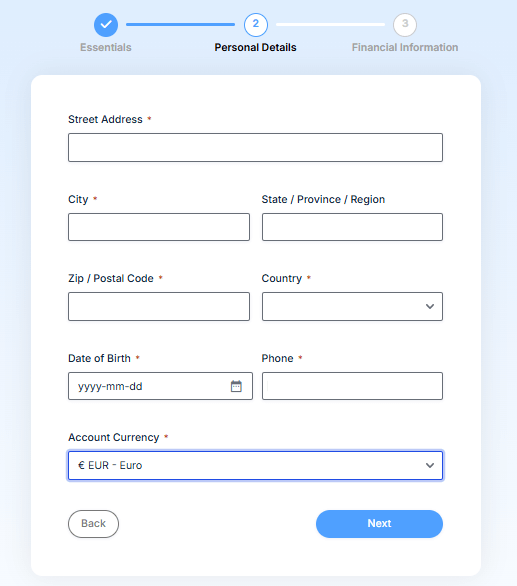

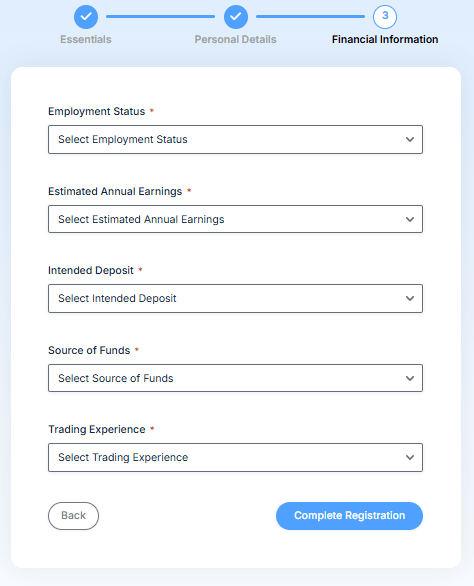

Account Types and Features

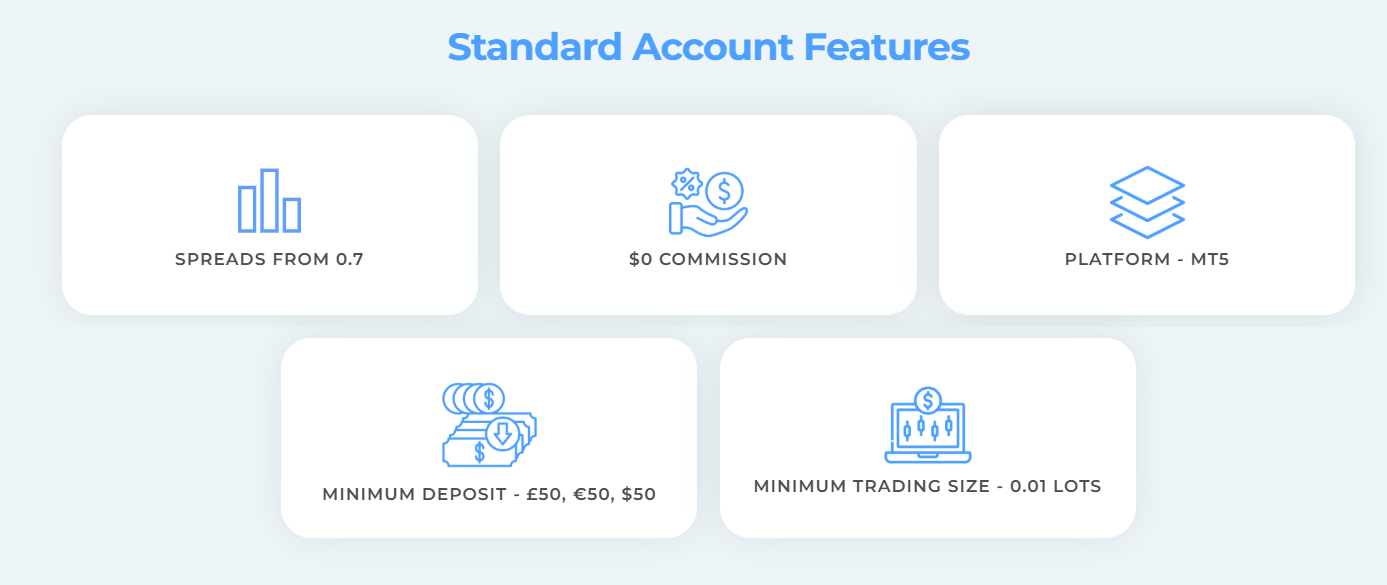

Kudotrade offers multiple account types designed to suit different trading styles and experience levels. Whether you're a beginner looking for a simple setup or an advanced trader seeking the lowest spreads, Kudotrade provides tailored options to fit your needs.

