Oanda review 2025Discover OANDA's comprehensive review for 2025. Explore its regulated status, trading platforms (OANDA Trade, MT4), competitive pricing, and account types.

Last updated

06.01.2025

Exclusive features:

Key highlights:

Introduction

Established in 1996, OANDA has become a trusted name in forex trading, especially for U.S. traders. Whether you're a beginner or an experienced professional, OANDA provides everything you need to succeed in the forex market. With access to over 68 currency pairs, a user-friendly proprietary platform, and advanced tools like MetaTrader 4 (MT4), it caters to traders of all levels.

A key advantage is OANDA's transparent pricing. Clients can choose between:

high-volume traders.

Key Features

Backed by strict regulatory oversight from top-tier authorities like the Commodity Futures Trading Commission (CFTC), OANDA delivers a secure, transparent, and cutting-edge trading experience that continues to set the standard in 2025.

What is OANDA?

OANDA is a globally trusted broker known for its diverse range of trading services tailored to both retail and professional traders. With a robust product portfolio and stringent regulatory oversight, OANDA ensures a secure and transparent trading experience for its clients.

Products Offered:

Features and Benefits

Trading Platforms

OANDA provides versatile trading platforms tailored for traders at all level

OANDA Trade Platform:

MetaTrader 4 (MT4):

TradingView Integration:

OANDA ensures accessibility across platforms, providing a robust and flexible trading experience.

