How to Check If a Broker Is Licensed?

Learn how to verify if a broker is licensed, ensuring fund safety and avoiding risks like fund misuse and withdrawal issues.

Writen by:

Arslan Ali But

17 January 2025

8 minutes read

Writen by:

Arslan Ali But

17 January 2025

8 minutes read

Verifying a broker’s license is essential for secure trading. Brokers act as intermediaries in

financial markets, and their regulatory compliance directly impacts the safety of your funds and

trading experience.

Unlicensed brokers operate without oversight, leading to risks like fund misuse, delayed

withdrawals, and hidden fees. Reports indicate that over 70% of complaints against unregulated

brokers involve withdrawal issues or fund misuse, highlighting the dangers of trading with such

entities.

Licensed brokers, regulated by authorities like the FCA (UK), ASIC (Australia), and CySEC

(EU), adhere to strict standards. They segregate client funds, ensure transparency, and provide

mechanisms for dispute resolution.

This guide walks you through verifying a broker’s licensing, so you can trade confidently

and protect your investments.

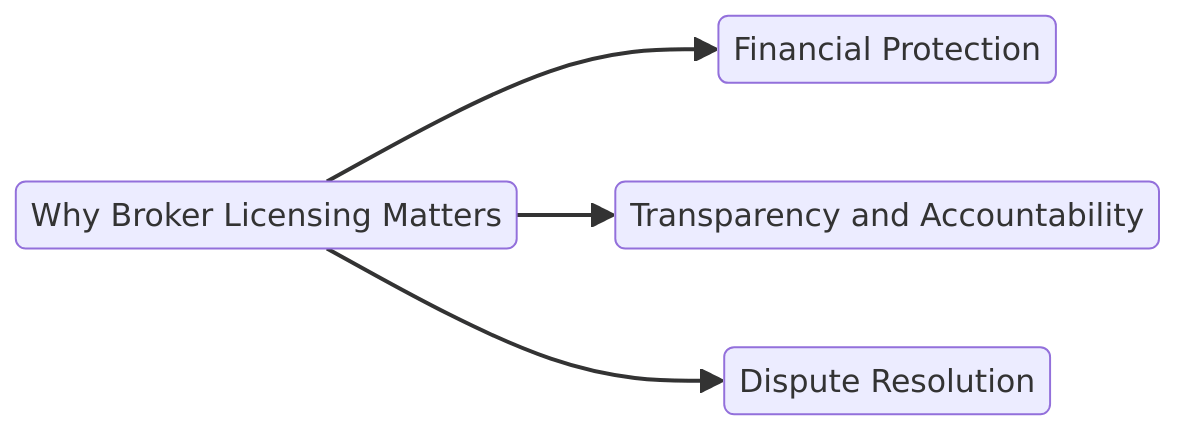

Why Broker Licensing Matters

Broker licensing is crucial for safeguarding your investments. Licensed brokers operate under strict regulatory standards that prioritize trader protection and market integrity.

- Financial Protection: Licensed brokers are required to segregate client funds, ensuring your money is separate from their operational accounts. This reduces the risk of fund misuse or loss during insolvency.

- Transparency and Accountability: Regulatory oversight mandates regular audits and disclosure of financial data, promoting fairness and trust. Traders can rely on licensed brokers to follow clear and ethical practices.

- Dispute Resolution: Licensing provides traders access to compensation schemes and legal recourse. For example, the FCA (UK) protects traders under the FSCS, covering up to £85,000 if a broker becomes insolvent.

Without proper licensing, traders risk losing funds with no guarantees or legal options for recovery. Choosing a licensed broker ensures your investments are secure and protected.

Steps to Verify a Broker’s License

Verifying a broker’s license is a critical step to ensure your funds and trading experience are secure. Follow these steps to confirm a broker’s legitimacy:

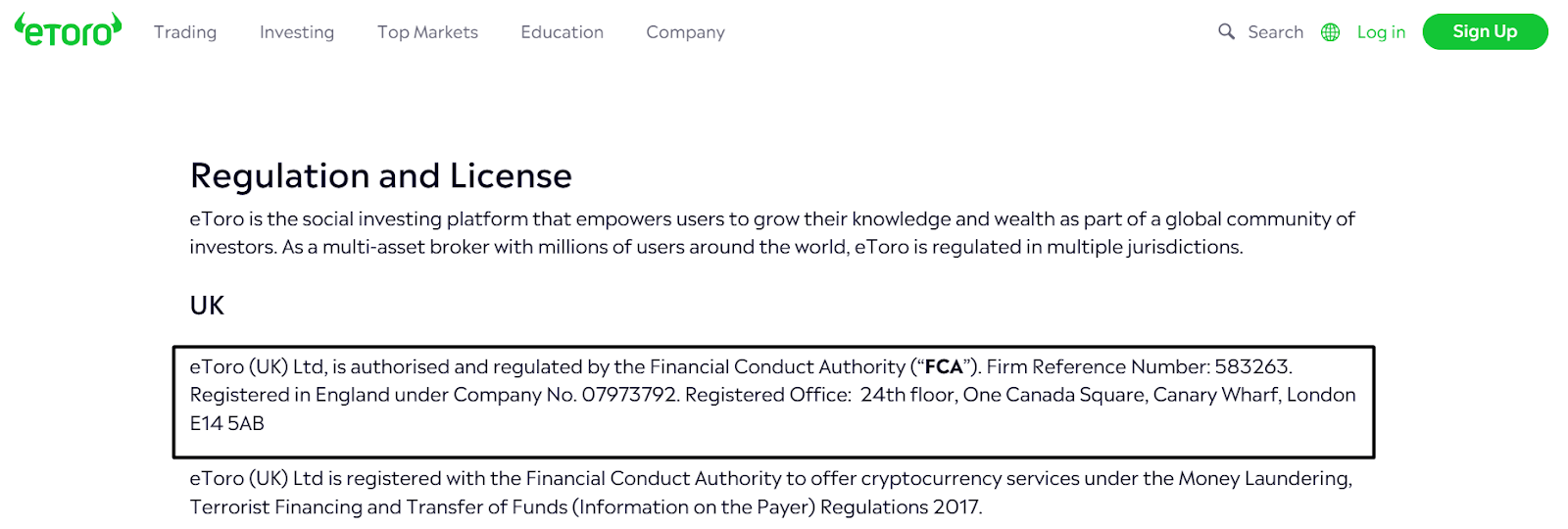

Check the Broker’s Website

Start by visiting the broker’s website and locating the “Regulation” or “Licensing” section.

Look for Key Details:

- Name of the regulatory authority (e.g., FCA (UK), ASIC (Australia), CySEC (EU)).

- License number or registration ID.

Look for Key Details:

- eToro: On its website, eToro provides comprehensive regulatory details, stating that it is licensed by the FCA (UK) under license number 583263. It also mentions regulation by CySEC (EU) and ASIC (Australia), providing links to verify this information.