- Ideal for beginners and intermediate traders.

- Spreads starting from 0.7 pips.

- $0 commission on trades.

- Leverage up to 1:500, allowing for flexible position sizing.

- Minimum deposit: £50 / €50 / $50.

- Supports MetaTrader 5 (MT5) for trading.

- Minimum trade size: 0.01 lots.

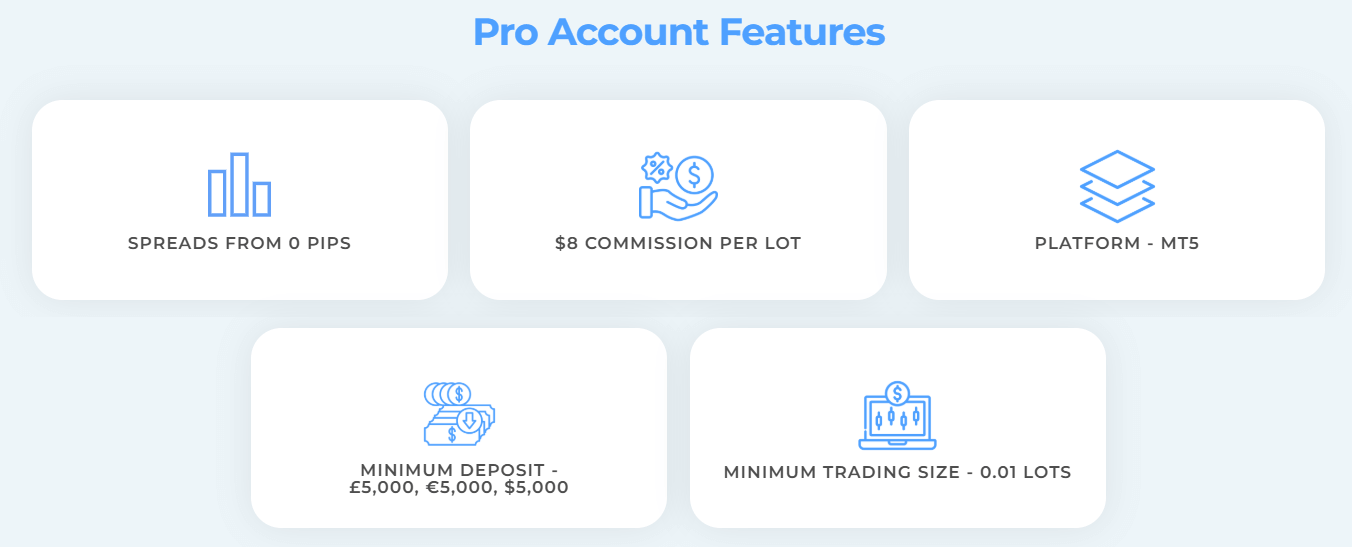

- Designed for experienced traders who require lower trading costs.

- Spreads starting from 0 pips.

- $8 commission per lot, offering tighter spreads for high-volume traders.

- Leverage up to 1:500.

- Minimum deposit: £5,000 / €5,000 / $5,000.

- Minimum trade size: 0.01 lots.

- Uses the MT5 platform with lightning-fast execution speeds.

- Available upon request for traders following Islamic finance principles.

- No overnight swap fees on leveraged positions.

- Offers similar trading conditions as the Standard or Pro account, without interest charges.

- Risk-free environment for testing strategies.

- Virtual balance to practice trading without real financial risk.

- Access to full trading features on MT5.

- Unlimited time access, allowing users to develop and refine their trading strategies.

Kudotrade' diverse account options provide flexibility for all types of traders, from beginners testing the waters to professional traders optimizing their strategies with tighter spreads and commission-based execution.

Tradable Instruments

Kudotrade offers a diverse range of financial instruments, enabling traders to access multiple global markets from a single platform. Whether you're interested in forex trading, stock CFDs, indices, commodities, or cryptocurrencies, Kudotrade provides a seamless trading experience with competitive conditions.