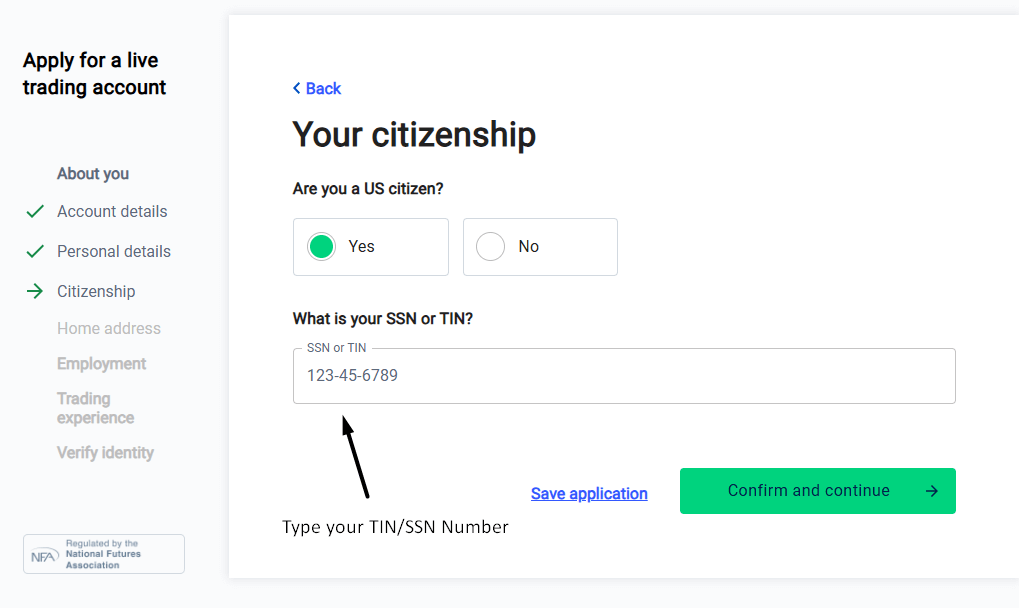

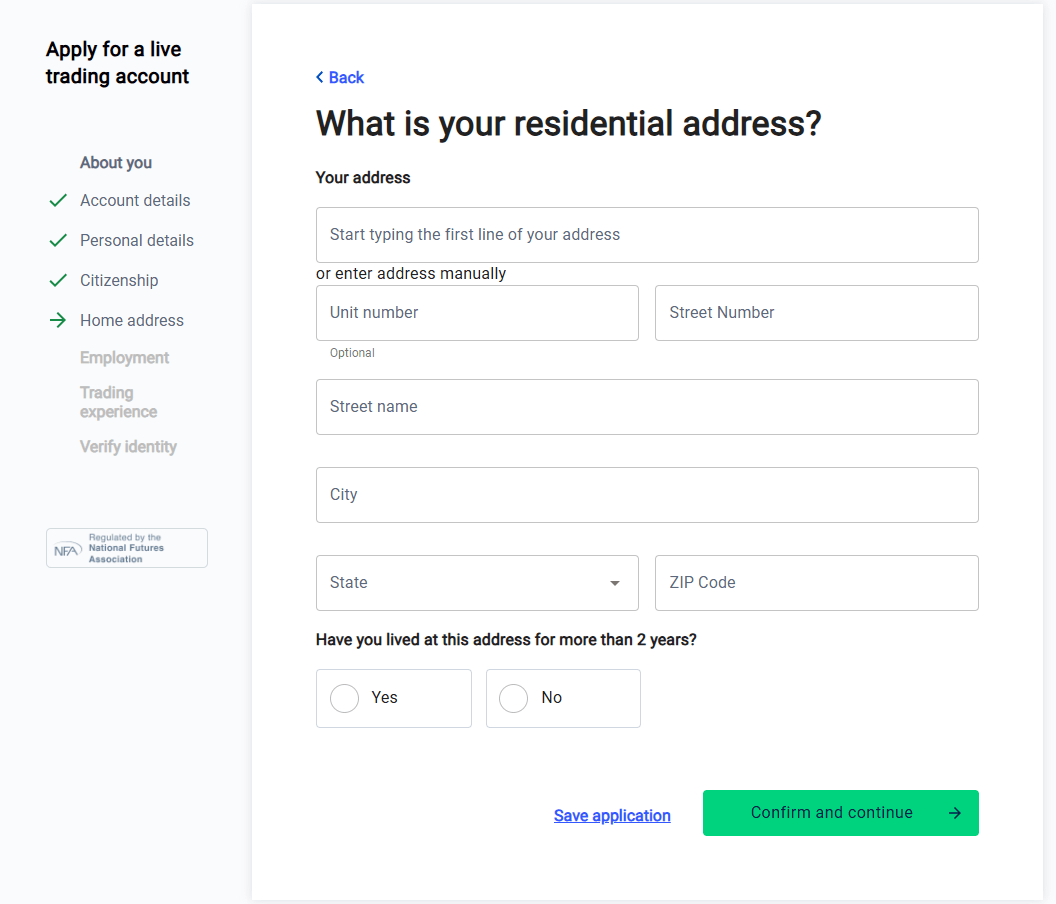