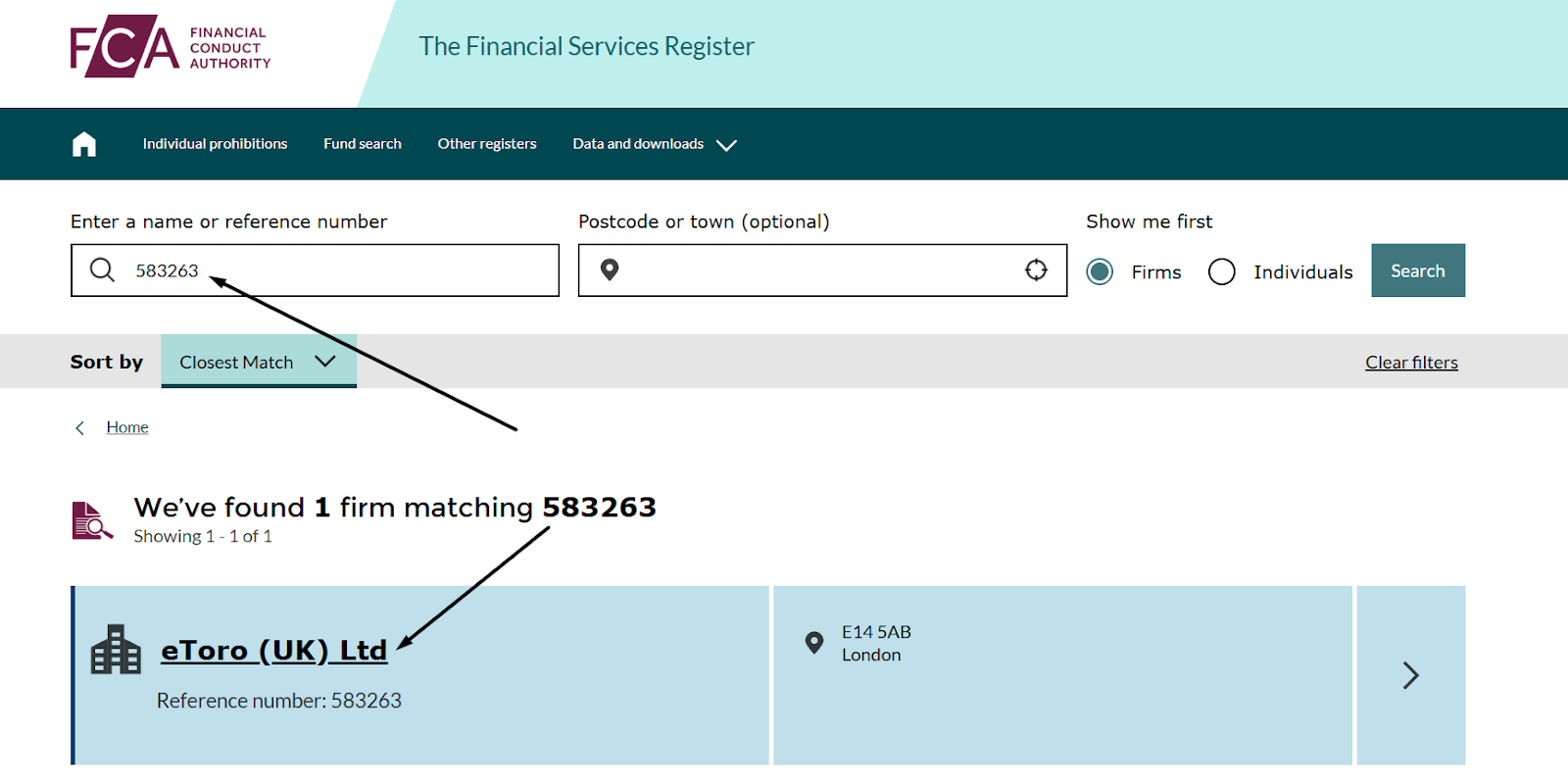

Verify on the Regulator’s Database

Visit the official website of the stated regulatory authority and search for the broker’s licensing details to confirm its legitimacy.

Steps to Verify:

- Go to the regulatory authority’s official website (e.g., fca.org.uk, asic.gov.au, cysec.gov.cy).

- Enter the broker’s name or license number into the search function.

- Confirm that the details provided (e.g., company name, address, contact information) match the information listed on the broker’s website.

For Instance:

-

Financial Conduct Authority (FCA) Register::

This register allows you to search for firms and individuals authorized by the FCA. For example,

you can verify eToro's authorization under Firm Reference Number 583263.

- Australian Securities and Investments Commission (ASIC) Connect: Through ASIC Connect, you can search for registered organizations and licensees. For instance, you can confirm AvaTrade's regulation under License No. 406684.

- Cyprus Securities and Exchange Commission (CySEC) Regulated Entities: Cyprus Securities and Exchange Commission (CySEC) Regulated Entities: CySEC provides a list of regulated entities, including investment firms. You can check if a broker like eToro is listed under CySEC's regulated entities.

Tip: If the details on the regulator’s database do not match the broker’s claims, this discrepancy is a significant red flag. Always cross-check to ensure you’re dealing with a legitimate broker.

Look for Red Flags

Unregulated brokers often try to appear legitimate by using misleading information.

-

Common Warning Signs:

- Licensing details that are absent or difficult to find.

- Mismatched information between the broker’s website and the regulatory database.

- Claims of regulation by obscure or nonexistent authorities.

- Misuse of logos from reputable regulators.

Cross-Check Reviews and Feedback

User reviews can provide valuable insights into a broker’s authenticity and practices.

-

Platforms to Use:

- Trustpilot: Check for ratings and specific complaints about fund safety and withdrawals.

- ForexPeaceArmy: Look for reports on licensing issues or fraudulent activities.

- Warning: A high number of complaints about withdrawals, customer service, or hidden fees often indicates problems with the broker’s legitimacy.

Contact the Regulatory Authority Directly

If you still have doubts, reach out to the regulatory authority for confirmation.