By offering a wide range of tradable instruments, Kudotrade ensures that traders have multiple opportunities to diversify and optimize their trading strategies.

Trading Platforms and Tools

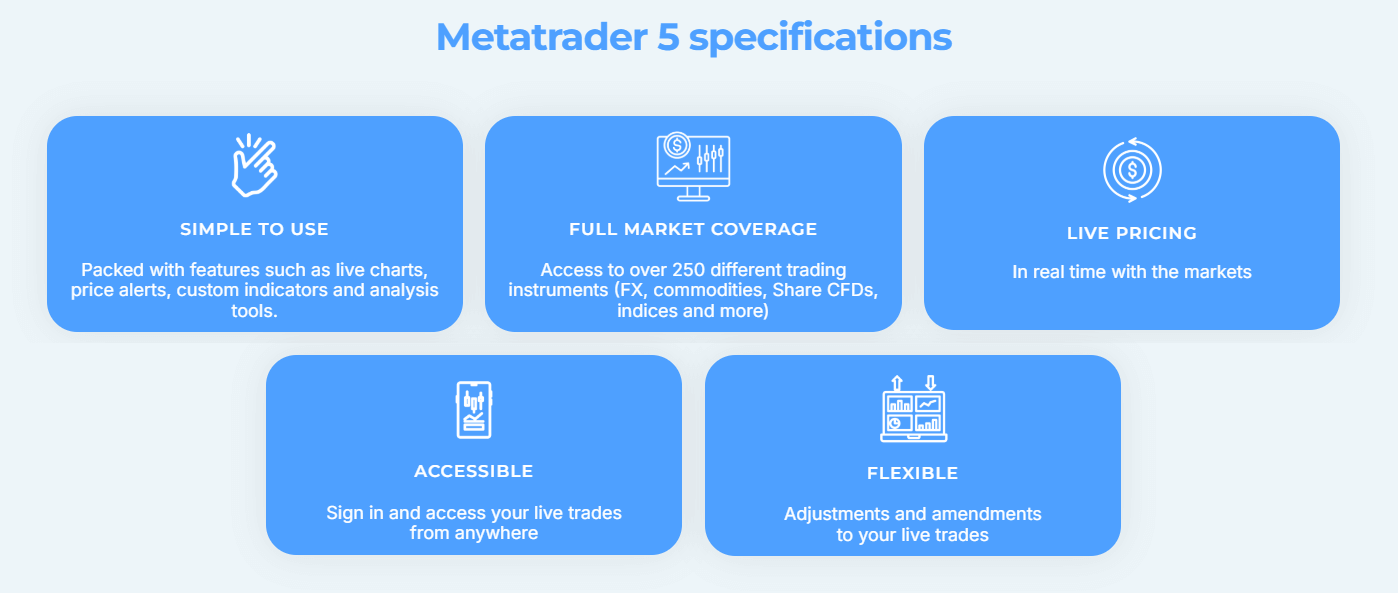

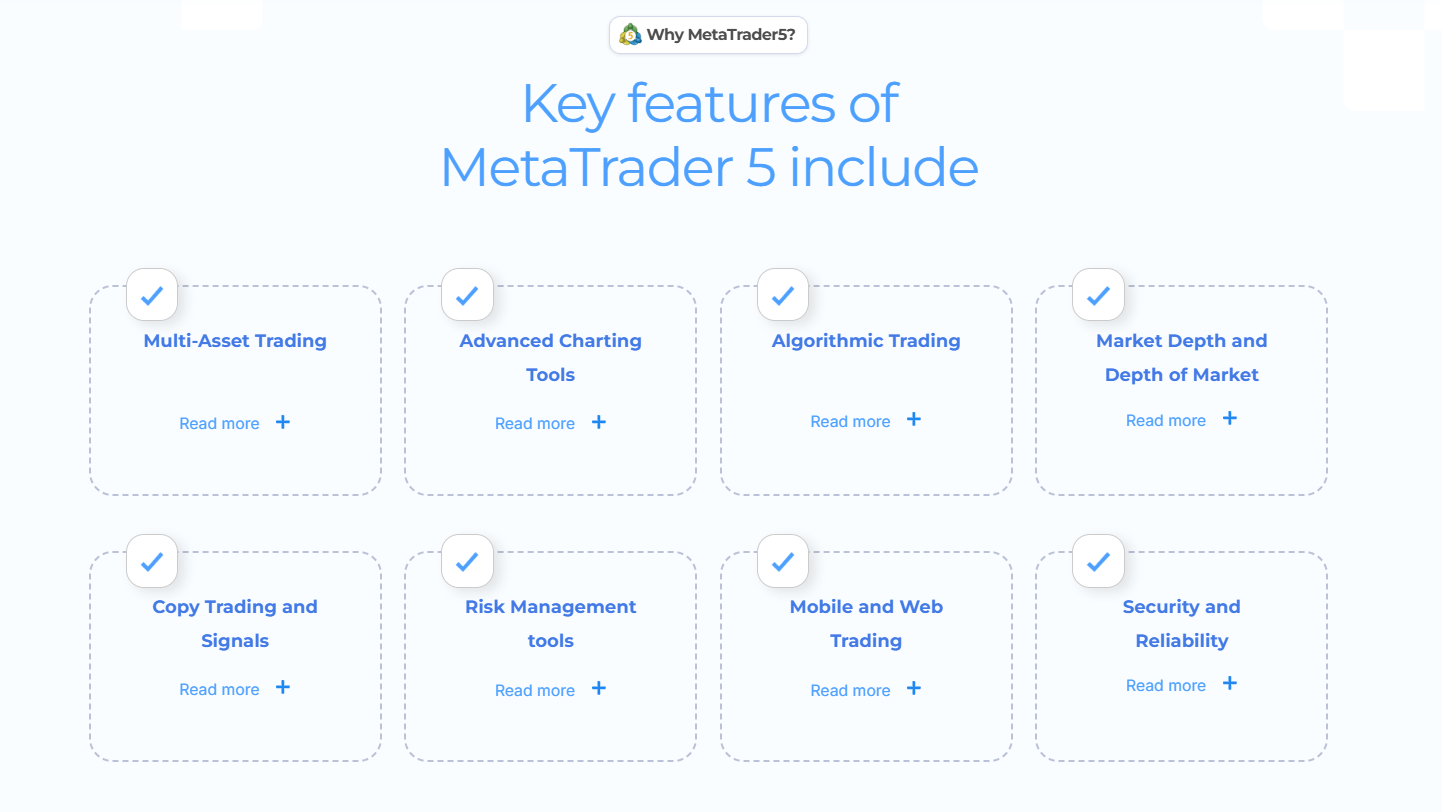

Kudotrade provides traders with cutting-edge trading experience through its MetaTrader 5 (MT5) platform, renowned for its advanced functionalities and seamless execution. The platform caters to both beginner and professional traders with features designed to optimize trading efficiency.

MetaTrader 5 (MT5): The Primary Trading Platform

Kudotrade relies on MT5, one of the industry’s most advanced platforms, offering:

Multi-Asset Trading – Trade forex, stocks, indices, commodities, and cryptocurrencies from a single account.

Advanced Charting Tools – Analyze trends with multiple timeframes, 30+ built-in indicators, and customizable charting options.

Algorithmic Trading & Expert Advisors (EAs) – Automate trading strategies with custom bots and scripts.

Market Depth & Order Execution – Full market depth transparency, enabling better trade decision-making.

Copy Trading & Signals – Access signal providers or copy professional traders’ strategies.

Mobile & Web Trading – Trade on the go with a fully functional mobile app for iOS and Android.

Risk Management Tools – Implement stop-loss, take-profit, and trailing stop functionalities to manage market exposure.

Upcoming In-House Trading App

Kudotrade is developing its own proprietary trading app, designed to enhance mobile trading with seamless execution, real-time analytics, and an intuitive interface.

Execution Speed & Reliability

Ultra-Fast Execution – Trades are processed using Equinix data centers, ensuring low latency and minimal slippage.

Market Execution – Orders are executed at the best available price, ensuring reliability even in volatile markets.

With MT5’s robust features and an in-house app on the horizon, Kudotrade provides a powerful trading environment for all levels of traders.

Leverage and Risk Management

Leverage is a powerful tool that allows traders to control larger positions with a smaller capital investment. Kudotrade offers high-leverage trading, potentially up to 1:500 for professional traders, enabling greater market exposure. However, leverage magnifies both profits and losses, making risk management essential.

Risk Protection Measures

Stop-Loss Orders – Automatically closes a trade at a predefined price to limit losses.

Take-Profit Orders – Locks in profits by closing trades when a target price is reached.