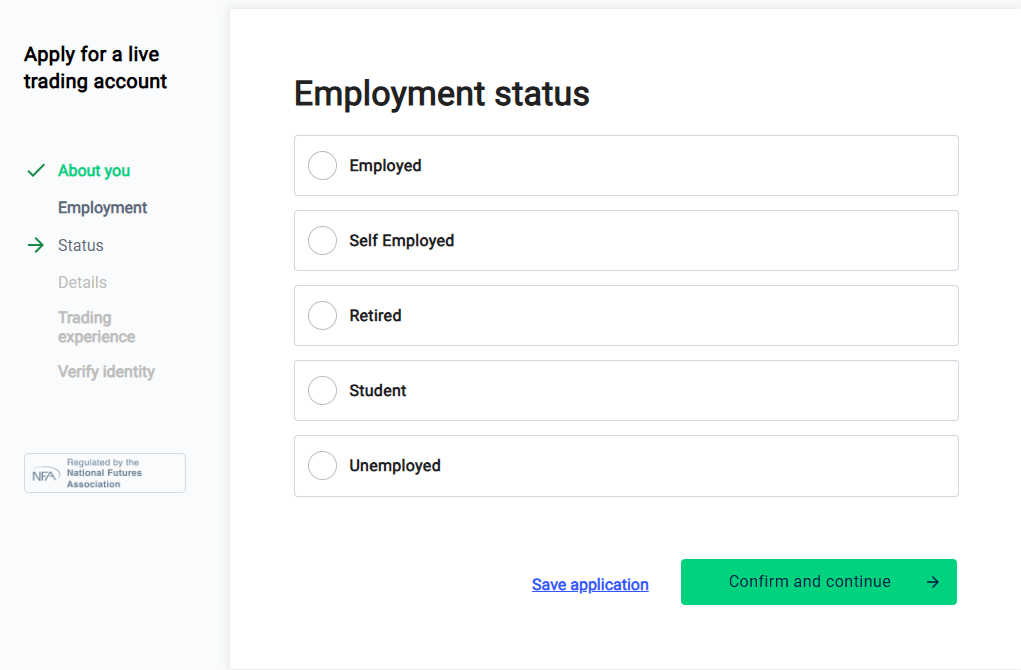

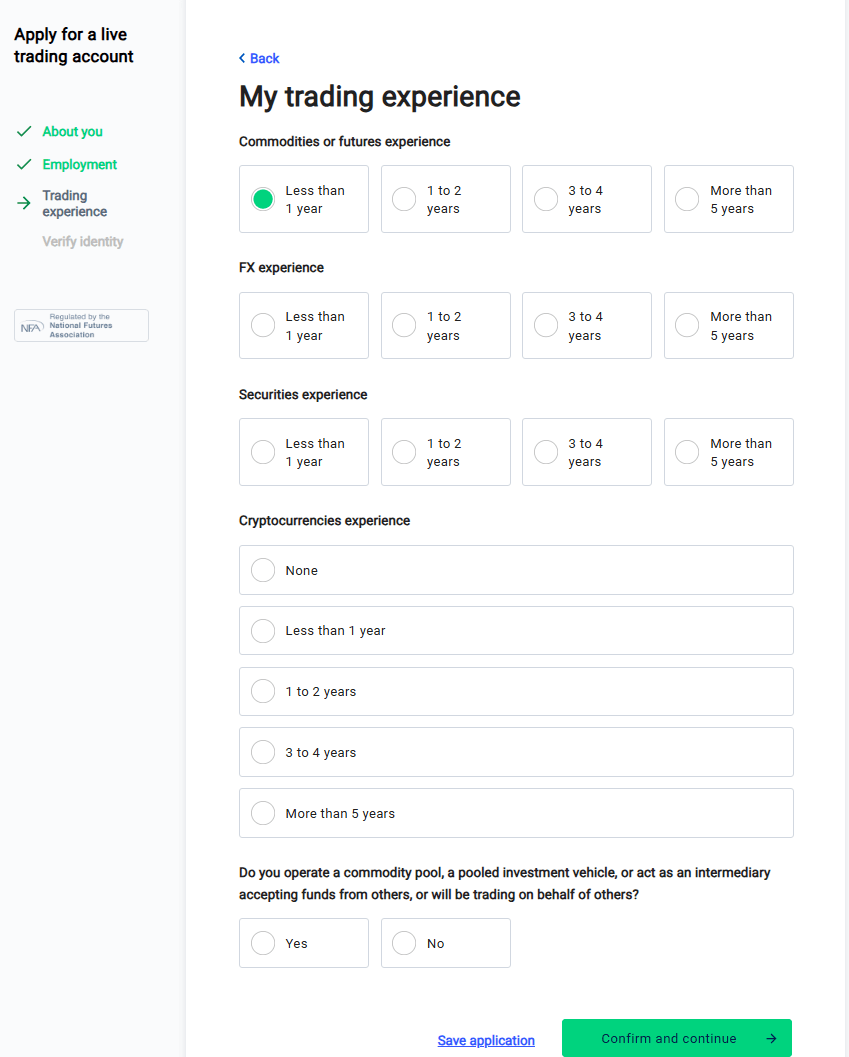