-

Steps:

- Use the helpline or email address provided on the regulator’s official website.

- Share the broker’s details (e.g., name, license number) and ask for verification.

This extra step can provide definitive assurance about the broker’s regulatory status.

Common Regulatory Authorities and Their Standards

Understanding key regulatory authorities and their standards helps traders identify trustworthy brokers. Here are some of the most reputable organizations:

FCA (UK):

- Requires brokers to segregate client funds from operational accounts, ensuring funds are protected during insolvency.

- Mandates detailed financial reporting and regular audits to maintain transparency.

- Offers compensation through the Financial Services Compensation Scheme (FSCS), covering up to £85,000 per client.

ASIC (Australia):

- Enforces strict client fund protections by mandating segregated accounts.

- Implements leverage limits for retail traders (e.g., 30:1) to mitigate excessive risks.

CySEC (EU):

- Ensures brokers adhere to EU financial standards, promoting transparency and fairness.

- Provides compensation up to €20,000 per client through the Investor Compensation Fund (ICF) to protect traders in case of broker insolvency.

CFTC/NFA (US):

- Focuses on fraud prevention by enforcing transparency in pricing and fund handling.

- Imposes a minimum capital requirement of $20 million for brokers to ensure financial stability.

Choosing brokers regulated by these authorities ensures a safer and more reliable trading environment.

Red Flags of Fake Licensing Claims

Unregulated brokers often use deceptive tactics to appear legitimate. Watch out for these warning signs of fake licensing claims:

- Claims of Regulation by Unknown or Fake Entities: Some brokers mention obscure regulatory bodies that do not exist or lack credibility. Always cross-check the claimed authority’s legitimacy.

- Misleading Logos: Fraudulent brokers may use logos that mimic reputable regulators like the FCA or ASIC to mislead traders.

- Ambiguous Licensing Details: Legitimate brokers provide clear information about their regulatory status. Be cautious if the broker’s website lists incomplete or unverifiable licensing details.

Verify licensing through the regulator’s official database to ensure authenticity.

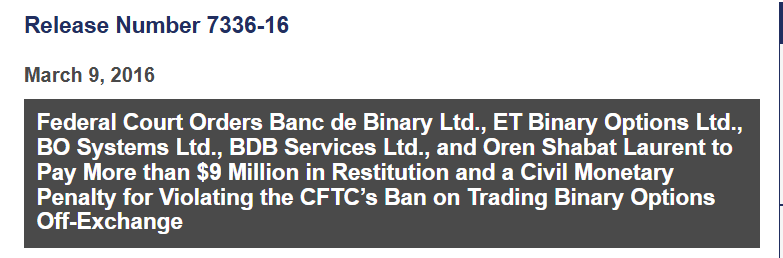

For instance, Banc De Binary, a now-defunct broker, falsely claimed regulation and misused logos of reputable authorities like the FCA. Legal actions led to $20 million in penalties for deceptive practices.

Key Takeaway:

Always double-check a broker’s regulatory credentials through official databases to avoid falling victim to such deceptive practices.

What to Do If a Broker Isn’t Licensed

If you discover a broker isn’t licensed, take the following steps to protect yourself and others:

- Avoid Depositing Funds: Refrain from transferring money to unlicensed brokers, as they lack oversight and could misuse your funds.

- Report Unregulated Brokers: File a complaint with consumer protection agencies or relevant regulatory authorities, such as the FCA, ASIC, or CySEC, to help prevent others from being scammed.

- Warn Others: Share your experience on review platforms like Trustpilot or ForexPeaceArmy. Highlight red flags and issues to alert other traders.

Conclusion

Verifying a broker’s licensing is essential for protecting your investments. By following these

steps, you can ensure you’re dealing with a legitimate broker that prioritizes transparency and

safety.

Don’t leave your trading success to chance. At WhereToTrade, we help you choose regulated

brokers that ensure your investments are safe and your trades are secure.

Table of contents

1. Why Broker Licensing Matters 2. Steps to Verify a Broker’s License 3. Check the Broker’s Website 4. Verify on the Regulator’s Database 5. Look for Red Flags 6. Cross-Check Reviews and Feedback 7. Contact the Regulatory Authority Directly 8. Common Regulatory Authorities and Their Standards 9. Red Flags of Fake Licensing Claims 10. What to Do If a Broker Isn’t Licensed 11. Conclusion