Trailing Stops – Adjusts the stop-loss level dynamically as the market moves in the trader’s favor.

However, negative balance protection is not explicitly mentioned, meaning traders should be cautious with highly leveraged trades. By combining smart risk management tools with disciplined trading strategies, traders can optimize their positions while minimizing potential downsides.

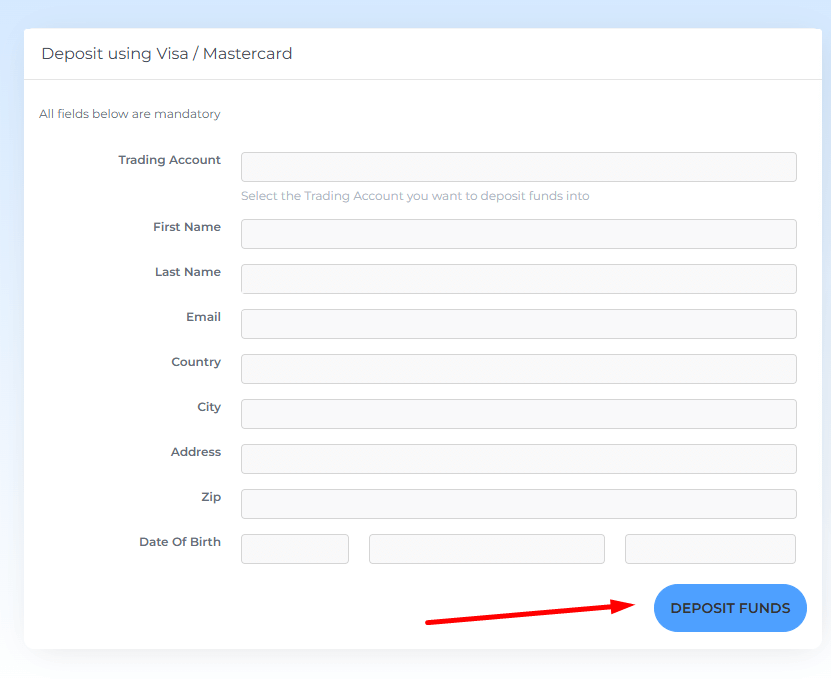

Deposit and Withdrawal Processes

Kudotrade offers a streamlined funding experience with multiple deposit and withdrawal options designed for speed and security. Whether traders prefer traditional banking methods or digital assets, the broker ensures a hassle-free process with instant or same-day processing times.

Deposit Methods: Simple and Efficient

Visa/Mastercard – Instant deposits for immediate trading access.

Cryptocurrency Deposits – Supports Bitcoin (BTC), Ethereum (ETH), USDT, and other leading digital assets.

Bank Wire Transfers – Suitable for larger transactions, though processing times may vary.

Each deposit method is processed instantly or within a few minutes, except for bank wire transfers, which may take longer depending on the bank.

Withdrawal Methods: Fast and Fee-Free Payouts

Visa/Mastercard – Direct withdrawals to bank cards.

Cryptocurrency Withdrawals – Payouts in Bitcoin, Ethereum, and USDT.

Bank Wire Transfers – For secure, high-value transactions.

Kudotrade does not impose withdrawal limits or fees, ensuring traders can access their funds without unnecessary costs.

Important Considerations for Secure Transactions

AML & FIFO Policies – To maintain security and prevent fraudulent activity, deposits and withdrawals must match (e.g., if you deposit via wire transfer, you cannot withdraw in crypto).

No Hidden Fees – Unlike many brokers that charge processing fees, Kudotrade keeps all deposit and withdrawal transactions completely fee-free.

Fast Processing Times – While most withdrawals are processed within hours, external bank processing times may vary.

With a focus on flexibility, security, and speed, Kudotrade provides traders with a smooth and transparent funding experience, making it easier to manage capital and execute trades without financial disruptions.

Fees and Costs

Kudotrade offers a clear and competitive fee structure, ensuring traders can manage costs effectively without unexpected charges.

Trading Fees: Competitive Spreads, No Hidden Costs

Spreads – Kudotrade offers tight spreads starting from 0.7 pips on the Standard account and as low as 0.0 pips on the Pro account, available via the MT5 platform.

Commission Structure – Standard accounts come with zero commissions, while Pro accounts charge $8 per lot for institutional-grade pricing.

No Hidden Fees – Unlike many brokers, Kudotrade does not charge additional markups or slippage-based costs.