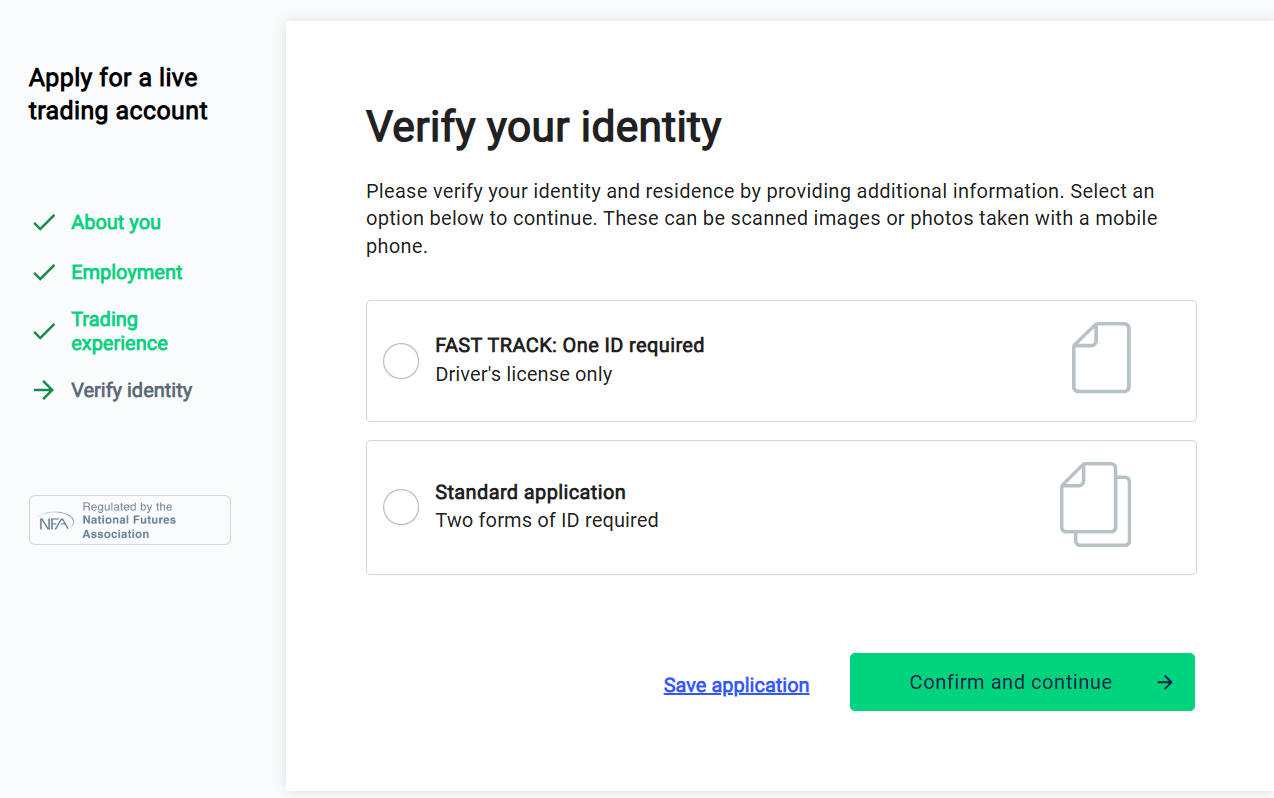

Account Types

OANDA offers a range of account types to meet the diverse needs of traders

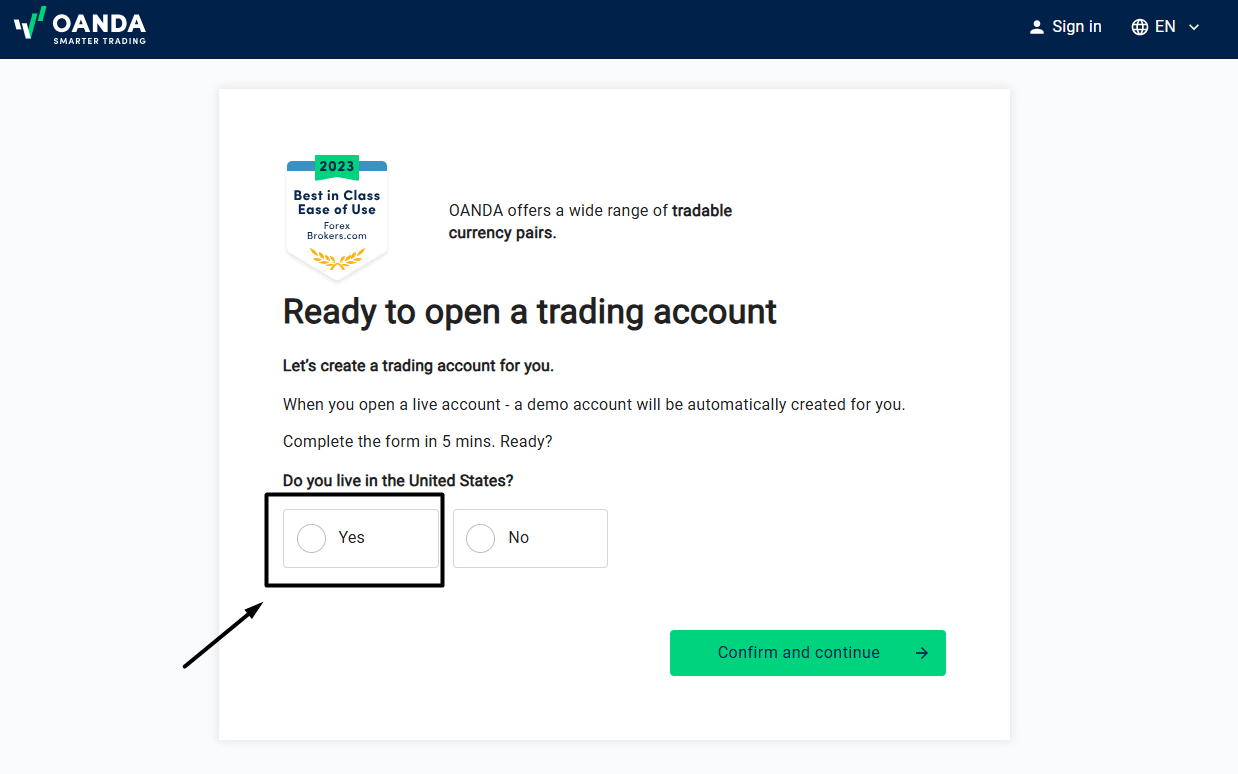

Demo Account:

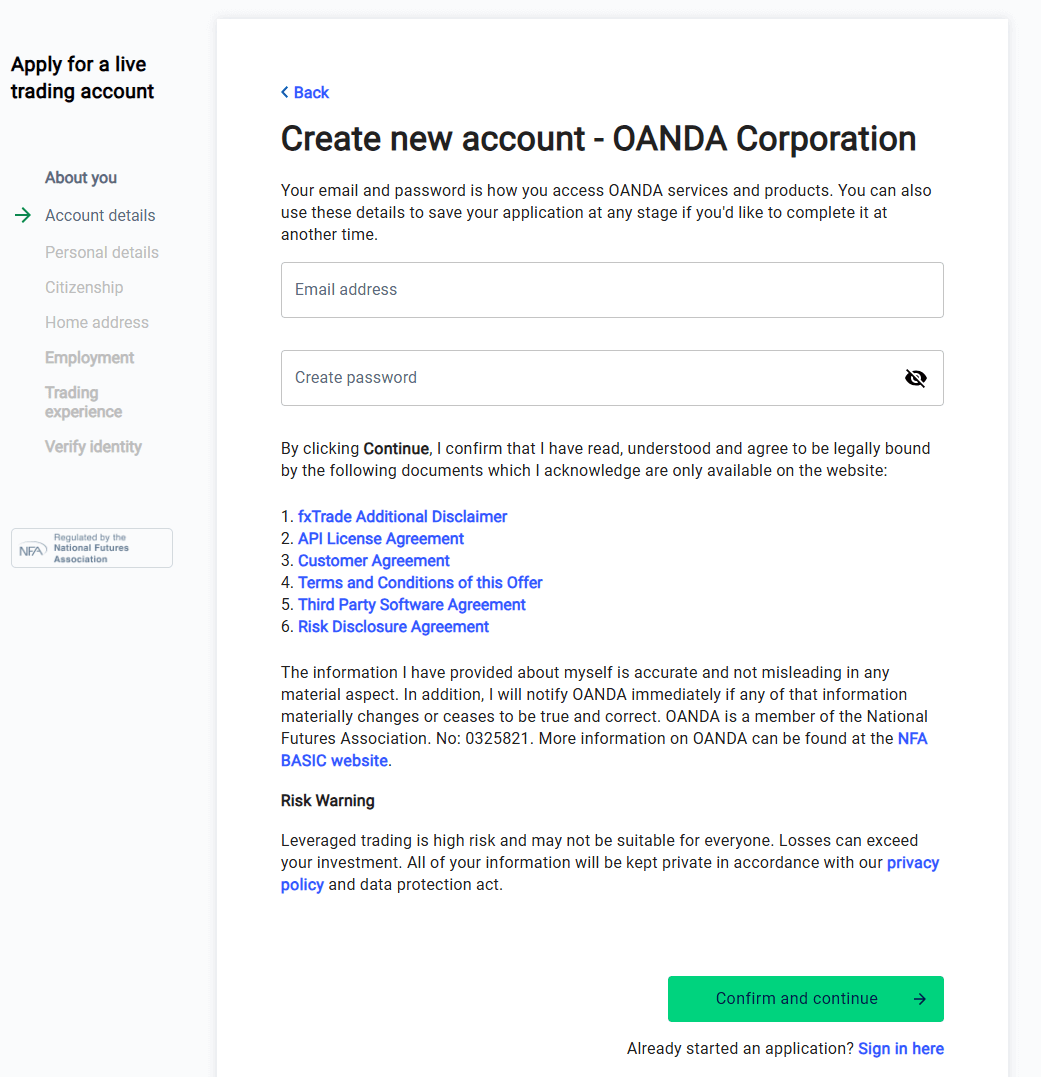

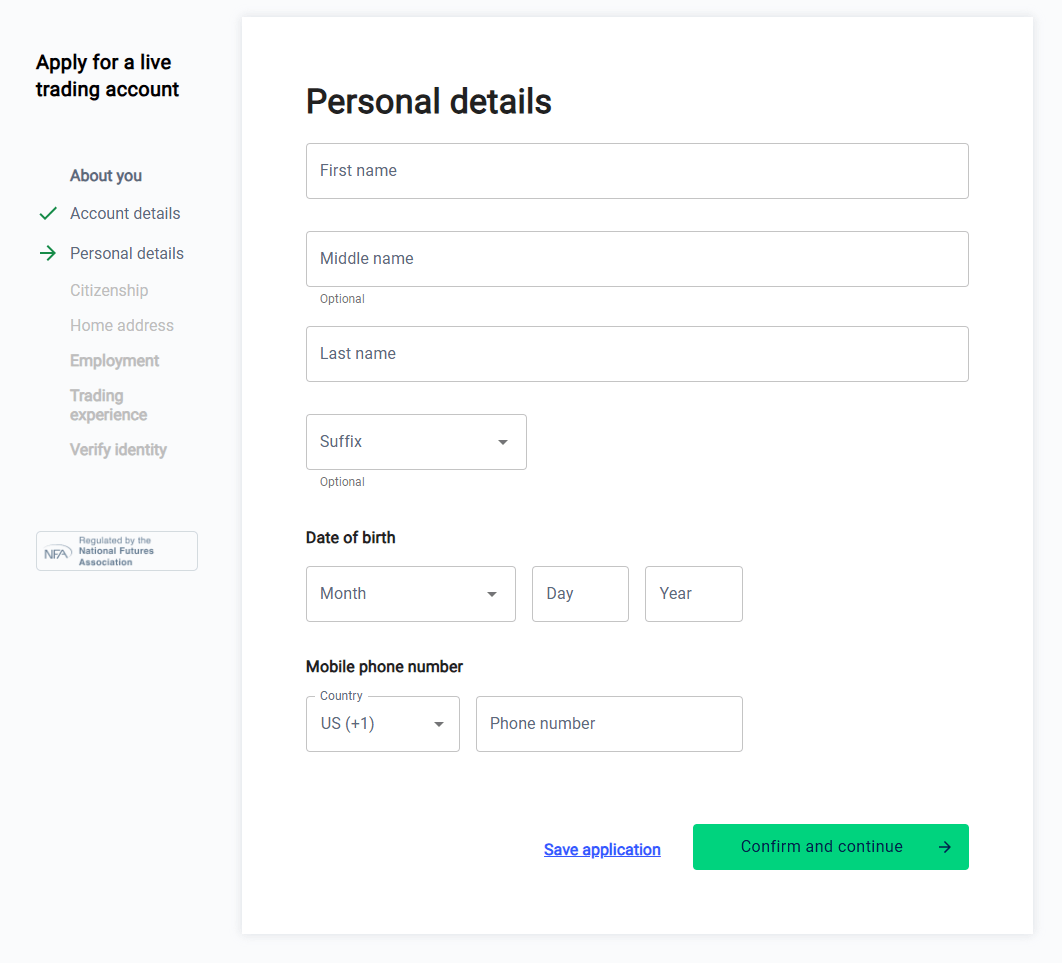

Live Trading Account:

Designed for both retail and professional traders, this account includes:

Institutional Account

Tailored for high-volume traders, corporations, and hedge funds:

OANDA's flexible account offerings ensure traders of all experience levels-whether beginners testing strategies, professionals seeking tight spreads, or institutions requiring tailored solutions-can meet their trading goals effectively.

Fees and Charges

A clear understanding of OANDA's fee structure helps traders manage costs effectively. Here's a breakdown of the trading and non-trading fees:

Trading Costs:

OANDA provides competitive spreads that vary depending on currency pairs and market conditions. For example, spreads on the EUR/USD pair can be as low as 0.6 pips during active trading hours.

Spread-Only Pricing: Standard accounts operate on a

spread-only basis, with no additional commissions.

Core Pricing Plus Commission: Traders seeking tighter

spreads can opt for the core pricing model, which

combines reduced spreads with a fixed commission per

trade.

Positions held overnight incur financing costs, which reflect the interest rates associated with leveraged positions. These fees vary based on the instrument and market conditions.

Deposit Fees:

OANDA does not charge deposit fees. However, third- party payment providers or banks may apply their own charges.

Some withdrawal methods are free, but wire transfers may incur a $20 fee per transaction. Traders are encouraged to review available options to minimize costs.