Non-Trading Fees: Keeping Costs Low

No Deposit or Withdrawal Fees – All transactions, including bank transfers and crypto payments, are processed fee-free.

Inactivity Fee – A €20 per month fee applies if an account remains inactive for 6+ months without any trading activity.

Why It Matters

By maintaining low trading costs, zero deposit/withdrawal fees, and a transparent commission model, Kudotrade ensures that traders can focus on executing trades efficiently without worrying about excessive charges.

Trading Policies and Restrictions

Kudotrade maintains a trader-friendly environment with flexible trading conditions but enforces specific policies to ensure fair market execution.

Allowed Trading Strategies: Freedom for Active Traders

Scalping – Short-term trading strategies with quick entries and exits are permitted.

EA/Robotrading – Automated trading is fully supported through MetaTrader 5 (MT5), allowing traders to implement algorithmic strategies.

Restricted Trading Strategies: Maintaining Fair Trading Conditions

Arbitrage Trading – Price-lag arbitrage is not allowed, ensuring a stable market environment.

Execution Model: Fast and Reliable Order Processing

Market Execution – Trades are executed at the best available price, ensuring minimal delays.

Low Latency Processing – Servers are hosted in Equinix data centers, reducing execution lag.

Slippage Considerations – During high volatility (e.g., news events), slippage may occur.

By offering flexible trading conditions while ensuring fair market integrity, Kudotrade caters to both manual and algorithmic traders looking for fast and transparent execution.

Educational Resources and Client Support

Kudotrade offers a structured learning academy alongside dedicated customer support, ensuring traders at all levels have access to essential knowledge and assistance.

Kudotrade Academy: A Learning Hub for Traders

The Kudotrade Academy provides a comprehensive educational experience, covering a range of trading topics to help traders develop their skills.

Trading Guides & Tutorials – Covers fundamental and advanced concepts in forex, CFDs, and cryptocurrency trading.

Strategy Breakdowns – Detailed insights into trading strategies, technical indicators, and market analysis techniques.

Video Tutorials – Step-by-step guides on platform navigation, order execution, and risk management.

Beginner to Advanced Courses – Includes modules on fundamental analysis, technical analysis, money management, and trading psychology.

The structured learning approach allows traders to gradually build expertise, making it easier to transition from beginners to more advanced trading strategies.

Customer Support: Reliable Assistance for Traders

Kudotrade provides standard industry support, ensuring traders receive prompt help with technical or account-related issues.

Support Availability – While specific details are not explicitly mentioned, industry norms suggest availability via live chat, email, and possibly phone support.

Trading Assistance – Expected to cover platform guidance, account verification, deposits/withdrawals, and troubleshooting issues.

By offering well-structured educational resources and responsive customer support, Kudotrade empowers traders to make informed decisions and effectively navigate financial markets.

Country-Specific Highlights

Kudotrade operates globally, providing trading services to a wide range of clients while adhering to its Mauritius-based regulatory framework.

Mauritius – Licensed under FSC Mauritius, offering an offshore-friendly trading environment while ensuring compliance with international financial standards.

Global Reach – No regional restrictions on onboarding international clients, but traders must adhere to their local financial regulations where applicable.

By maintaining flexible yet compliant regulatory oversight, Kudotrade ensures accessibility for traders worldwide without compromising on security and governance.

Pros and Cons

PROS

Supports Bitcoin, Ethereum, and other cryptocurrencies for funding and trading.

Permits high-frequency trading strategies, offering flexibility to active traders.

CONS

While Kudotrade offers strong trading conditions, traders should consider platform preferences and strategy restrictions before committing to an account.

Conclusion

Kudotrade delivers a strong trading environment for those seeking fast execution, MT5 integration, and crypto-friendly funding options. With FSC Mauritius regulation, traders can access a broad range of instruments, including forex, stocks, indices, commodities, and cryptocurrencies, all while benefiting from Equinix-powered ultra-low latency execution.

The broker is particularly well-suited for active traders, including scalpers and crypto traders, thanks to its tight spreads, zero commission standard account, and flexible deposit/withdrawal methods. However, those relying on MetaTrader 4 (MT4) or arbitrage trading strategies may need to consider alternatives.

FAQs

Kudotrade is an FSC-regulated broker offering fast execution, cryptocurrency funding, and access to a diverse range of CFDs. With a strong focus on technology and trader flexibility, it caters to both beginner and advanced traders.