Accounts with no activity for 12 consecutive months are charged $10 monthly until activity resumes or the balance is zero.

OANDA's fee structure is transparent and accommodates both active and occasional traders. By offering flexible pricing models and competitive spreads, it allows clients to choose cost-effective trading solutions that align with their strategies.

Regulation and Security

Regulatory Oversight

OANDA operates under stringent regulatory frameworks across multiple jurisdictions, ensuring compliance and client protection:

OANDA Corporation is registered as a Futures Commission

Merchant and Retail Foreign Exchange Dealer with the

Commodity Futures Trading Commission (CFTC) and is a

member of the National Futures Association (NFA).

OANDA Europe Limited is authorized and regulated by the

Financial Conduct Authority (FCA) under registration

number 7110087.

OANDA (Canada) Corporation ULC is regulated by the

Canadian Investment Regulatory Organization (CIRO),

overseeing all investment dealers and trading activity in

Canada.

OANDA Australia Pty Ltd is regulated by the Australian

Securities and Investments Commission (ASIC),

ensuring adherence to Australian financial laws and regulations.

OANDA Asia Pacific Pte Ltd operates under the supervision

of the Monetary Authority of Singapore (MAS), ensuring

compliance with Singapore's financial regulations.

OANDA Japan Inc. is regulated by the Financial Services

Agency (FSA) of Japan, upholding stringent standards for

financial services.

This extensive regulatory oversight ensures that OANDA adheres to international standards, providing clients with a secure and transparent trading environment.

Security Measures

OANDA prioritizes the security of client accounts through multiple protective measures

Clients are strongly encouraged to enable 2FA to

safeguard accounts from unauthorized access. This adds

an extra layer of security by requiring a verification code in

addition to the password during login.

OANDA employs advanced encryption protocols to protect

client data during transmission, ensuring confidentiality

and integrity of sensitive information.

Client funds are held in segregated accounts with top-tier

banks, ensuring they are kept separate from the

company's operational funds and providing an additional

layer of protection.

OANDA applies negative balance protection to all new and

existing accounts, ensuring clients cannot lose more than

their account balance.

These security measures reflect OANDA's commitment to providing a secure trading environment for its clients.

Customer Support

Contact Methods

OANDA provides reliable 24/5 customer support to assist traders efficiently across multiple regions

Instant support available directly through the OANDA website.

Submit inquiries at [email protected]

Support hours align with the global forex market, running from Sunday 4 p.m. ET to Friday 6 p.m. ET, ensuring traders receive timely assistance. Multilingual support is primarily available in English, with limited Mandarin and Spanish coverage based on regional availability.

Education and Resources

OANDA equips traders with practical and insightful educational materials to enhance their trading knowledge

Regular updates on market trends, technical analysis, and trading news.

Designed for beginners and experienced traders alike, covering trading strategies, platform tools, and risk management techniques.

Includes market analysis reports, strategy guides, and economic indicators to support decision-making.

These resources are tailored to help traders improve their skills, stay informed about market movements, and trade with confidence.

PROS

Proprietary OANDA Trade and MT4 with advanced tools for analysis and execution.

Choice between spread-only and core pricing with commissions.

Risk-free practice accounts for beginners and strategy testing.

CONS

This concise overview highlights OANDA's key strengths and limitations for traders.

Who Should Use OANDA?

OANDA's trading solutions are designed to accommodate traders of varying experience levels, trading volumes, and goals

Beginner Traders

OANDA's Demo Account allows new traders to practice with virtual funds before risking real capital.

With no minimum deposit required for Standard Accounts, beginners can enter the forex market at their own pace.

Educational resources, including webinars, tutorials, and blogs, provide essential learning tools.

Retail Traders

Tight spreads starting as low as 1.0 pip (Standard Account) and no deposit fees ensure cost efficiency.

The OANDA Trade platform and integration with MT4 offer user-friendly interfaces for executing trades seamlessly.

Professional Traders

The Core Pricing account offers spreads as low as 0.1 pips, with a competitive commission of $40 per million traded.

Advanced features include API access, automated trading through MT4, and tools like TradingView integration.

High-Volume Traders

Eligible traders can join the Elite Trader Program, which offers cash rebates up to $17 per million traded.

Institutional Traders

OANDA's advanced APIs and algorithmic trading capabilities ensure precision execution for large orders.

By providing tailored account types, competitive pricing, and tools for advanced trading, OANDA meets the needs of both individual traders and institutional investors, supporting diverse strategies and goals.

Conclusion

OANDA continues to solidify its position as a leading forex broker in 2025, thanks to its robust regulatory compliance, advanced trading platforms, and competitive pricing. Regulated by top-tier authorities like the CFTC and FCA, OANDA ensures a secure and transparent trading environment. Its diverse offerings include over 68 currency pairs, CFDs, and spot virtual currency products, catering to retail, professional, and institutional traders alike. The OANDA Trade platform and support for MetaTrader 4 (MT4) provide flexibility, while competitive spreads and tools like API trading make it appealing for advanced and high-volume traders. Security measures such as segregated client funds and negative balance protection further enhance trust. However, limitations remain, including language restrictions in customer support and withdrawal fees for certain methods like wire transfers. Overall, OANDA stands out as a reliable, well-rounded broker, making it a top choice for forex and CFD trading in 2025.

Frequently Asked Questions (FAQs)

Yes, OANDA provides free demo accounts with virtual funds, ideal for beginners to practice trading and test strategies without financial risk.

This globally trusted broker provides access to diverse markets, including forex, stocks, and crypto. Ideal for both beginners and seasoned traders with user-friendly platforms and competitive pricing.